Despite the War in Europe, Gold Remains Below Its 2011 High / Commodities / Gold and Silver 2022

Can gold's recent short-term rally beconsidered bullish, or can we expect a decline like in 2008?

IsSilver Really Strong?

Gold and silver are moving higher today,but nothing really changed despite that. Silver moved to its previous highs,while gold didn’t (chart courtesy of https://GoldPriceForecast.com).

Yes, the silver price is onceagain outperforming on a very short-term basis, and it makes the previousbearish indications stronger.

As a reminder, silver is much morepopular with the investment public than gold is (relatively to how they areboth popular with institutional buyers, that is), quite likely due to multipletheories surrounding its mispricing and also quite likely due to the fact that thesilver market is much smaller than the gold market and big buyerscan’t easily enter the silver market without moving its price too much.

Since the investment public tends to buyclose to the tops (and sell close to the bottoms), silver’s outperformance relativeto gold is what we often see as an indication that both preciousmetals are about to move lower.

Yes, there is some fundamental sense toPMs’ moving higher – China is ending its zero-COVID policy, which means someextra uncertainty for the markets, but overall, it’s unlikely to change thatmuch.

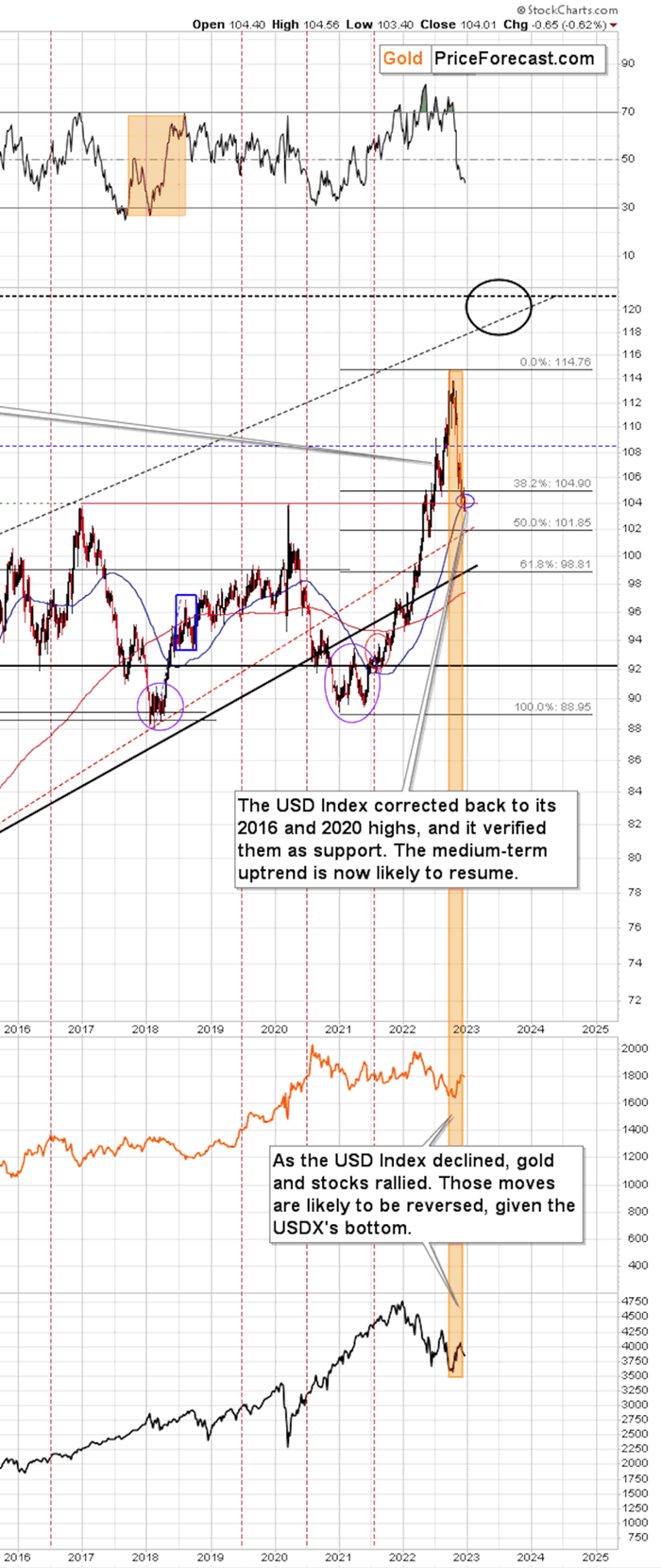

Aside from the day-to-day price swings,the big picture for gold and the USD Index (one of gold’s price key drivers)should make it clear that whatever wehave seen in the recent months was not bullish, but rather a regular correctionwithin a medium-term downtrend.

HistoryTends to Rhyme

The size of the recent short-term upswingmay seem significant, but only until one zooms out and notices that thecorrection that we saw in 2008 was even bigger. It was then followed by a hugedecline. I marked both rallies – the 2008 one and the current one – with greenrectangles.

The 2008 correction ended with gold aboveits 40- and 60-week moving averages. That’s where gold has moved recently aswell.

Why would the current situation besimilar? In both cases, there is major trouble ahead for the stockmarket due to tighter financial conditions. Back in 2008, it was thesubprime crisis that started it all, and while the circumstances were differentthis time, interest rates (nominal and real) are now on the rise (globally!),which is likely to contribute to people's rapidly decreasing motivation to holdanything that doesn't provide interest or a decent yield. Also, speaking of thebig picture, did you notice that gold is NOT above its 2011 high despite somany dollars, euros, yen, and other currencies being printed since that time? Gold is not above its 2011 high even thiughthere’s now a war in Europe!

Silver is not even trading at half of thevalue that it had at its 2011 top…

And gold stocks… The HUI Index is tradingbelow its 2003 (yes!) high.

All these are not signs of a strongmarket. Conversely, these are indications that the precious metals market wantsto move lower in the following months, and (probably) weeks.

While the precious metals sector doesn’tneed a specific trigger to decline, getting one would speed up the decline, andit seems that it’s about to get one from the USD Index.

The USDX moved to its 2016 and 2020 highsand is now trading slightly above them. It’s normal for any market to verifybreakouts by moving back to the previously broken levels, before the main move continues.Consequently, it’s no wonder that the USD Index did exactly that.

It’s also normal that the recentcorrective downswing was sharp – because that’s how the preceding rally was,too.

As very strong support was reached, theUSD Index is now likely to rally once again. Since the USDX and the preciousmetals market tend to move in opposite directions, it implies lower preciousmetals values in the future, and it seems that we won’t have to wait too long,either.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.