Deficits And Cryptocurrencies Could Be Bullish For Gold

The demand for gold in the United States exceeded the supply in 2017.

Gold does not react to the law of supply and demand as we would expect due to the overwhelming presence of the futures market.

The United States is expected to run enormous deficits for as far as the eye can see which could lead to inflation in a rising interest rate environment.

Gold is a hedge against inflation due to the fact that it cannot be created out of thin air like a fiat currency can.

The futures market is hundreds of times the size of the physical gold market so it dominates the price for now but that could change should physical demand grow.

Over the past few weeks, I have seen a number of interesting articles and signs that lead me to become somewhat more bullish on gold (GLD). This is an asset that has languished in the market in recent years, especially when compared to other assets such as stocks. Nevertheless, there are certainly some things that can cause it to break out to the upside and it is important to be aware of these things so you can decide if gold is right for your portfolio.

The Gold Deficit

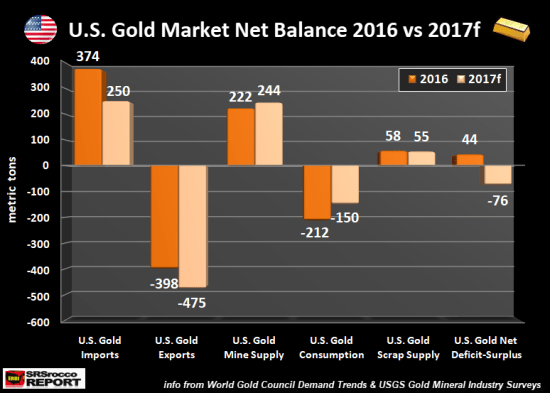

On Saturday, January 6, 2018, precious metals researcher Steve St. Angelo published an article entitled, "US Gold Market Switches From A Surplus In 2016 To A Deficit In 2017." In this article, Mr. St. Angelo states that, as a result of exports, investor demand for gold exceeded the supply of gold in 2017 while the reverse was true in 2016.

Source: Steve St. Angelo, TalkMarkets

Source: Steve St. Angelo, TalkMarkets

It is interesting that he focused on only the US market when gold is a global commodity and thus the more important indicators of possible future price action would be global supply and demand. However, as I have argued in numerous past articles, the United States has apparently been exporting gold for years (despite our official figures not reflecting this) and demand for gold in the US has been rather muted for years due to other assets such as stocks performing much better, so it is interesting to see that the demand for gold is now outstripping the supply at home.

In theory, gold is just like any other asset in that it responds to the economic law of supply and demand. Thus, when the demand for the asset exceeds the supply, the price should increase until that is no longer the case. In practice however, it does not work this way with gold due to the overwhelming influence of the futures market, which will be discussed later in this article.

The Specter of Inflation

Almost everyone reading this is likely aware of the fact that predictions of coming inflation have been becoming more and more numerous since the beginning of the year. At least some of these predictions are rooted in the recently passed Tax Cuts and Jobs Act due, at least partly, to the Congressional Budget Office's estimation that this bill will add an additional $1.4 billion to the national debt over the next decade. One of my fellow contributors here at Seeking Alpha pointed this out earlier today and I have seem similar predictions in articles on other media outlets. This prediction does make a lot of sense too. The US budget deficit for fiscal year 2018 was estimated by the CBO to be approximately $593 billion although it seems likely to be substantially above that (for the record, it is at $717 billion as of the time of writing) due to the tax cuts. The fiscal year 2019 budget deficit is estimated to be just under $1 trillion. There is very little chance that these deficits will be reduced any time soon and thus the national debt will rapidly increase. When we consider that the debt-to-GDP ratio is already over 100%, we can easily come to the conclusion that there is a serious financial crisis looming.

The Federal Reserve has announced its intention to raise interest rates either three or four times this year, which will wreak further havoc on the federal budget as the nation sees its interest payments skyrocket. It is not hard to think of a scenario where the United States begins to print money to cover its obligations and thus stoke inflation.

Historically, gold has acted both as a store of wealth and as a hedge against inflation. This makes sense. Unlike with fiat currencies (such as the US dollar), gold cannot be created out of thin air. Gold instead is a physical asset, there is only so much of it. As the root cause of inflation is a greater and increasing amount of money chasing the same amount of goods and services, prices increase due to scarcity. This should cause the price of gold to increase (assuming the demand for gold remains static).

At this point, there may be some readers that point out that the quantity of gold can increase. For example, a gold mining company can always pull more gold out of the ground. While this is true, doing so requires human and mechanical labor. Thus, the production of gold actually produces wealth and therefore results in gold being a store of wealth.

Futures Market Impact

Although the fundamentals for gold are quite good, the price action has been somewhat distorted from the fundamentals for a long time now. As I mentioned earlier in this article, the primary reason for this is the influence that the futures market has on the gold price. This is at least partly due to the sheer size of it, which I have discussed in my previous articles on gold. According to Clint Siegner of Money Metals Exchange, the amount of gold represented by contracts in the futures market was recently as high as 500 times the amount of physical gold in existence, although the figure varies considerably over time. This is because, unlike physical gold, a futures contract can be created out of thin air; there is no requirement that the seller of a contract actually possess the gold represented by the contract. The contract seller only has to post a relatively small amount of cash as margin. In addition, the buyer of the contract will rarely demand physical delivery of the gold but is only interested in profiting off of the price fluctuations.

These characteristics allow a large monied buyer to manipulate the price of gold if they so choose. I have in past articles shown evidence of suspicious price movements that could have been caused by an attempt to manipulate the price, but I have seen no strange price movements recently. Regardless though, the absence of physical gold from the futures market does mean that there is no actual price discovery.

China attempted to remedy this problem in 2014 when it launched the Shanghai Gold Exchange, a commodities market for trading physical gold. While this market does involve trading gold contracts like any other commodities market, in this case the contracts must be backed by physical gold so market participants cannot "create gold out of thin air" like they can on other futures markets. Admittedly, this new market did not become as popular as China hoped, or perhaps it has simply failed to supplant the ordinary paper markets in setting the price of gold. It has, however, become the largest physical bullion exchange in the world. In addition, the price of gold on the exchange does not typically deviate much from the price of the metal on the paper markets.

The Rise of Cryptocurrencies

It is hardly a surprise to anyone reading this that cryptocurrencies have become increasingly popular worldwide. One of the reasons for this is that there is a growing distrust of government-backed fiat currencies and people are looking for alternatives that are not controlled by a government or government-affiliated institution (like a central bank). Gold would seem to be a logical beneficiary of this trend. In fact, gold should logically benefit to a much greater degree because it exists as more than just a few lines of code on a computer. Thus far, however, that has not happened.

At some point, it seems likely that people may genuinely want physical gold as opposed to just a paper contract. As many gold bulls do use the futures market to speculate on the metal, this seems like it will happen at some point and when it does, we will see the price breakout to the upside. When we consider that people that distrust fiat currencies will also distrust the futures market, it does seem logical that these people will want to have the physical gold in their possession. As the number of these people grow due to the reasons discussed above, it will be harder and harder to acquire the metal and therefore force the price up, regardless of what happens in the futures market.

Conclusion

There certainly appears to be a growing argument for gold in your portfolio. We already see a deficit of physical gold in the United States and when combined with the near certainty of coming inflation, surging public debt in the United States, and distrust of fiat currencies, it seems logical that demand for gold should increase. As people desire to hold physical gold instead of merely paper gold, we should see the price of gold increase.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.