August 11, 2025

How to Profit from the Upcoming Market CRASH

Contents

- The US Economy Isn’t Doing Well

- The US Dollar Continues Falling

- US Treasuries Tumble as Investors Consider Recession

- Why You Shouldn’t Stay Invested in Broad Markets

- Where Should Investors Seek Safety?

- These Factors Support a Rally in Gold Mining Juniors

- Focus on Gold-Rich Guatemala

- A Game-Changing Discovery

Good times are coming to an end for US markets.

Mainstream stocks are slashing their profit forecasts… consumers expect prices to soar again… and investors are seeking safety.

They are scooping up safe-haven assets… not knowing that most of them will most likely crash along with the rest of the market.

They are making a huge mistake.

In a moment, we will explain why most safe havens don’t work anymore… and which ones still do.

This knowledge will put you ahead of most individual—and even institutional—investors.

When everybody else panics and runs for the exits, you will know what to do.

Our goal here at the Canadian Mining Report is to prepare you for the worst.

And it’s coming…

Here’s what you need to know.

The US Economy Isn’t Doing Well

You have heard about the latest jobs report. It was all over the news.

In short, in July, the US economy added only 73,000 jobs. But that wasn’t the number that grabbed headlines everywhere.

What shocked investors was the downward revision of the May and June statistics. Revised numbers showed an ugly picture. For the past three months, the US has added only 35,000 jobs. This is one-third less than a year ago.

The Trump administration didn’t like the numbers, and the President fired the head of the Bureau of Labor Statistics (BLS).

While every mainstream news outlet focused on another White House drama, investors missed the really big story hidden in these numbers.

And it’s not pretty.

A weak jobs report like the one released in July tells us that the US economy is slowing down.

And this slowdown is accelerating.

Goldman Sachs forecasts a “sharp downturn in real income growth.” This is bad news for the economy that depends on consumers, business investment, and hiring.

The markets have noticed… and rushed for safety.

But most investors look for it in the wrong places. Here’s why.

The US Dollar Continues Falling

Investors’ favorite safe-haven asset has delivered a disastrous performance. It has been losing value all year.

So far this year, it’s down about 9%. This is an abysmal performance for a supposedly “unsinkable” asset.

Well, it has been underwater for about six months already. And the worst could be yet to come.

See, the rest of the world believes in the Fed, even if the US voters are skeptical.

To foreign investors, the US market is the most liquid and safest one. And the market for the US dollars is where they go when everything else fails.

But the ongoing drama between the Fed and the White House is damaging the dollar’s status. And whenever foreign investors feel that the Fed could cave in to the White House’s pressures to lower rates, it sells USD.

And if the Fed does cave in September, which the markets put an 87.5% probability for, it will weaken the US dollar even further.

There is no scenario in which the USD could win this year, in our opinion.

It could only dive deeper from here…

We urge you to review your USD holdings. If you do what everybody else does, you could be on the losing side of the trade.

But what about other safe havens?

US Treasuries Tumble as Investors Consider Recession

US government debt isn’t as safe as it was in the past.

The country is running a massive budget deficit, and its debt-to-GDP ratio is out of control.

The Congressional Budget Office estimated back in February that the country’s deficit as a percentage of GDP was higher only during World War II.

By 2035, federal debt held by the public could soar to as high as 118% of the country’s GDP. If it does, it’ll surpass the previous record of 106% of GDP in 1946.

The country has already lost its “perfect” AAA credit rating from the three biggest rating agencies. Right now, it trails countries such as Australia, Canada, Germany, the Netherlands, and Sweden.

What does it mean?

It means that the world sees the US government debt as risky. It wasn’t like that before, but as the US kept growing its debt pile, investors started to question whether the US economy is strong enough to support it.

Right now, they are skeptical. And don’t forget that foreigners hold 30% of all publicly held debt.

A slowing US economy could send Treasury prices into a tailspin. Interest rates would go higher, bond prices would go lower… and the investors seeking a safe haven in this asset class will suffer.

This has already begun. While the US hopes to sell hundreds of billions of dollars in new debt, investors are in no rush to buy.

The first of the three bond auctions scheduled right after the dismal jobs report saw cool demand from investors.

An unexpected surge in service sector inflation released by the Institute of Supply Management won’t make things better. Service-sector inflation is at its highest since October 2022.

This is important: services comprise 77.6% of the US economy.

And the latest numbers tell us that inflation is heating up again…

So, we will not be surprised to see interest rates go higher from here, not lower… which will only accelerate the economic slowdown that we’re seeing already.

This would tank US Treasury prices mercilessly. Investors who hope that their US debt allocation is safe should think twice.

With both the US dollar and bonds no longer acting like safe-haven assets, where should investors go?

One place you should really be skeptical about is US stocks…

Why You Shouldn’t Stay Invested in Broad Markets

So far this year, US equities have been resilient. They have been weathering the ongoing tariff storm quite well.

Right now, equities are rising again. But the broad bull market in stocks hides something very few investors know…

Most of this growth comes from tech stocks. Specifically, the ones focused on artificial intelligence (AI). Microsoft, Amazon, Google, and Meta have delivered positive profit results in the second quarter, driving the markets higher.

But there are two problems.

First, these companies aren’t subject to tariffs. They don’t import foreign goods. A lot of others, however, do. And the companies working in the “real” economy aren’t doing well.

Employment in the cyclical industries, such as construction, is down.

Caterpillar, the US economic “bellwether,” missed earnings estimates and posted weak margins.

The S&P 500 has barely moved this year if you exclude the high-flying tech sector from it. It’s up about 4.9% as of writing.

This proves our thesis. The real economy is struggling. While everybody else is focused on the AI hype machine, the US economic growth is stagnating, and its workers are worried.

Some of the stock superstars have started to feel the pain, too.

The latest numbers from Tesla showed that its sales in the US dropped 13% compared to a year ago. The first quarter of this year was the company’s worst since Q2 2022.

Year-to-date, Tesla’s shares are down 24% while broad markets are up 7%.

The world’s highest-flying companies could be in for a rude awakening. Analysts have already started revising companies’ 2025 earnings estimates. They have been downgrading them at recessionary levels, according to the Financial Times.

Institutional investors are listening. In March alone, they slashed their US holdings by the most on record.

Individual investors haven’t caught up with the trend yet. When they do, it could be too late… But you have been warned.

Where Should Investors Seek Safety?

It’s not all gloom and doom, of course. There’s always a bull market somewhere. Finding it, however, could be challenging.

We’re here to help.

And right now, the most attractive market is precious metals. Specifically, gold.

As the broad indexes were struggling and bonds came close to the brink of collapse, gold continued delivering outstanding gains.

So far this year, it’s up 29%.

When the weak job market report went out, gold had one of the best days this year. Some investors clearly understand what is going on. We urge you to pay attention to this sector, too.

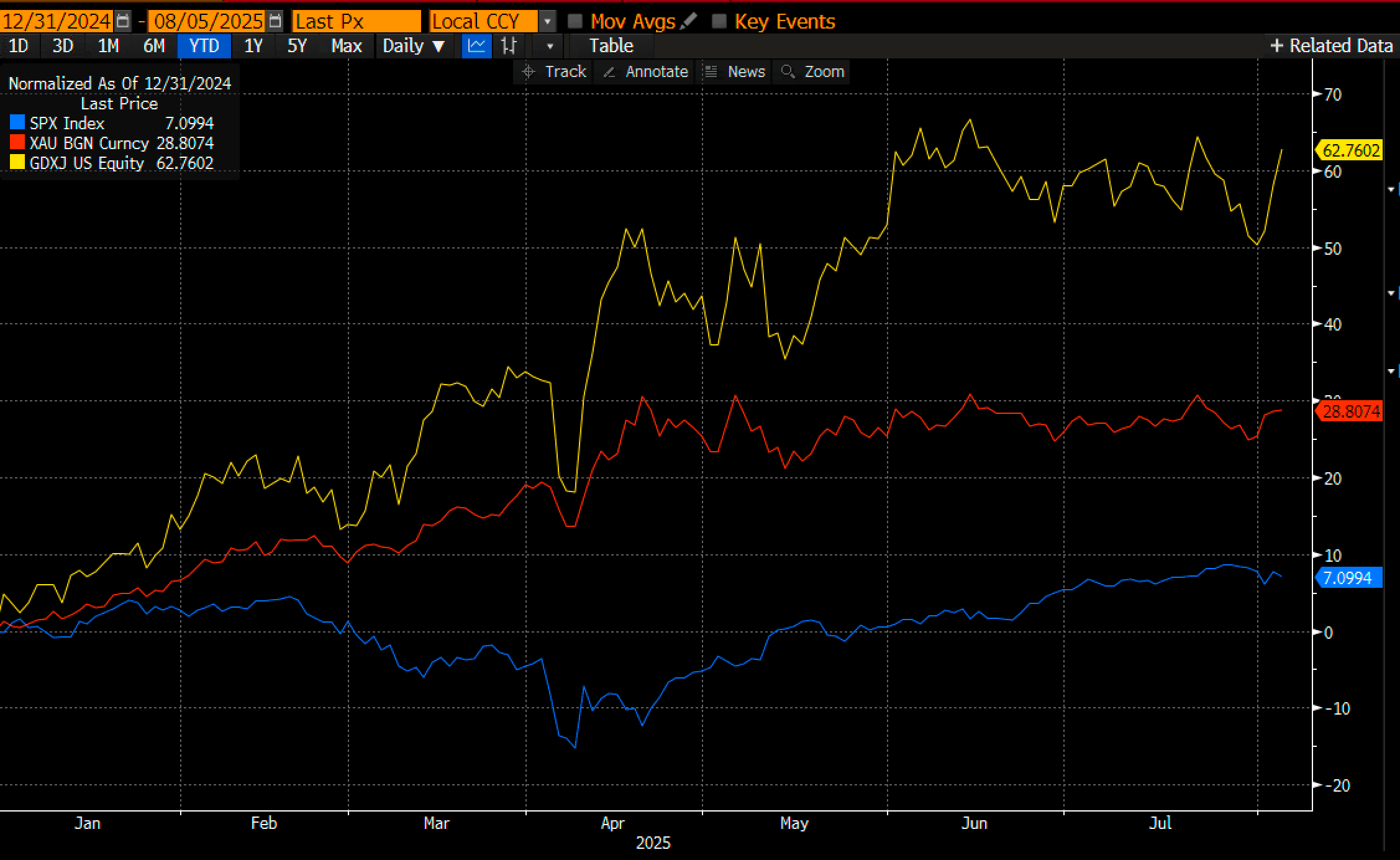

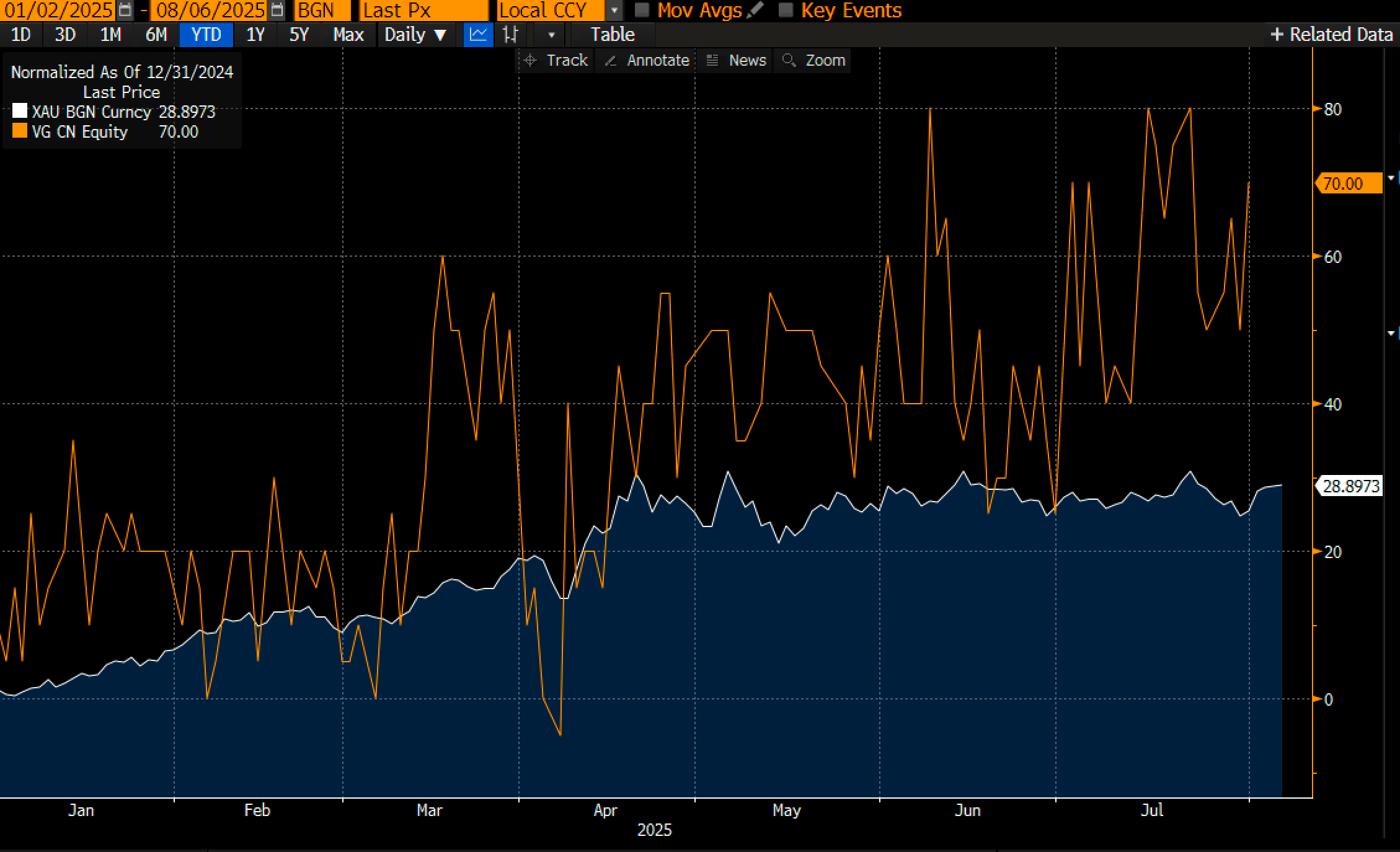

Specifically, we want to turn your attention to gold mining companies. Look at this chart…

Since the beginning of the year, the S&P 500 rose by about 7.1%... gold rose by 28.8%... but gold mining juniors soared by 62.8%.

They outperformed gold by 2.2x.

And let us remind you… They delivered this performance as analysts and institutional investors have grown sour on US equities.

We’re not saying that all of them are buying gold stocks instead of US tech companies… but some of them are clearly aligned with how we see the markets.

From here, broad indexes could fall as the US economy sputters. But gold mining juniors will probably do just fine—in fact, we expect them to continue outperforming the US market.

Let us walk you through the catalysts driving this performance.

These Factors Support a Rally in Gold Mining Juniors

First, it’s the coming economic collapse. When cash loses value, gold tends to preserve it. Companies leveraged to gold perform well, too. There could be volatility, of course—nothing goes up in a straight line—but companies exploring for and producing gold are, in our opinion, better positioned to weather an economic storm than cyclical stocks.

We have shown you that the economic collapse is coming. Some of the most sophisticated investors have already started moving into the gold market.

Second, the AI trend is waning.

AI has grabbed the market’s attention for more than a year. Investors piled into AI-related stocks en masse.

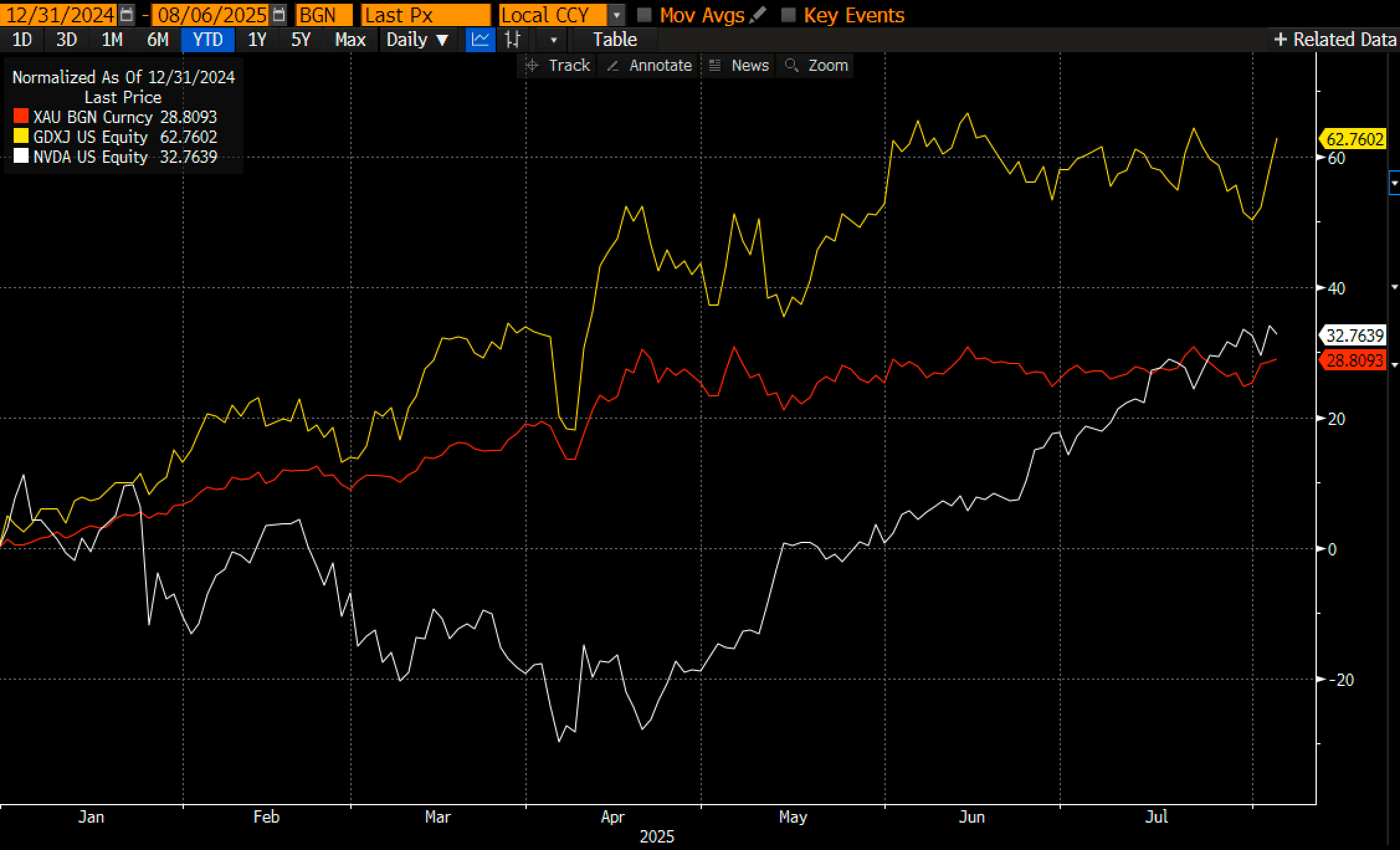

But something strange started happening this year. AI stocks have trailed gold miners.

Take a look at this chart. It shows year-to-date performance of gold, Nvidia, and gold miners as a group.

Junior gold stocks have outperformed Nvidia, the AI leader, by a factor of almost 2x this year.

This is an outstanding performance for an under-the-radar industry that few investors pay close attention to.

We expect that gold companies could outperform the AI “megatrend” for the rest of the year and beyond. For all the talk of AI conquering the world, what we are seeing is that one of the oldest industries in the world is running circles around the “coolest kid on the block.”

Third, gold mining companies are globally diversified. They look for and produce gold everywhere. Which means that they don’t depend on the whims of a single jurisdiction, including the United States.

This global diversification gives gold mining juniors access to the best assets in the world, the most able workforce, and the most favorable regulatory regimes.

In fact, we would argue that companies working outside the United States could be more attractive than those operating in the United States, for example.

While most investors have been following the twists and turns of the US tariff policy, gold mining juniors working outside the country have had enormous successes—overlooked by the majority of the trend-chasing crowd.

We want to bring one of the potentially most promising companies working outside the chaos of US politics to your attention. Its name is Volcanic Gold Mines Inc. (TXSV:VG, Frankfurt:CKC1).

Focus on Gold-Rich Guatemala

The company has been operating in one of the most promising mining regions in the world.

Central America is a known quantity for mining investors. It strikes the right balance between familiarity and opportunity. It’s not a “frontier” region, where risks are high. Nor is it an overexplored and overrated region where all the good projects have been picked up already.

Guatemala, which is the largest economy in Central America, has been home to several recent discoveries, including the Marlin gold mine, Escobal silver mine, and the Cerro Blanco gold project.

These discoveries wouldn’t be possible without Guatemala’s focus on investor attractiveness. The country has a solid track record of macroeconomic stability and inflation control.

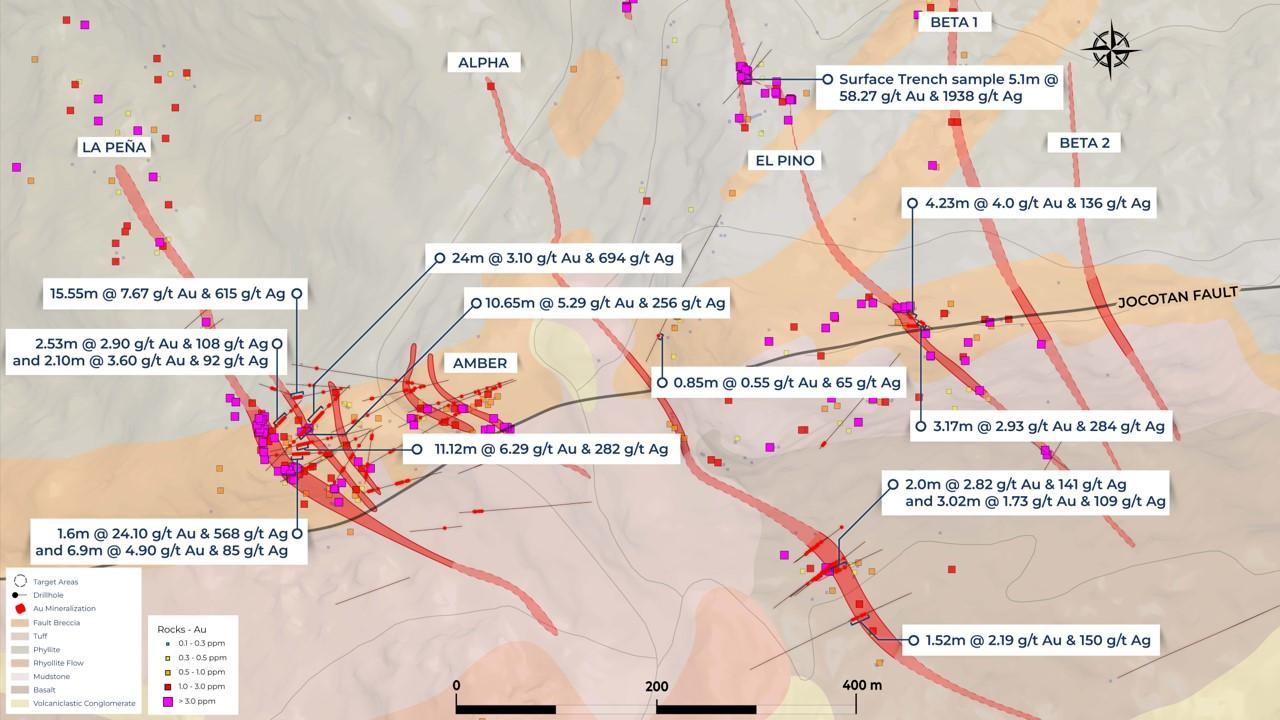

Volcanic Gold Mines Inc. (TXSV:VG, Frankfurt:CKC1) is focused on Eastern Guatemala specifically.

Recently, it made a high-grade gold discovery there: the Holly Project.

A Game-Changing Discovery

The Holly project is a joint venture between Volcanic Gold Mines Inc. (TXSV:VG, Frankfurt:CKC1) and Radius Gold.

The team that made the discovery has a proven track record in the industry. The same people discovered San Martin, Cerro Blanco, Tambor, Pavon, and San Jose deposits in Central America.

They have spent most of their careers working in the region and looking for gold. The team’s longevity is impressive: 25 years.

At Holly, the company’s team has discovered many high-grade gold and silver occurrences. Even the preliminary results were impressive. The company found samples of up to 396 g/t gold and 7,092 g/t silver at the property.

Historical drilling delivered high-grade intercepts as well. A historical 2002 campaign delivered such intervals as 6.0 meters of 43.56 g/t gold and 1,617 g/t silver.

This historical work was the foundation of Volcanic’s early-stage exploration effort.

But the Volcanic team didn’t stop with field work, as is often the case with less experienced and less well-funded companies.

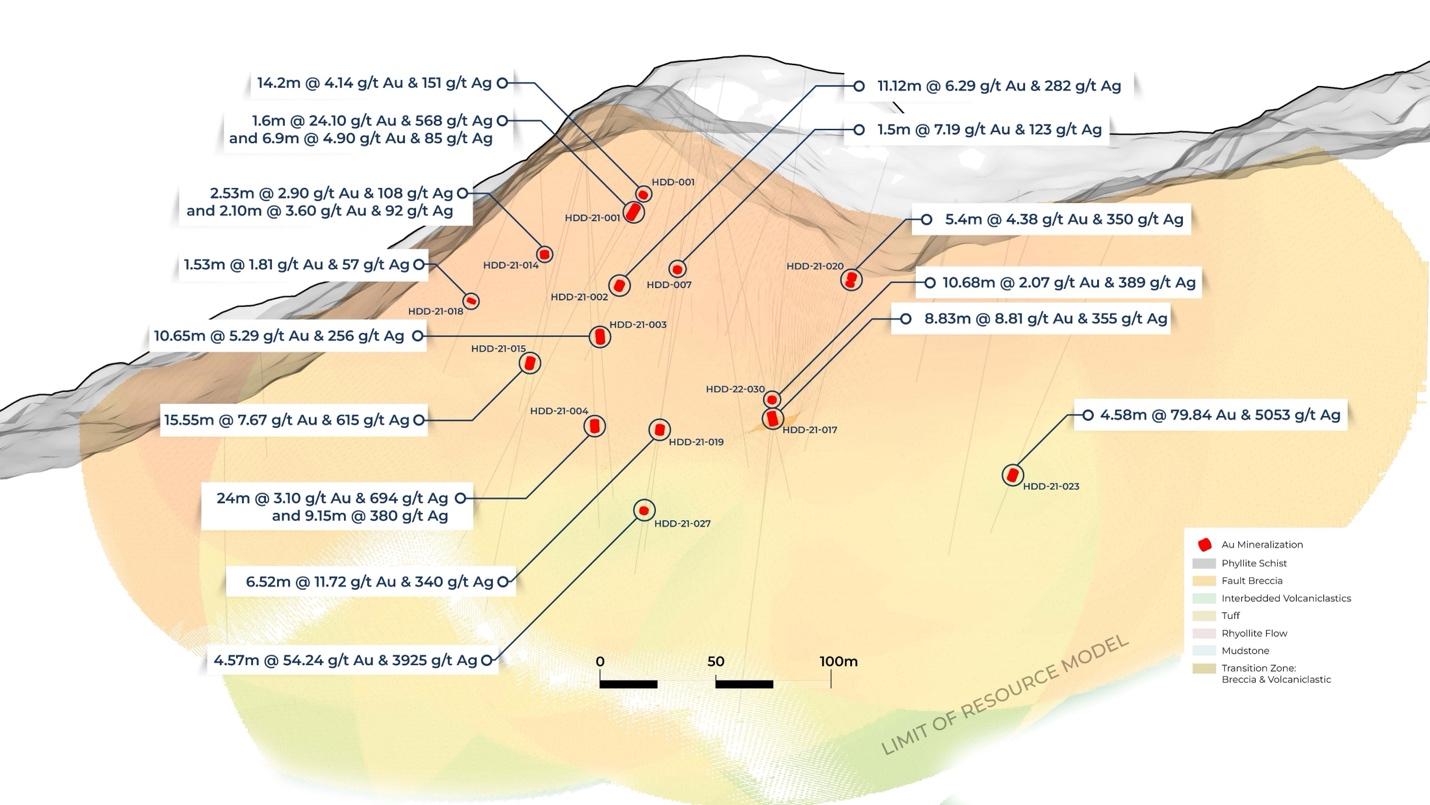

Volcanic’s geologists conducted drill campaigns to have a better understanding of the multiple targets at Holly.

This drilling didn’t discover just one or two veins. It came across a system of high-grade quartz veins intersecting the mineralized Jocotan fault zone. The picture below shows some of the veins discovered to date.

Ongoing drilling has produced outstanding results, including 4.58 meters of 79.84 g/t gold and 5,053 g/t silver.

The company’s confidence in its geologic model led it to prepare an initial resource estimate for Holly. The company now has an official NI43-101 compliant inferred resource at Holly.

Note that the resource is based on the gold price of $1,800 per ounce and a silver price of $22 per ounce.

For reference, the current price of gold is $3,380, and the price of silver is $37.80.

In other words, Volcanic Gold Mines used conservative estimates for its initial resource. At the current prices, it can potentially include even more ounces. As of now, the project’s inferred resource includes 1.32 million tonnes at 6.46 g/t gold and 256 g/t silver for 272,110 ounces of gold and 10.9 million ounces of silver.

In gold equivalent terms, the project hosts 1.32 million tonnes at 9.57 g/t gold equivalent for 406,316 gold-equivalent ounces.

Most importantly, the La Peña vein, which hosts the resource, is open both along strike and at depth. The picture below shows how much potential mineralization around the current resource area hasn’t been explored yet.

We would not be surprised to see the La Peña resource grow in all dimensions.

And remember that La Peña is just one of the multiple veins the company discovered at Holly. It’s entirely possible that Volcanic Gold Mines will deliver more high-grade resource estimates in the future.

(We need to make the necessary disclaimer that any statements about the company’s future are uncertain and shouldn’t be seen as facts. Investors should do their own due diligence before investing in Volcanic Gold Mines Inc.)

This exploration potential is just one of the company’s catalysts.

However, there are other reasons why you should put Volcanic Gold & Silver on your radar.

The company is well-financed. Volcanic has just raised funds through a private placement. It offered 12.5 million shares but ended up selling 1.4 million more.

This placement was a success in itself. While other resource juniors struggle to raise even a hundred thousand dollars, Volcanic’s story generated so much interest in the investment community that its offering was oversubscribed.

This financing tells us that savvy investors are watching this story. It’s a vote of confidence.

Exploration work to begin shortly. Volcanic has made impressive progress at its Holly project so far. It drilled less than four kilometers and managed to put together a high-quality, high-grade NI43-101 compliant resource estimate.

With more than one and a half million added to its treasury, the company will accelerate its exploration work at Holly. More drill results will be coming.

As we said earlier, Holly hosts multiple veins. The company’s resource estimate is based on just one portion of one of them. We will not be surprised to see other shallow and deep zones discovered at Holly once drilling begins again.

A successful team at work. An exploration-stage company can only be as good as the team doing the work on the ground. As we mentioned earlier, the team working at Volcanic was responsible for some of the highest-profile discoveries in Guatemala, including Cerro Blanco, San Martin, San Jose, Pavon, and Tambor.

With a track record like this, the company arguably has a better chance of spotting the next economic discovery than its peers.

The management team, too, includes some of the most well-regarded professionals in the mining industry. For example, the company’s President and CEO, Simon Ridgway, has over 35 years of experience in exploration and mining. Mr. Ridgway is the founder of Gold Group Management and Fortuna Silver Mines (market cap of $2.1 billion).

He personally was involved in the discovery of Cerro Blanco and other deposits in Central and North America.

At the helm of the company’s technical team is Mr. Luc English. Mr. English is the company’s vice president of exploration.

He has over 30 years of experience in the mining industry, 18 of those in Central America.

But beyond their qualifications and experience, Volcanic’s management drives another catalyst for the company’s shares…

Management has skin in the game. The company’s executives are invested in its success. Management owns about 8% of the total shares outstanding. This is another major vote of confidence. The management is in the same boat as other shareholders.

The company isn’t exposed to the US economic calamity. As a Canadian resource junior working in Central America, Volcanic isn’t at the mercy of the weakening US economy.

On the contrary, it can leverage the economic and political chaos up north to attract and retain inexpensive and highly qualified labor in Guatemala.

Relationships with local decision-makers are solid. The company has a transparent relationship with the governments of the towns close to the Holly project.

In a jurisdiction such as Guatemala, the relationship with local communities and their representatives is of paramount importance. Volcanic has been developing them successfully for years.

Timing is also a catalyst. Investors should start watching Volcanic NOW.

The company is well-financed to do a meaningful and potentially story-changing amount of work at Holly. It has both macroeconomic and company-specific tailwinds.

The company’s stock chart (note that past performance doesn’t guarantee future results) shows that it has outperformed gold so far this year. In our opinion, Volcanic has all it takes to deliver more upside to its shareholders in the future.

Investors looking for opportunities to get leverage to the price of gold should add Volcanic Gold Mines Inc. (TXSV:VG, Frankfurt:CKC1) to their watchlists.

Sign up to receive our future articles and updates.

Disclosure

The Canadian Mining Report has been retained by Volcanic Gold Mines Inc. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Volcanic Gold Mines Inc.. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Volcanic Gold Mines Inc. and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More