Demand for Options Surges as RNG, AVYA Stocks Explode

Some AVYA options traders may just scored major profits

Some AVYA options traders may just scored major profits

Two of the biggest stock moves today are coming from RingCentral Inc (NYSE:RNG) and Avaya Holdings Corp (NYSE:AVYA). The companies last evening announced an exclusive partnership, sending the shares of each soaring, and options activity has picked up in a major way, as well. Let's jump into what's happening around RNG and AVYA shares.

RNG was last seen up 25.8% at $160.55, earlier hitting an all-time high of $169.58, putting the SaaS expert's year-over-year lead close to 90%. Options traders today appear to be betting on more upside, too, with call volume running at 15 times the pace expected. In the lead is the November 160 call, where new positions are opening, while the October 155 put has seen the second most volume.

Coming into today, the security had been seeing unusual put buying. The 10-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands at 3.07 and ranks in the 92nd annual percentile, so long puts have outpaced long calls by a quicker-than-usual pace in recent weeks.

Interestingly, RingCentral still has some short-covering potential. The 4.11 million shares sold short is equal to 5.4 times the average daily trading volume, so there's ample cash on the sideline. These bears are already in cover mode, with short interest down 17.9% in the last two reporting periods.

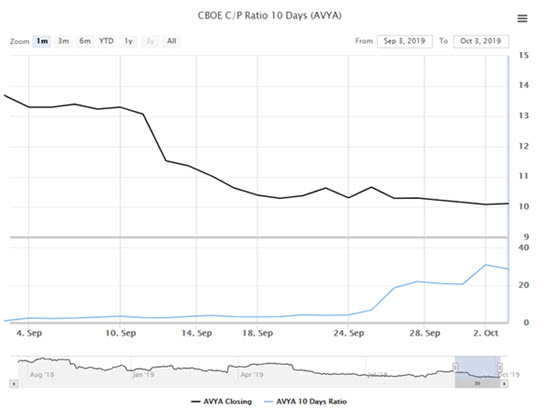

Turning to AVYA stock, it's trading up 26.5% at $12.80, coming off yesterday's record low of $9.72. Both call and put volume has blow past their daily average, and the most popular contract has been the October 12.50 call, though this was home to heavy open interest before today, suggesting closing activity could be occurring.

In fact, much of the activity for the October 12.50 call was just in the past 10 days, when more than 8,000 positions were opened. In total, more than 9,600 calls were bought to open across the ISE, CBOE, and PHLX in the past two weeks, compared to just 334 puts. The trend toward call buying essentially started back on Sept. 24, based on the chart below.