De Beers diamond output to peak this year thanks to Gahcho Kue

Anglo American's De Beers, the world's largest rough diamond producer by value, said Thursday it plans to mine precious rocks this year at a rate not seen since the 2008 global financial crisis.

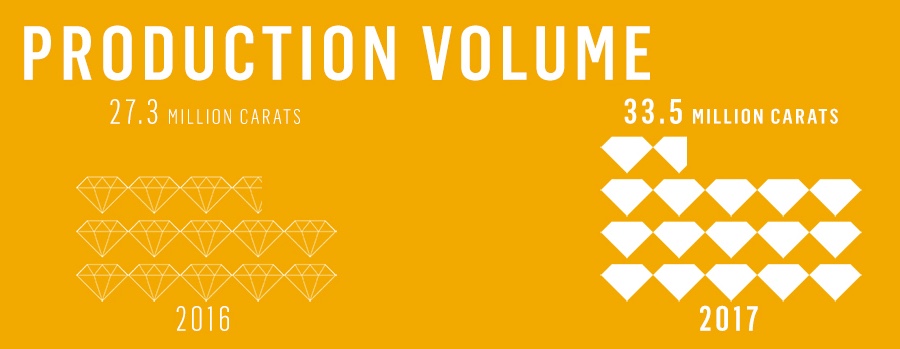

Delivering its preliminary financial results for 2017, the miner said it intends to dig up as much as 36 million carats this year, up from 33.5 million in 2017, thanks mainly to the participation of its newest mine - Canada's Gahcho Ku?(C).

However, it expects output to then slide to 32 million carats in 2019 and 2020 due to the closure of its Victor mine in Canada, expected in the first half of 2019, as well as the transitioning of its South African Venetia mine from an open-pit to an underground operation.

Courtesy of De Beers.

The company, which is currently exploring for new deposits in South Africa, its home country, said the planned closure of some of its operations in Namibia would also affect overall production numbers.

De Beers maintained a positive outlook for this year off the back of stronger consumer demand for diamond jewellery in US and China last year. Demand has picked up for certain polished categories that had struggled of late, including VVS-clarity stones, while the miner's retail unit, De Beers Diamond Jewellers, saw a strong December sales period.

"Improving global macroeconomic conditions remain supportive of consumer demand growth for polished diamonds in 2018," the company said in the statement. "The degree of global economic growth, however, will be dependent upon a number of factors, including the extent of the positive impact on growth in consumer spending from US tax cuts, the strength of the dollar on consumer demand in non-dollar-denominated countries, and how successfully China manages its adjustment to a more domestic consumer-driven economy," it noted.