Crystallex awarded US$1.2 billion plus interest for damages

The World Bank sided with Crystallex over the Venezuela government and awarded the Canadian gold miner on Tuesday US$1.202 billion plus interest for the unlawful expropriation of Crystallex's investment in its Las Cristinas mining project.

In 2011 Crystallex filed the arbitration request with the World Bank's International Centre for Settlement of Investment Disputes. During the same year the company filed for bankruptcy and lost is TSE listing.

According the company's website, Crystallex signed a mine operating contract with the Corporacion Venezolana de Guayana in 2002, which granted Crystallex exclusive rights to develop and exploit the gold deposits on the Las Cristinas property. At a US$550 per ounce gold price, reserves of 16.9 million ounces of gold, contained in a measured and indicated resource of 20.8 million ounces. Crystallex said Las Cristinas was one of the largest undeveloped gold deposits in the world.

But during the late Hugo Chavez's presidency Crystallex's environmental permits were withheld and the project was essentially nationalized.

In a news release Crystallex highlighted some World Banks findings:

Among other things, the Tribunal criticized Venezuela's Ministry of the Environment for its "arbitrary" and "non-transparent and inconsistent conduct" in connection with its denial of an environmental permit. The Tribunal stated that it "cannot but conclude that the Permit denial letter and the Romero Report on which the first appears to be based are so fundamentally deficient that, to the eyes of a reasonable third person, they surprise a sense of juridical propriety'...". Venezuela, the Tribunal concluded, "frustrated Crystallex's legitimate expectations ..., engaged in arbitrary conduct in denying the Permit and rescinding the [Contract it had signed with Crystallex], and committed several acts lacking transparency and consistency." The Tribunal therefore found that Venezuela's "overall conduct vis-? -vis Crystallex, thus violated the [Treaty] standard ... and caused all of the investments made by Crystallex to become worthless."

CEO Robert Fung thanked his shareholders for their patience:

"On behalf of Crystallex's board of directors, management, employees and all of its stakeholders, we are pleased that the Tribunal has recognized Venezuela's unlawful expropriation of the Company's investment in the Las Cristinas mining project. The company looks forward to collecting on the Award on behalf of all of its stakeholders. We thank our stakeholders for their deep understanding and support throughout this difficult and prolonged process, and our legal team, led by Freshfields' partner Nigel Blackaby."

Another miner, which had its own legal entanglements with the Venzuela government, may be moving forward. In February the Venezuela government and Gold Reserve reached a settlement over the 2009 termination of the company's Las Brisas gold concession.

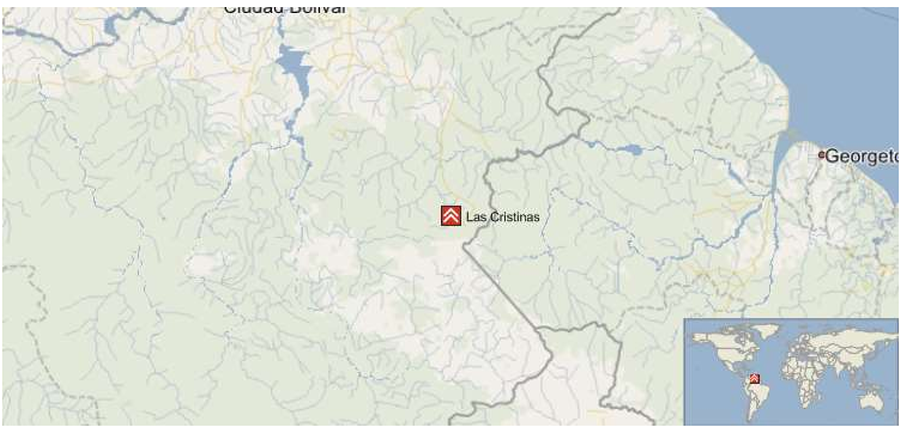

Las Cristinas is located in Venezuela, 6km West of Las Claritas. Las Cristinas is considered to be a veins and breccia deposit.