Dead Ends Ahead for Silver Price / Commodities / Gold & Silver 2023

With the fundamental roadblocks addingup, silver confronts a bearish outlook at nearly every turn.

With the FOMC’s hawked-up SEP andPowell’s inflation focus upending several risk assets, rising real interestrates continue to weaken silver’s bull thesis.And with the Fed chief promising more of the same on Sep. 20, higher interest rates and/or a recessionare both bullish for the USD Index. Powell said:

“The worst thing we can do is to fail torestore price stability, because the record is clear on that. If you don’trestore price stability, inflation comes back and... you can have a long periodwhere the economy is just very uncertain, and it’ll affect growth. It... can bea miserable period to have inflation come constantly coming back and the Fedcoming in and having to tighten again and again.”

Thus, with Powell keen on avoiding themistakes of the 1970s, the soft landing narrative should disintegrate as theinflation fight continues. For example, the National Association ofHomebuilders (NAHB) released its Housing Market Index (HMI) on Sep. 18. Thereport stated:

“All three major HMI indices posteddeclines in September. The HMI index gauging current sales conditions fell sixpoints to 51, the component charting sales expectations in the next six monthsalso declined six points to 49 and the gauge measuring traffic of prospectivebuyers dropped five points to 30.”

Worse Conditions Ahead

More importantly, the drag was drivenby higher long-term interest rates, which we warned were the key ingredient fora recession. And with the rate surge still ongoing, the situation should worsenand help push gold off the recessionary cliff.

Please see below:

Likewise, while homebuilder confidence has come under pressure from higherlong-term Treasury yields, there is still plenty of room to fall.

Please see below:

To explain, the green line above trackshomebuilder confidence, while the red line above tracks homebuyer confidence.If you analyze their movement, you can see that the pair were largelyinterconnected since the 1980s. Yet, with unaffordability pushing the red lineto/near its all-time lows, higher long-term interest rates make the situationeven gloomier. As such, the data does not support a soft landing.

Speaking of which, RedFin – a U.S.residential real estate brokerage and mortgage origination company – revealedon Sep. 14 that “the median U.S. monthlymortgage payment hit an all-time high of $2,632 during the four weeks endingSeptember 10.” And again, long-term interest rates are higher now, whichmeans even worse conditions in the weeks ahead. The report added:

“It’s more expensive than ever to buy ahome, with monthly payments at a record high due to stubbornly high rates andhome prices. Although the weekly average mortgage rate has declined slightlyfrom August’s two-decade high, it’s still sitting above 7%. Prices are up, too,increasing 4% year-over-year (YoY).”

Please see below:

Oil Is a Bad Indicator

While some view higher oil prices asan indicator of economic prosperity, the harsh truth is that crude is alate-cycle darling that only dampens the economic outlook.Remember, higher oil prices increase gasoline and heating costs for Americans.And with the colder weather poised to bite over the next 60 days, that’s lessdisposable income to spend on S&P 500 companies’ goods and services.

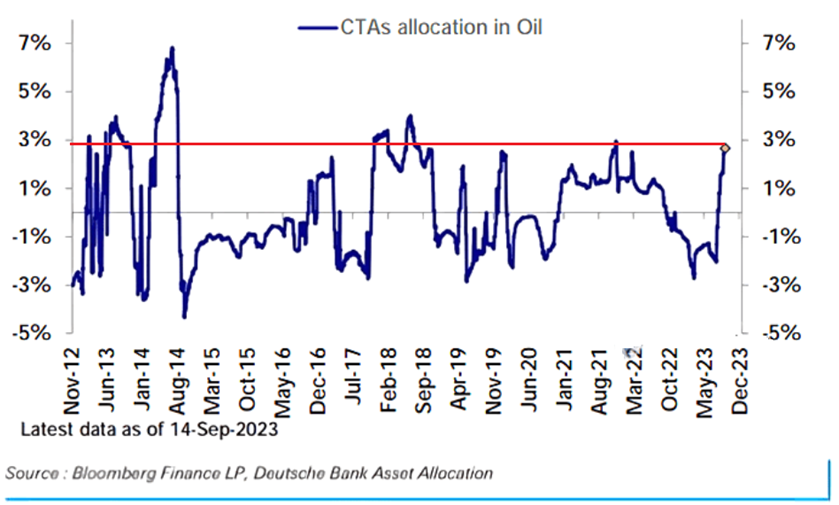

Furthermore, with the CTAs’ (algorithms)momentum bets boosting prices, the unraveling should be swift when therecession scars become more obvious.

Pleasesee below:

To explain, the blue line above tracksCTAs exposure to oil. If you analyze the horizontal red line, you can see thatthe bulls are nearly all in, and a major liquidation is unlikely tohelp the S&P 500 or the PMs. In other words, whenvolatility strikes and is a function of real fear, the ramifications are highlybearish for risk assets like silver and mining stocks.

Overall, soft landing expectations andFOMC belief helped elicit a prominent bond-market sell-off. Yet, the irony isthat higher long-term interest rates only increase the chances of a recession,which negates the two catalysts that pushed them higher in the first place.But, theUSD Index should be a profound winner from the rate re-pricing,while the PMs will likely come out on the losing end.

To understand how to read and react inreal-time, subscribeto our premium Gold Trading Alert. We’ve made money on 10consecutive trades and think even more profits will blossom in the fall andwinter months. Moreover, combining the technicals with the fundamentals allowsyou to manage risk when liquidations unfold.

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.