Did Jerome Powell just give the green light to inflation averaging?

Yesterday, I reviewed Wednesday's Fed rate decision and press conference with Jim Goddard on HoweStreet.com. Key topics included the positive outlook for gold, the USMCA opportunity for contrarians, the role the Fed seems to be playing in financing the US deficit, and a big potential policy shift in H1 that could have big implications for Canadian stocks.

We started the show by talking about gold which was one of the few clear winners after the Fed meeting. It found its legs as investors seemed to conclude that gold would win under either an inflationary scenario being sought by the Fed or an economic slowdown which the bond market is currently signalling. I discussed the ground covered in the January Top 20 Gold Report which explains that the gold stocks which could win under an inflationary scenario could be different from those that work in a deflationary environment.

The second segment talks a little bit about Trump signing the USMCA or NAFTA 2.0. Essentially, I characterize it as removing some uncertainty from the markets. Over the medium term, stocks like Linamar (LNR) with lots of gloom priced in could benefit. The issue is when the global auto industry will start to recover. Until it does, LNR is a candidate for patient contrarians only.

For the rest of the interview, we return to the Fed and implications for Canadian stocks. I note that Powell has put a floor on the required amount of reserves in the system ($1.5 trillion) and that he expects,

Our balance sheet will be expanding gradually over time, reflecting the trend growth in the demand for currency and other Federal Reserve liabilities.

The continual expansion of the balance sheet was an interesting admission when taken in the context of the role he sees the repo market playing. When he was asked by the Associated Press about how intervening in the repo market helps main street, he seemed to suggest that it is to ensure that the US government gets funded without putting upward pressure on interest rates.

This is a one-time thing that we are doing to adjust the level of reserves so that money markets will be able to operate smoothly on an ongoing basis. Repo markets are important because that's where...the purchases of Treasury securities which is part of the way the federal government is funding its operations...are financed. These are largely Treasury securities that have been purchased by dealers for distribution to end buyers to a substantial extent that is what is going on in the Treasury repo market. So, it is just the financing for that. Again... that activity is a market activity, we're not looking to eliminate volatility or protect anybody from volatility. What we care about is that volatility in the repo market can affect the transmission of our policy decisions to the Federal Funds rate and that is really important for the public.

He seemed to conveniently interject the notion that the Fed was not trying to protect players from volatility. However, that was not the question. His answer, however, seemed to suggest to me that US government funding demands were at least part of the reason why overnight rates jumped last year. In light of that, I suspect the Fed will play some sort of permanent role in helping to grease the wheels for Uncle Sam's debt issuance. Right now, we have not-QE. Perhaps in Q2 we will get not-permanent repo.

I believe the most important part of the press conference relates to a question on inflation averaging that Jean Yung from Market News International asked Powell near the end of his presser. Here is how Jerome Powell characterized inflation targeting in his answer:

It is a change in framework and over time it would lead to a different approach to policy

I think it is notable that he did not dismiss the idea of inflation targeting and he went at some length to describe how it would be different from the current policy approach.

Did Jean Yung just flush out the Fed on inflation averaging? (click to watch at 44:05)

It doesn't take a great leap of logic from there to conclude, at this point, with inflation having run well below target for some time, that the central bank will have to be looser for longer with a focus on policies that are pro-inflationary. That would have big implications for Canadian stocks.

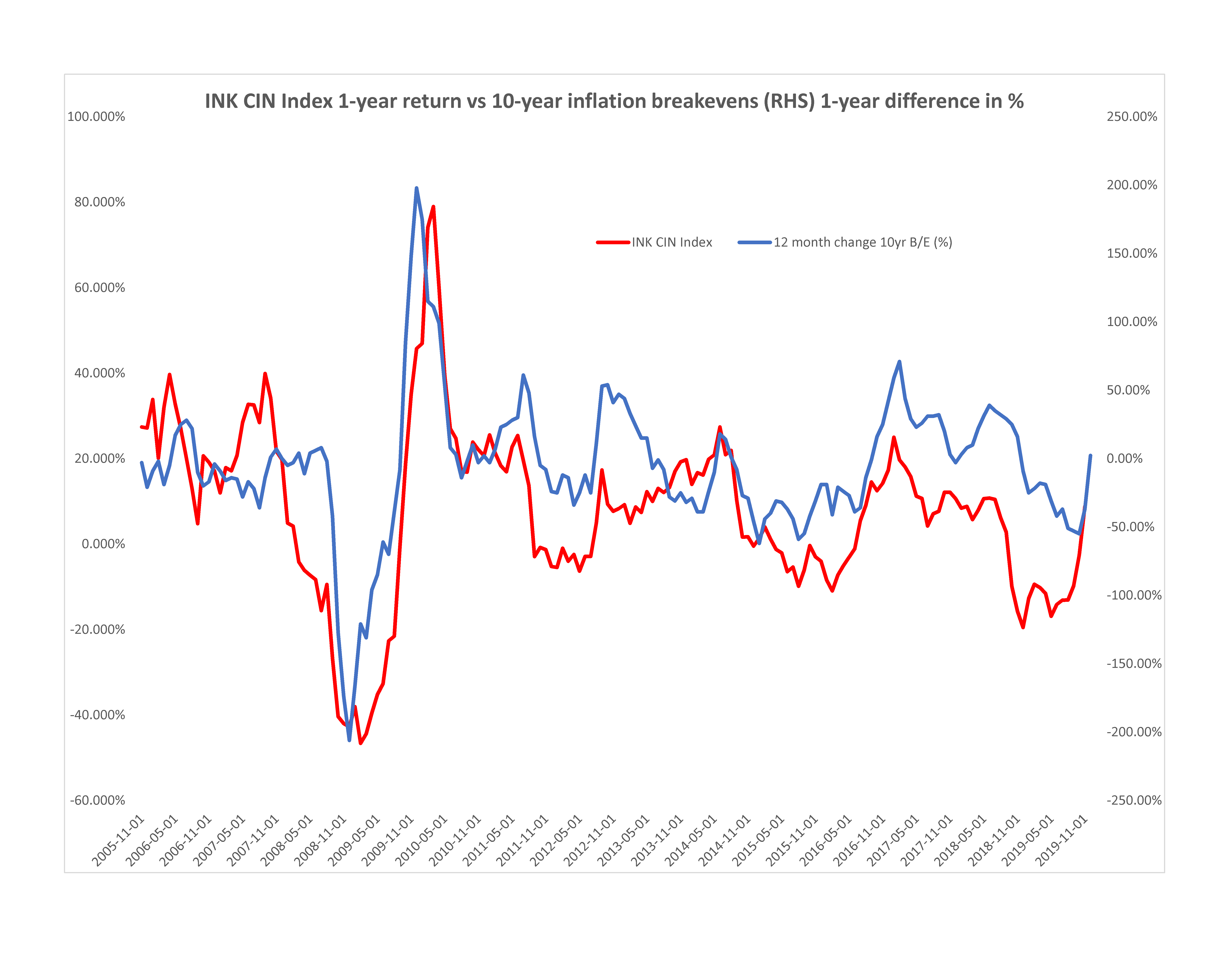

With all the gloom in the market right now with the Wuhan coronavirus, few investors are bracing for a potential pro-inflation shift at the Fed. However, if the Fed begins to gain credibility with a new, pro-inflation framework, that would be a game changer. Canadian mid-cap stocks are one way to position for a Fed pivot. The INK Canadian Insider (CIN) Index has more than a 70% correlation with changing 10-year inflation expectations. The INK CIN Index is used under a license with INK by the Horizons Cdn Insider Index ETF (HII), a 2017 and 2018 Fundata Fundgrade A+ award winner.

Interview produced by https://www.HoweStreet.com.

Your browser does not support the audio element. Download