Did the Fed backtrack enough on rates?

All ears were listening to Fed chairman Jerome Powell's comments on monetary policy Wednesday for hints as to whether the central bank would be easing up on its rate hike plans. As explained in yesterday's post, US stocks move into fair-valued territory, stocks are likely to face more downside pressure unless the Fed pulls back on its hawkish path. As it turns out, the Fed chairman suggested that interest rates were now very close to neutral:

they remain just below the broad range of estimates of the level that would be neutral for the economy

(A replay of the speech is available in yesterday's blog post).

That take on rates combined with Mr. Powell's assessment that the outlook for growth and inflation appear to be not-too-hot and not-too-cold set stocks flying. At least for the day. The question now is whether it is enough to keep stocks moving higher?

In my interview with Jim Goddard later today which will be posted on Canadian Insider, I expect to describe four signposts that we will be watching for to see if the Wednesday bounce is sustainable:

Is the INK Canadian Insider Index outperforming the large-cap S&P/TSX 60 Index? Have our INK Canadian and US sentiment indicators peaked? Are value stocks outperforming growth stocks on the upside? Are Financials leading?We will also be watching developments in the bond market for clues as to whether gold stocks will break out. In the November 13th post, Will it take a Fed accident to boost gold?, I put forward two scenarios for gold to move higher sustainably: either a Fed backtrack on rate hikes or a policy accident resulting in something like a stock market crash. On Wednesday, gold jumped, suggesting the Fed was starting to take back some rate hikes planned for the future.

As with the overall stock market, gold investors are asking was the Powell backtrack enough?

Regular HoweStreet.com contributor Mike Swanson from WallStreetWindow.com explains the situation with gold nicely in his Wednesday interview. He suggests that gold and precious metals will be the biggest beneficiary of the end of the interest rate cycle when it happens.

He goes on to warn:

The interest rate cycle will end not because we are on the verge of economic boom, but because we are at the end of this one.

Mr. Swanson's thinking seems aligned with the thoughts of Bob Hoye last week who suggests gold stocks should do well in a post-bubble contraction.

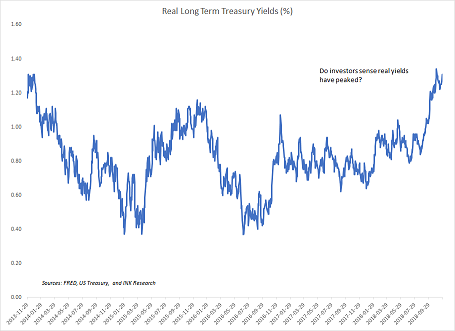

So, are we near the end of the rate cycle? Long-term real yields hit a five year high on November 2nd. After the Powell speech, they had the opportunity to take out those highs but instead moved back down.

If real yields are in the process of peaking, I suspect investors will start to believe we are approaching peak tightening. Our work suggests investors tend to favour gold in anticipation of such Fed tightening reversals.