May 02, 2025

Trump Trade: Making Gold Great Again

After years of previous administrations’ mostly pro-globalization policies, Donald Trump shocked the market with his unusual “art of the deal” approach.

In early April, he announced a landslide of tariffs affecting most countries. These tariffs changed established trade rules and practices, sending markets tumbling.

Since then, there has been a flood of social media posts and news canceling, pausing, reinstating, and further changing the originally suggested measures.

The most dramatic of them was the 145% tariff on Chinese imports.

This massive levy, and the rest of them, was supposed to further Trump’s agenda to Make America Great Again.

Some countries, including China, introduced counter-tariffs. This saga isn’t over yet. Investors should be extremely careful.

More Things to Break

Trump's policies are indeed bizarre and shocking for many.

He is trying to revive the US manufacturing sector and encourage companies to move their facilities to the US.

That sounds reasonable. But first, he needs to make the local currency more affordable for foreign trade. Otherwise, no country can afford to pay for American goods and services.

His plan has worked so far. The US dollar index has fallen over 8.0% year-to-date.

His next target is interest rates, which Trump sees as having stayed too high for too long.

That’s why he started wrestling with Federal Reserve decisions and threatened to fire Fed chair Jerome Powell.

That’s direct pressure on the US dollar and interest rates, which is coming not from China, Russia, or any other nation but from the President himself.

It’s no surprise that, given this market uncertainty, stocks have tumbled from their recent peaks.

Major stock indices posted big losses. At the recent bottom in early April, the S&P 500 plunged by over 15% since the beginning of the year. It has recovered since then, but the index still remains in the red year-to-date.

At the Canadian Mining Report, we warned you about Trump-induced volatility. Hopefully, you heard our warning and diversified your portfolio into safe-haven assets.

Gold, the main crisis-proof metal, broke its new all-time high of $3,500 per ounce in intraday trading. We're glad to see that, but it also means we’re right about the current and future economic problems, and we'll likely see more negative news hitting the markets.

Following major central banks, large institutional investors began pulling into gold. Money managers have also begun buying gold stocks. They have a strong record of outperforming gold during rallies.

Many major gold stocks have already surged to their new highs.

For example:

• Agnico Eagle Mines (AEM) gained over 50% so far this year.

• Franco Nevada (FNV) is up over 40% year-to-date.

• Orla Mining (ORLA) has nearly doubled from the beginning of the year.

What’s Next?

History doesn’t repeat itself, but it often rhymes.

Usually, after investors increase their exposure to the sector's go-to names, they turn to smaller stocks. These are generally riskier but also have higher reward potential.

These smaller gold mining companies tend to outperform in a prolonged gold bull market.

However, investors have to be very selective when picking gold stocks.

They need to focus on high-quality projects in stable jurisdictions. A high-grade deposit usually means serious profit potential down the road.

Higher grades often translate to lower costs and wider margins, which is a major win—especially when gold prices keep increasing.

Even when the market goes through a period of volatility, strong grades and economics help companies stay profitable. Plus, high-grade discoveries tend to move faster toward production. They can catch the eye of big players looking to scoop up promising assets.

All in all, it's the kind of upside that’s hard to beat.

At the Canadian Mining Report, we follow high-quality gold companies led by people with strong track records, like Simon Ridgway and his Rackla Metals (TSX-V:RAK). The company’s share price has tracked gold and gained over 100% year-to-date. (Note that past performance doesn’t indicate future results.)

Feel free to read more about the company here:

An Established Exploration Company to Play Gold’s Ongoing BULL Market

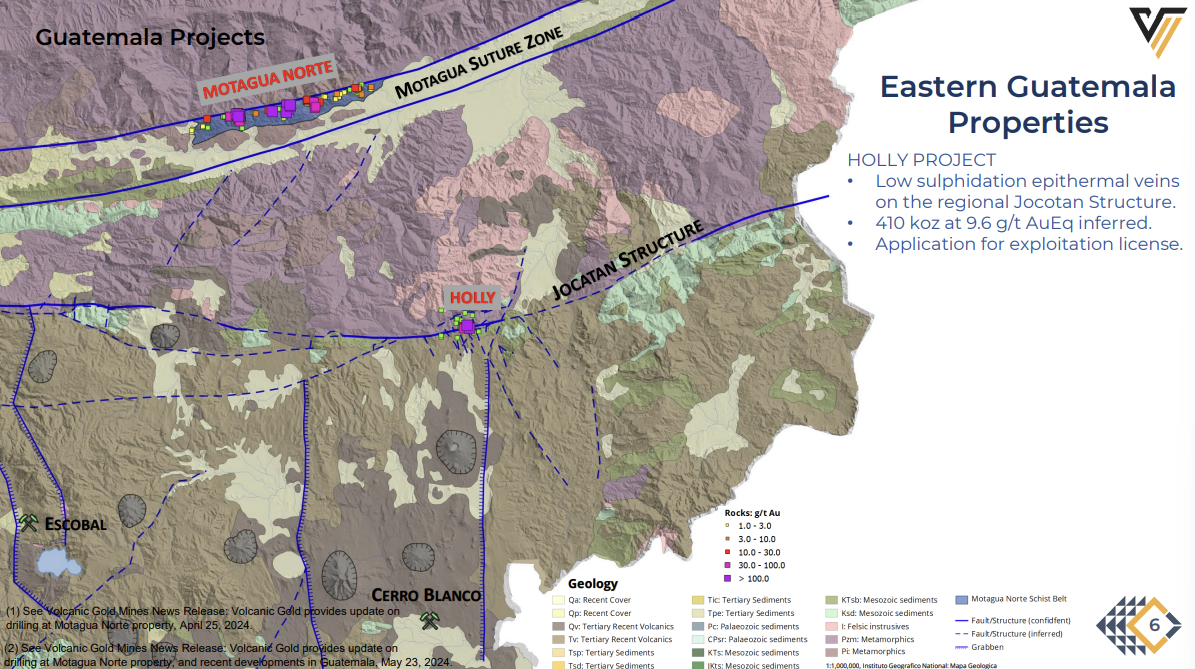

Mr. Ridgway has another company working on a gold project in Guatemala—Volcanic Gold Mines (TSX-V:VG).

The company’s flagship project is close to Mr. Ridgway’s previous discovery: the high-grade Cerro Blanco gold deposit, which was recently bought by Aura Minerals.

Mr. Ridgway has extensive knowledge of the local geology. We believe that Volcanic Gold Mines’ (TSX-V:VG) Holly project has a good chance of delivering high-grade drill results in line with the existing resources of 410,000 ounces of gold at 9.6 g/t gold equivalent.

Find more about Volcanic Gold Mines (TSX-V:VG) here:

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome.