Despite Signs to the Contrary, Gold Price at or Near Top / Commodities / Gold and Silver 2021

The thing that most likely raisedquite a few eyebrows this week was – in addition to gold’s recent move byitself – the fact that gold rallied mostly without the dollar’s help. Yesterday(Jan. 5) I wrote that one swallow doesn’t make a summer and that a singlesession rarely changes much.

We didn’t have to wait for long – thesituation seems to be getting back to normal.

Figure1 - COMEX Gold Futures

After the January 4th rally, gold movedonly insignificantly higher, and it’s even a bit lower in today’s pre-markettrading.

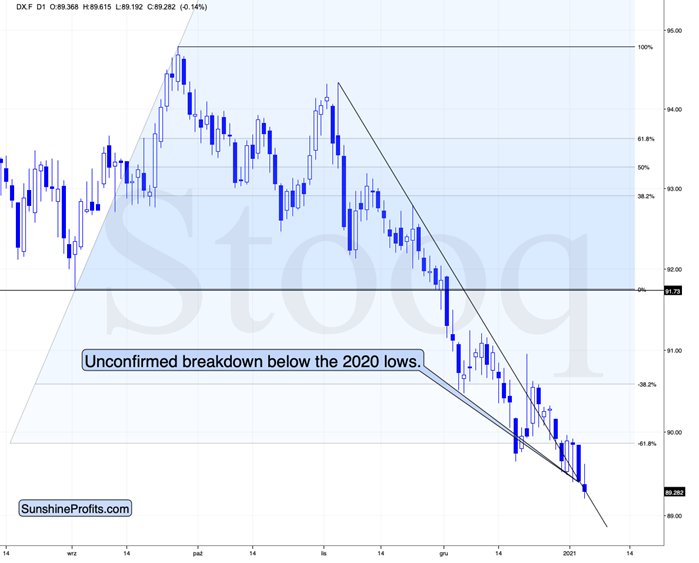

Figure2 - USD Index

While the USD Index didn’t decline onJan. 4, it did in the following days – yesterday and in today’s pre-markettrading. So, the gold-USD link seems to be relatively normal after all; it doesn’t – by itself – indicatefurther relativestrength in gold .

There are three important things that oneneeds to note here.

The first one is what I already wrotepreviously – gold is not even above its Nov. 2020 high, while the USDX is belowits 2020 low, which means that gold is weak relative to the USD Index andMonday’s (Jan. 4) rally seems to have been an exception.

The second one is also something that Iwrote about previously – gold is right at its triangle-vertex-based reversaland it might have just topped (given its tiny decline despite a decline in theUSDX).

The third one is that the USD Index hasquite a steep declining resistance line that’s based on the early-November andlate-November highs. Each previous attempt to break above it that we saw in thelast few weeks failed. But thanks to the steepness of the line, the USD Indexis at this line even despite today’s decline. All it takes for the USD Index tobreak above it is for it to do… nothing. This should be relatively easy givenhow excessive the bearishness is in this market, how similar it is to what wesaw in early 2018, what’s happening in the RSI and even given the similarity between 2018 and now in the cryptocurrencies. Youcan see details on the chart below.

Figure3 - USDX, USD, GOLD, GDX, and SPX Comparison

By the way, someone who is not interestedin markets or investments at all just called me yesterday to ask if I can helpan individual they knew with cryptos – this is a classic case study ofsomething that you see in the final stages of a price bubble. It’s an exampleof the general public buying, and they tend to enter at the tops. Bitcoin is atabout $35,000 when I’m writing these words - you have been warned.

How does it all combine? The gold-USDlink is intact and a soaring USDX would likely trigger a sell-off in gold.There are many reasons due to which the USDX is likely to rally soon, even thesituation in the cryptocurrency market makes the current time similar to early 2018. The triangle-vertex-basedreversal in gold is right about now, so it seems that we won’t have to wait forlong.

Figure4 - COMEX Silver Futures

Additionally, silver is showing strength.

Figure5 – VanEck Vectors Gold Miners ETF

Miners, however, are not showingstrength. They even declined yesterday (by just one cent, but still) while goldmoved a bit higher, but this is just a small confirmation of what we’ve beenseeing for many weeks.

Let’s study the above chart:

Miners were underperforming gold for manydays and weeks, and they showed strength on Monday (Jan. 4). Just like in thecase of gold – it was a one-day phenomenon, and one swallow doesn’t make asummer.

During the day, the GDX ETF managed torally above its 50-day moving average – just as it did at its November top.Unlike gold, miners are not very close to their November high. They correctedabout 61.8% of the decline from this top. Moreover, please note that minershave corrected about 38.2% of the August – November decline. They haven’t evenerased half of the decline that occurred in the previous months – so it’sdefinitely too early to say that miners started a new powerful rally here.Instead, we see that miners are making lower lows and lower highs.

Moreover, please take note of the spikein volume that we saw on Monday. There were very few cases when we sawsomething similar in the previous months, which was at the November high and atthe July high, right before the final 2020 top. The implications are bearish.

Thank you for reading today’s free analysis. Its full version includes details ofour currently open position as well as targets of the upcoming sizable moves ingold, silver and the miners. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Sign up for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.