Diamond recycling could save the natural industry

Conventional wisdom says that an increased rate of diamond recycling results in downward diamond price pressure due to the theoretical increase in supply. However, the contrary may actually be true today in this relatively nuanced market. In fact, a more prevalent diamond recycling market could in fact be the natural diamond industry's saving grace.

Historically, given that a more active recycled market would inevitably increase the amount of polished in the supply chain, the upstream and midstream diamond industries have understandably lacked incentive to support the secondary market. However, given the current state of the diamond industry there is new incentive.

Given a rising generation of consumers that perceive diamonds as environmentally and socially unscrupulous, not rare, and overpriced, an increased emphasis on diamond recycling could in part address these concerns. The lab-created diamond industry has already strategically positioned itself to attend to these issues, but the natural industry has the potential to provide an even more attractive product in this context.

Addressing the issue of a "green" or "environmentally friendly" diamond, it is difficult to compete with a recycled diamond as any energy, environmental, or social cost of producing the diamond has already been realized. While a lab-created diamond does not involve excavation of earth, the production process still requires a significant amount of energy and there is no guarantee that labor practices are ideal, especially in legacy HPHT factories in the eastern world. A recycled diamond is theoretically free from all of the above production costs on a society.

Acknowledging the concerns of value, a more readily available, competitive and active diamond resale market would increase the secondary market liquidity for previously owned natural diamonds which would in effect support the market price of all natural diamonds, primary and secondary market. Essentially the only thing that sets a natural diamond apart from its lab-created counterpart is that a natural is a non-renewable resource.

Essentially the only thing that sets a natural diamond apart from its lab-created counterpart is that a natural is a non-renewable resource. This is especially significant given that a diamond is a luxury item. The supply of natural diamonds is limited by nature and there is a value that the theory of economics ascribes to that.

This value is apparent in the secondary market for natural diamonds and it is why most of the prominent C2B (consumer-to-business) buyers of diamonds tend to only buy natural. For example, industry leaders WP Diamonds (White Pine), IIDV and Mondiamo, a Blue Nile partner, currently do not buy lab-created diamonds. Online player, Worthy.com, will buy lab-created diamonds, but only in solitaire sizes 2-carats or larger. I Do Now I Don't (Delgatto) recently started "experimenting" with buying lab-created but noted that they will only buy at very discounted prices.

While new companies have emerged in recent years using the reach and efficiencies of the internet to make the reselling of diamonds more comfortable and convenient for consumers, the space is still relatively small. Currently, it is estimated that the diamond resale market accounts for 1-3% of natural diamond supply on an annual basis, or 2 to 4 million carats of rough equivalent. It is estimated that this market is growing at approximately 3-5% annually, or about 150,000 carats of rough equivalent a year. For context, natural diamond production is projected at 143 million carats of rough in 2019.

Notably, De Beers quietly entered the recycled diamond business in 2016, after a multi-month trial period, under the generic moniker Institute of Diamond Valuation or IIDV, as aforementioned. The entity buys diamonds from consumers through approximately 100 approved brick-and-mortar jewelers in the U.S. and also through an online process. Using the online option, "diamond sellers" fill out a submission form and are provided with a pre-paid shipping label, e.g. FedEx, to be used to send their diamond to the Institute for inspection. In a matter of days, a "market price quote" is given which the seller can take-or-leave free of charge. If the seller agrees to sell, funds are transferred via bank wire.

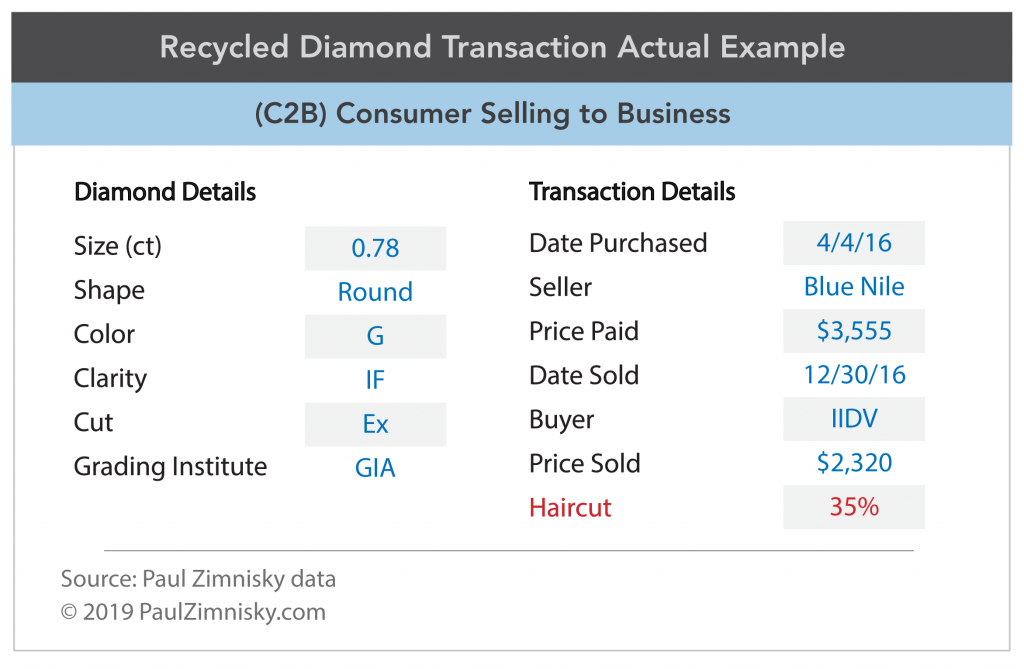

As an anecdote, a 0.78-carat (pictured above) internally flawless, G-color round was sold via the IIDV process at a 35% haircut.

It would be in the natural diamond industry's favor to support and improve the resale price spread for consumers. Optimally the industry should target a discount between the retail price of a natural diamond and the resale price, i.e. a "haircut," that is less than the cost of an equivalent lab created diamond. For example, if a natural 1.25-carat, round, G-color, VS1, Ideal-cut, retailed for $8,600 and an equivalent lab-created retailed for $4,550, the optimal haircut for the natural diamond would be less than 47%.

In this case it would theoretically make economic sense for the consumer to purchase a natural diamond over a lab-created (excluding any cost of carry or price appreciation over time of the natural, and assuming that the lab-created diamond has little to no resale value). Further, it could be argued that the price of lab-created diamonds will eventually gravitate towards the natural diamond resale spread discount, as this is the amount of money that a consumer is "willing to allow" the industry to consume.

While industry push back is understandable given that increased supply via recycled diamonds could negatively impact the supply/demand dynamic for miners and given that recycled supply does not support manufacturers of rough-to-polished, the benefits of a more prevalent diamond recycling industry arguably outweigh the potential costs.

Miners could benefit from higher overall diamond prices supported by a more effective diamond recycling mechanism. Manufacturers could still find business in recutting of recycled diamonds. For wholesalers and other midstream participants, going forward the business of dealing in recycled diamonds could pose a more attractive opportunity than in the past as traditional margins continue to be squeezed.

Supporting a robust diamond resale market for consumers is arguably one of the best ways for the industry to demonstrate the value of its product and also differentiate itself from not only lab-created diamonds, but from other competing luxury products. De Beers should continue to enhance efforts in this area and other industry leaders such as ALROSA, top mid-stream participants and influential retailers should also seriously consider the potential longer-term benefits to their industry. Further, this concept would also fit well within the narrative of the Diamond Producers Association marketing effort of natural diamonds.

Lastly, it is important to conceive that the potential outcome of such an initiative would likely improve the perception of natural diamonds without actually resulting in a significant influx of new diamond supply to market. Most consumers would probably still be reluctant to sell their diamonds (for reasons other than price) even if the resale market was in fact more liquid. However, the simple notion of consumers knowing that they could sell their diamonds if they decided to would in itself accomplish the aforementioned benefits to the industry.

Paul Zimnisky, CFA is an independent diamond industry analyst and consultant based in the New York metro area. For more regular analysis of the natural and lab-created diamond industry please consider subscribing to his State of the Diamond Market, a leading monthly industry report. Please message at the email below for a sample issue. Paul is a graduate of the University of Maryland's Robert H. Smith School of Business with a B.S. in finance and he is a CFA charterholder. He can be reached at [email protected] and followed on Twitter @paulzimnisky.

Disclosure: At the time of writing Paul Zimnisky held a long position in companies with exposure to the natural diamond industry including Lucara Diamond Corp, Stornoway Diamond Corp, Mountain Province Diamonds Inc, Diamcor Mining Inc, North Arrow Minerals Inc, Tsodilo Resources and Signet Jewelers. There are currently no stand-alone publicly-traded lab-created diamond companies.