Did BHP just call the bottom of the mining cycle?

BHP Billiton chief executive Andrew Mackenzie was upbeat about the outlook for the world's top mining company in an interview published Saturday in the The Australian.

A turnaround in the prices of the commodities the Melbourne-based giant produces would be volatile and prolonged and in some cases markets will take "a very long time" to come back into balance Mackenzie told the newspaper.

"If you look at the basket of commodities that we deal with, the numbers are self-evident: the fall has stopped"Nevertheless, Mackenzie believes the worst may be over:

"We're not looking at the screens and things continue to go down, down and down. And yet we are able to look at our numbers to see costs going down, down, down.

"If you look at the basket of commodities that we deal with, the numbers are self-evident: the fall has stopped."

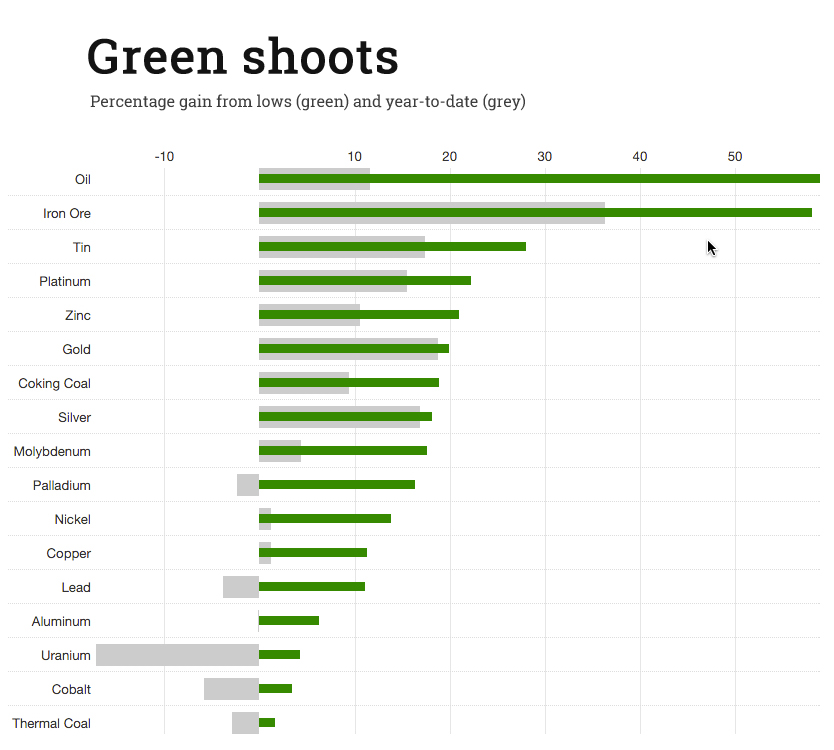

Given this week's rallies in crude oil (which would also help to stop deflation in other sectors), iron ore, coking coal and base metals, MacKenzie's timing may be spot on.

All the commodity prices tracked below are now trading above recent troughs, even if some still show declines year to date. In many instances the recovery has been from multi-year slumps and that includes bellwether copper which in January declined to seven-year low below $2.00 a pound even if the red metal is only back in positive territory for 2016 after today's 3% advance.

After massive back to back rallies iron ore is 58% above its $37 a tonne near decade low struck in DecemberBefore today's jump in crude oil to $42 a barrel which brought its advance from 13-year lows hit February to 58.9%, iron ore's turnaround was the most impressive. After massive back to back rallies iron ore is 58.1% above its $37 a tonne near decade low struck December 11.

Gold and silver seemed to rebound just as 2016 was getting started, but platinum fell to a 2008 low in January before retracing all the way back into a bull market (defined as a 20% move from a low). Palladium has also been dug out of its hole, but year to date the metal is weaker.

Australian hard coking coal has followed iron ore higher and the country's thermal coal exports have also inched up although few predict upside from current levels around $55 a tonne. Uranium fell to a near decade low at the beginning of April, but the spot price recovered slightly to $28.50 a pound last week.

The exception (that hopefully proves the rule) is potash. Producers are currently locked in negotiations with China about contract prices, but predictions are for a big leg down from last year's $315 a tonne. Perhaps Mackenzie was referring to potash (and not the usual suspect iron ore) when he said some commodities may be bumping along the bottom for "a very long time."

Source: Steel Index, LME, Comex, Nymex, UX, Infomine, MINING.com, World Bank