De Beers is selling diamonds for less and the industry isn't happy

After shocking the market with a decision to start selling jewellery containing synthetic diamonds, Anglo American's De Beers is planning to let buyers refuse some lower-quality stones.

The unusual move (the world's No.1 diamond miner is famous for requiring buyers to take what's offered) says lots about the state of the low-end diamond market. The last time De Beers did something similar, in fact, was two years ago, when India's move to ban high-value currency notes pushed down demand.

The diamond giant's new strategy for small stones, paired with its looming entry into the lab-grown stones market, have many in the industry worrying about prices.

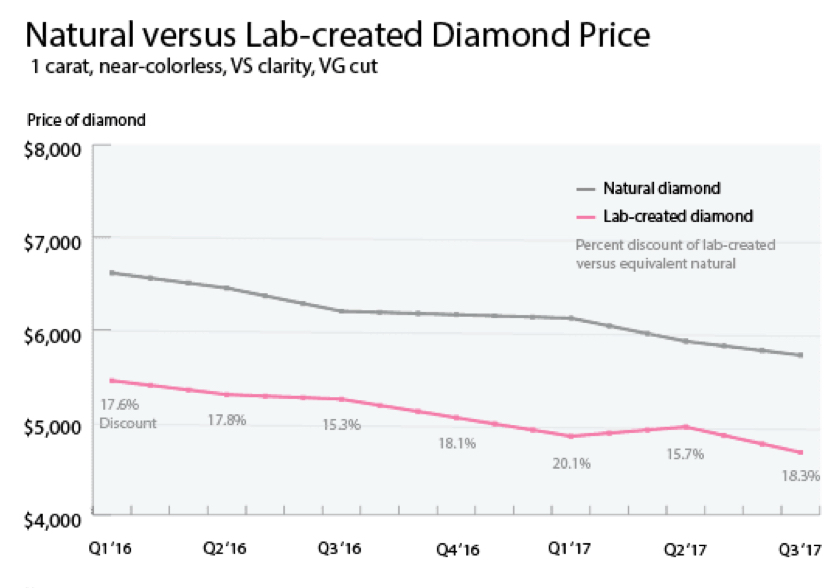

A 1-carat synthetic sells for roughly $4,000, about half the price of a natural diamond. De Beers new lab gems, to hit the market this month, will sell for around $800 a carat.Cheaper diamonds, which are often small and low quality, are selling for a lot less now than five years ago. And when it comes to synthetic stones, De Beers' entry in the market will create a big price gap between mined and lab diamonds, pressuring rivals that specialize in synthesized stones at the same time.

A 1-carat man-made diamond sells for about $4,000 and a similar natural diamond fetches roughly $8,000. De Beers new lab diamonds will sell for about $800 a carat. That's a fifth of the price of existing man-made stones and one-tenth of the cost of buying a similar natural gem.

No wonder competitors are worried. The lab-grown industry has filed a complaint with the U.S. Federal Trade Commission, accusing De Beers of price dumping and predatory pricing.

They did so even though the government body recently amended its jewellery guides in which it changed the definition of "diamond" to include synthetic ones.

The word "natural" has been omitted in the new description, while regulations in marketing diamonds have been altered to refer to synthetics as "gem" and "gemstones" requiring them to specify laboratory production.

The FTC's previous definition of a diamond read: "A diamond is a natural mineral consisting essentially of pure carbon crystallized in the isometric system." The words "gem" and "gemstones" when marketing the synthetic version were banned prior to the amendment.

Price comparison example of natural versus lab created diamond. (Courtesy of Paul Zimnisky.)

"De Beers aren't stupid," Chatham Chief Executive Officer Tom Chatham, who filed the complaint, said in an interview with Bloomberg's Businessweek last month. "They know how to grow diamonds, but this equipment is not cheap. They are selling below cost."

Based on the De Beer's own analysis, consumer demand for diamond jewellery in the US - where its Lightbox brand will be launched - represents more than half of global demand; it touched $43 billion last year versus $82 billion globally.

By the time De Beers $94 million synthetic diamonds plant outside Portland, Oregon, is fully online (by the end of 2020), it will produce about 500,000 carats of diamond rough a year. The figure is a far cry from the company's forecast of 34m-36m carats of gem-quality mined rough for 2018.

Ethical

Beyond being more affordable than mined diamonds, synthetics have positioned themselves as an ethical alternative that eliminates the possibility of dealing with conflict diamonds.

Man-made gems currently make up a small part of global diamond market, but demand is increasing. Overall diamond production was about 142 million carats last year, according to analyst Paul Zimnisky. That compares with lab production of less than 4.2 million carats, according to Bonas & Co.

With files from Bloomberg.