Detour Gold - A Look At The Latest Developments

A few days ago Detour Gold released its 1Q 2018 results; in my opinion, they were very decent.

Apart from that, the company changed its mine plan for the years 2019 - 2023; as a result, Detour Gold share prices tumbled.

In this article I discuss the latest developments at Detour Gold.

In my last article on Detour Gold (OTCPK:DRGDF) I was quite optimistic about this company. Although I pointed out that during the current bull market in precious metals the company was out of investors' fashion, a new mine plan could have a positive impact on Detour's performance. And I was initially right - since my publication (March 18, 2018) Detour shares went up 31.8%. Then...

A few days ago the company released its 1Q 2018 report plus a new mine plan for the years 2018 - 2023. However, the outcome was totally different than I thought and last Friday (April 27) Detour share prices tumbled to their lowest level since the beginning of the current bull market in precious metals.

Chart 1

DRGDF data by YCharts

DRGDF data by YCharts

Well, I am stunned so it is a good time to go through a new mine plan and the latest developments at Detour.

Introduction

To remind my readers, Detour Lake mine is a high tonnage, low grade open pit operation located in northeastern Ontario, Canada. According to the latest update, it hosts 508 million tons of ore grading 0.97 grams of gold per ton of ore (15.8 million ounces of gold, in total). The mine started its commercial operations in 2013 and since that time produced 2.5 million ounces of gold. However, due to some technical issues, permitting problems and delays in putting on line its two satellite pits (North and West), during the current bull cycle in precious metals the company's shares have been out of investors' fashion.

Operating costs

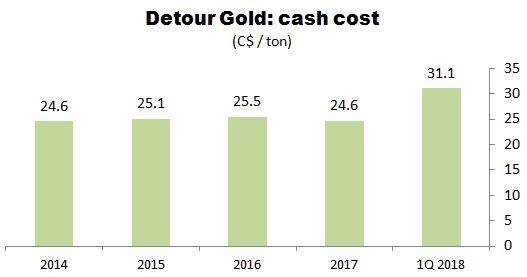

To be a successful operation, a bulk tonnage, low grade open pit mine has to produce its gold at a low cost of production. What is more, even a slight increase in costs may have a big, negative impact on the mining company's bottom line (much bigger than in the case of an underground operation). Let me look at Detour Lake historical costs of production (expressed in Canadian dollars per ton of ore milled):

Chart 2

Source: Simple Digressions

As the chart shows, over the years the mine was delivering its gold at a relatively stable cost of production of C$24.6 - C$25.5 per ton of ore milled. What is more, last year the company reported the lowest cost of production since 2015 (so a learning curve concept could be applied here). However, in the first quarter of 2018 the cost jumped to C$31.1 per ton (an increase of 26.4%, compared to an average cost reported in 2017). What happened? According to the company, the mine encountered:

Unplanned repairs and contractor crushing costs - the company lost its Caterpillar 7495 rope shovel, a crucial machine used to remove overburden and mine ore at the Detour Lake pit (there are two rope shovels working on the mine site so losing one of them is a big issue); although it is a one-off event its loss will have a big impact on the 2018 results - hence, a new guidance for this year Lower throughput - in 1Q 2018 the company processed 4.6 million tons of ore ( a decrease of 0.4 million tons, compared to 4Q 2017)However, due to higher head grades and good recovery rates, Detour produced a record quarterly amount of gold (157.1 thousand ounces).

Further, in 1Q 2018 the company sold 151.1 thousand ounces of gold and, taking advantage of higher gold prices ($1,330 per ounce vs. $1,256 in 2017) it reported a very good operating income of $45.3M.

Summarizing - despite a one-off negative event, in 1Q 2018 the company delivered very decent results.

New mine plan

A few months ago Detour revealed that it wanted to make some changes in the current mine plan. The main idea was to smooth annual gold production planned for the years 2019 - 2020. If the company were able to do it, the mine would generate higher (and sooner) cash flow (than initially planned) driving the company's value up. Simply put, higher and earlier production was supposed to lift up the value of Detour Lake set by a discounted cash flow model.

Note: according to the discounted cash flow concept, the cash flow delivered earlier is worth more than the same cash flow generated later. In the case of Detour Lake, free cash flow generated between 2019 and 2020 is more valuable than the same free cash flow delivered between 2021 and 2022.

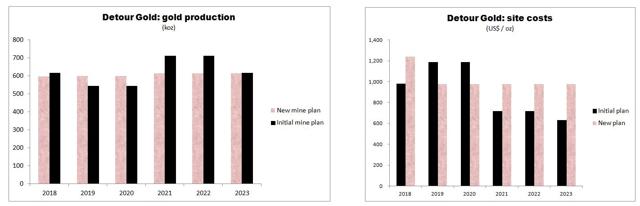

And indeed, in the latest release Detour Gold presented a new mine plan. According to this new plan, between 2019 and 2023 the company wants to produce comparable amounts of gold (around 600 thousand ounces per year), which is a change I have been expecting. The left panel of the chart below documents this change - instead of a drop in production in the years 2019 - 2020 (and an increase in the years 2021 - 2023) now the company plans to produce around 600 thousand ounces of gold per year between 2019 and 2023:

Chart 3

Source: Simple Digressions

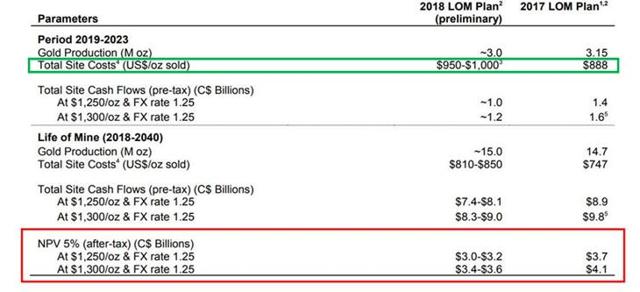

However, it is not the end of story. Despite this seemingly positive change, the net present value of Detour Lake is lower now. According to the company, using the price of gold of $1,300 per ounce, a "new" Detour Lake's net present value is C$3.4 - C$3.6 billion, instead of C$4.1 (as reported in the latest technical report) - look at the row marked in red:

Source: Detour Gold

The key explanation to this paradox is shown on Chart 3 (the panel on the right) and in the table above (the row marked in green). Indeed, although between 2019 and 2020 the mine should deliver higher amount of gold at a lower cost of production, this positive outcome is going to be erased by the following three factors:

the decreased free cash flow delivered this year ($55M vs. $115M initially planned) higher costs of production over the life of the mine ($950 - 1,100 per ounce now vs. $888 before) postponing the start of mining operations at the North Pit from 2019 to 2023 (and a loss of 187 thousand ounces, which were to be mined soon)Well, the points 1 and 3 are clear for me but I am really bothered about the point 2. As I mentioned in the beginning of this article, costs of production are extremely important for high tonnage, low grade open pit operations but the company's management is not specific about this issue. For example, in the 1Q 2018 Earnings Call Mr. Frazer Bourchier (the company's COO) said:

"Secondly, it is not the mine plan change that has increased cost, but rather a change in the near-term and longer-term assumptions as compared to the prior plan"

Well, I would like to know these assumptions as well but it looks like Mr. Bourchier himself has some trouble with this issue:

"I still need some more time to further understand and gain a higher level of confidence in some of these cost areas before we issue the full detail of the life of mine plan and associated financial results in June"

I do not think that Detour Gold investors were satisfied with these explanations and remarks. However, is the recent big price drop justified?

Detour's "new" value

Let me calculate the theoretical value of Detour Gold share using the company's latest estimates.

According to these estimates, using the price of gold of $1,300 per ounce, the project's net present value is C$3.4 - C$3.6B or $2.72B - $2.88B (using the exchange rate between the Canadian dollar and the US dollar of 1.25:1). At the end of 1Q 2018 Detour had net debt of $106M so the theoretical value of the company's equity is:

Net present value of $2,720M less net debt of $106M = $2,614M at least (I am using the lower end of the net present value delivered by the company)

Using a share count of 175 million, one share of Detour is worth $14.94. Today (April 30) these shares are trading at $7.25 so they are well below their intrinsic value.

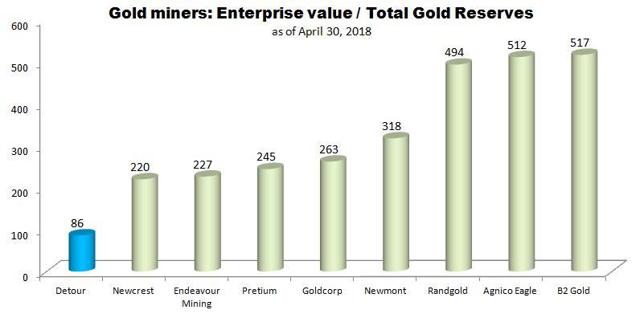

Every time there is such a big discount we should ask: "Do these shares present a buying opportunity?" I guess that most of investors do not think so - during the last two trading days at the Toronto Stock Exchange as many as 23 million shares changed hands (13.1% of the total share count). However, using a popular valuation measure defined as:

Enterprise value / Gold reserves

Detour Gold is the cheapest stock among its peers:

What does it mean? Simply put, I would not be surprised to see a bid offer coming from one of the big gold mining companies soon. In my opinion, Detour Gold and its huge Detour Lake deposit may present a screaming buying opportunity for a big miner looking for a quick and cheap way to increase its gold reserves.

Did you like this article? If yes, please, visit my Unorthodox Mining Investing section where I manage a portfolio of up-to-ten mining picks, discuss new investment ideas and provide my subscribers with a medium-term outlook on a few financial markets (particularly the base / precious metals market). Most recently I have introduced a new section called "Developers". This service is dedicated to mining companies planning to open new mines within one or two years.

Disclosure: I am/we are long CEF, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Simple Digressions and get email alerts