Detour Gold: The Latest Rally Seems To Be Justified

Since middle December 2018, Detour Gold is run by new management.

A few days ago the new management team released production guidance for 2019.

At first sight this guidance looks pretty gloomy but, in my opinion, the bigger picture is not that bad.

For example, I think that an all-in sustaining cost of production planned for 2019 is a bit overestimated.

I share the investors' optimism pushing Detour share prices higher.

Last year a group of investors led by John Paulson initiated a proxy battle to replace Detour Gold's (OTCPK:DRGDF) management with a new team. In December 2018 a special meeting of shareholders backed the Paulson group. As a result, now the company is run by a new management team. Interestingly, looking at the recent share price action, I think that investors have credited this management with confidence:

Source: Stockcharts

As the chart above shows, since the end of the proxy battle (red circle) the company's shares have broken up from a long-term downward trend (violet line) delivering a nice return of 25%.

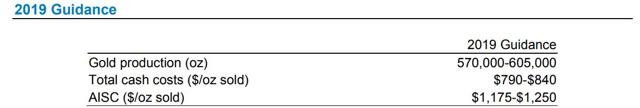

Guidance for 2019

On January 22, 2019 Detour released production guidance for 2019. Here are the basic figures:

Source: Detour

It is definitely not a growth scenario. To the contrary, I would say that new management was very conservative publishing these figures. For example, last year the company produced 621 thousand ounces of gold so guidance of 570 - 605 thousand ounces looks like a step back. What is more, over the first three quarters of 2018 Detour was producing gold at an all-in sustaining cost (AISC) of $1,181 per ounce of gold. According to guidance for 2019, this year the company expects to report the AISC of $1,213, on average (an increase of 2.7%).

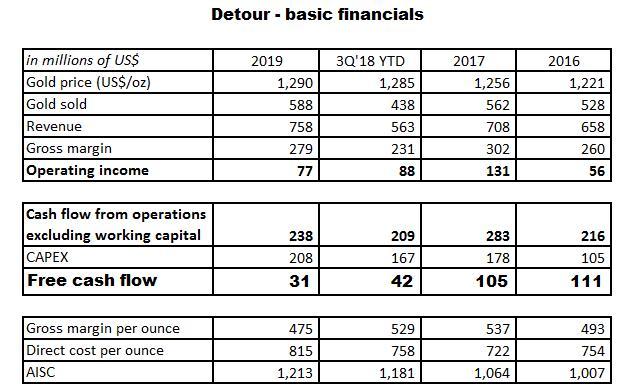

I have gathered all the data disclosed in guidance for 2019 and arrived at a few basic figures illustrating the expected company's performance in 2019. (For a better comparison I have also plotted historical figures for the first three quarters of 2018 and full years 2017 and 2016.)

Source: Simple Digressions and Detour's reported data

Source: Simple Digressions and Detour's reported data

First of all, it has to be noted that between 2016 and 2018 the company was selling the gold at similar prices ($1,221 - $1,285 per ounce). The price assumed for 2019 ($1,290) is close to historical prices as well. Hence, the results reported in each period are comparable.

The direct cost of production went up from $722 per ounce in 2017 to $758 over the first three quarters of 2018. This year I expect another rise in costs (to $815 per ounce of gold, on average).

As discussed above, the company also assumes a rise in AISC. If Detour is correct, we should see one of the highest AISC in history. However, as discussed below, the AISC for 2019 is, in my opinion, pretty distorted.

Stable prices of gold and higher costs of production should result in a lower cash flow from operations ($238M this year) compared to 2017 and 2018 (although the company has not released the 2018 full financial report yet I expect very decent results in 4Q 2018; hence, the cash flow from operations reported last year should be higher than $238M)

Finally, it looks like this year Detour will generate only a marginal free cash flow of $31M. However, investors should keep in mind that the company plans to spend as much as $80 - $90M to upgrade the Detour Lake tailings facilities. Although this spending is correctly classified as "sustaining capital spending", it is a one-off event as well. In other words, excluding this item from the sustaining capital calculations, the company would have reported the AISC of $1,068 per ounce of gold and a free cash flow of $116M, radically improving a bit gloomy picture emerging from guidance for 2019.

Summary

Since the middle of December 2018, Detour Gold has been run by new management. A few days ago the company released guidance for 2019 signed by the new management team. In my opinion, the figures presented in this release are quite conservative. As a result, some investors may be negatively surprised to see higher cost estimates or poor cash flow. However, I do not share this sentiment.

First of all, conservative guidance may be a tactic movement - if, despite a pessimistic scenario, Detour shows even slightly better-than-expected results, it will be a big plus for the new management team. Second, a high all-in sustaining cost of production projected by the company is distorted by a one-off event (capital spending to upgrade the tailings facility). After excluding this distortion the big picture looks much better, ranking the projected 2019 results among typical ones reported in the previous years.

As a result, I share the optimism expressed by Detour shareholders and mirrored in the recent strong rally in the company's shares.

Final note

Did you like this article? If your answer is yes, please visit my Marketplace service, Unorthodox Mining Investing.

In December 2018 I launched the detailed coverage of royalty/streaming companies related to the precious metals sector (for example, Sandstorm, Metalla, Maverix, etc.). During a precious metals market meltdown these stocks perform much better than classic miners.

Last but not least, during January Unorthodox Mining Investing is available at a 5% discount.

Disclosure: I am/we are long CEF, GDX, KL, SAND, ARREF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Simple Digressions and get email alerts