District Scale Land Package in Nevada

Maurice Jackson of Proven and Probable sits down with Northern Empire Resources CEO Michael Allen to discuss his company's discovery and exploration of gold deposits in Nevada.

Maurice Jackson of Proven and Probable sits down with Northern Empire Resources CEO Michael Allen to discuss his company's discovery and exploration of gold deposits in Nevada.

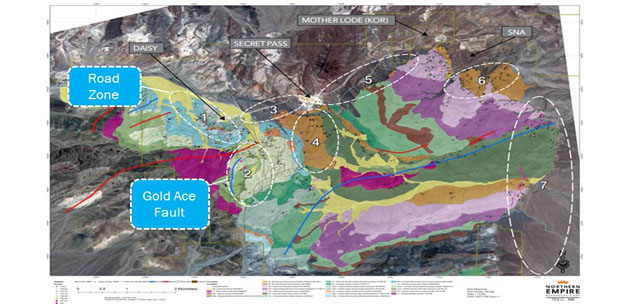

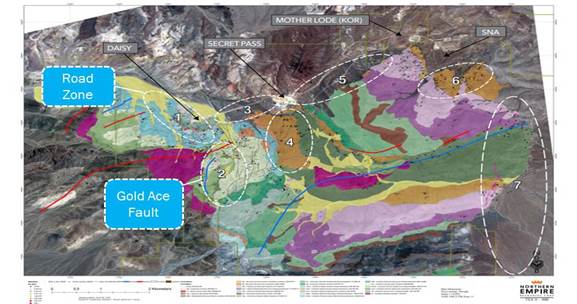

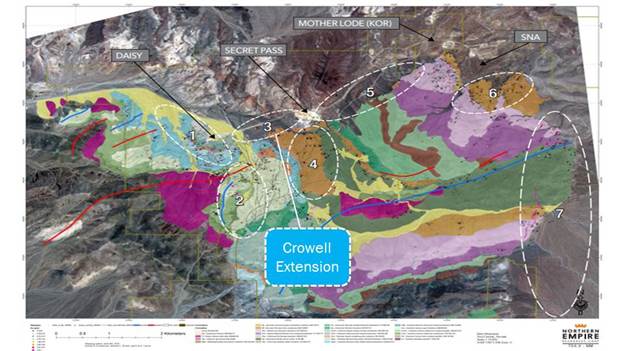

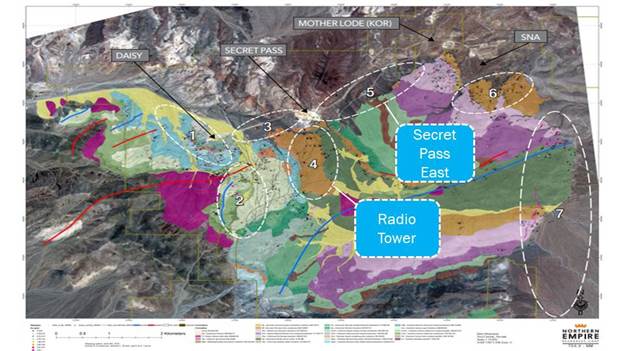

Northern Empire Map

Northern Empire MapMaurice Jackson: Today, we will discuss a company that is expanding and discovering heap-leach gold deposits in Nevada, Northern Empire Resources Corp. (NM:TSX.V; PSPGF:OTC.MKT ). I am speaking with Michael Allen, the president, CEO and director of Northern Empire. For someone new to the story, please share who is Northern Empire, and what is the thesis you're attempting to prove?

Michael Allen: I guess the best way to describe Northern Empire is it's a group of businessmen who happen to specialize in the mining industry. If you look at our board, we've got a very adept group that has created a lot of shareholder value. That would be things like founding International Royalties, which was sold for $700 million. The Kaminak founder is on the board; that company just sold for $520 million. Also, the most recent transaction on the board is New Market, which was sold to Kirkland Lake Gold for $1 billion. We are businessmen who specialize in mining.

The thesis for Northern Empire is that we've assembled a district scale land package in the southern part of Nevada, in something called the Walker Lane, about two hours northwest of Las Vegas. The property has four deposits on it. We feel that we can expand all four of those deposits through exploration and drilling with the extensions off. Also, the real upside is discovering new deposits that are amenable to heap-leach processing in the state of Nevada on our property.

Maurice Jackson: Michael, let's discuss your latest press release entitled "Northern Empire Provides Regional Update and Identifies Several New Exploration Targets." What are some of the key points from this press release that really have your attention?

Michael Allen: This press release is the culmination of a lot of work that has been done by the exploration team on the project. What we've been able to identify is that the key controls to the mineralization, particularly on the Crown part of the project, which is in the northern part. What we have identified are seven new exploration targets. They're just classified from more or less from west to east in the list that's on the news release. The Road Zone is just to the north of the Daisy deposit. What we like about that is that end, the Gold Ace Fault target is that they are shallow mineralization around a known deposit. We think that there is a potential there for adding ounces that are immediately minable, given the proper study and the drilling off the resources. That's what the focus has been for both the Road Zone and the Gold Ace Fault, it's immediately adjacent to the Daisy series of deposits. We think that there is a potential for expanding that deposit.

Crowell Extension is where we get into the real nitty gritty of what we've been doing on the project. The Crowell was a historical mine. Actually, there was a geologist that went down in it recently, not by our guys. He sampled the rib got 0.2 ounces per ton, 7 grams. Where this mine is, is actually at the hinge of a very large scale antiform, a big fold structure that points off to the northeast. This antiform, the hinge would be where it is most permissive for fluids to get through and mineralize. The very high-grade samples that were collected there historically, 7 grams, indicate that potential. It starts to create a story of us being able to link up the deposits there.

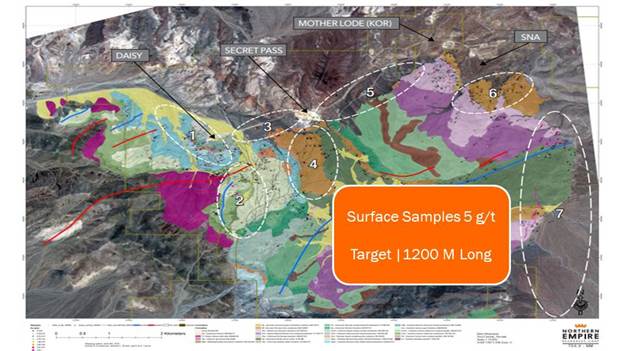

Further to the east, we get into the Radio Tower and Secret Pass East. Radio Tower is the updip extension of the Secret Pass deposit. There's some really interesting geochemistry there that suggests that there is a target at depth. Secret Pass East is where the Fluorspar Canyon detachment fault comes to surface. That's a key driver of mineralization on the property. We've got a large area that hasn't been effectively explored in the past. We've got surface samples up to 5 grams per ton at surface. It's a big target at 1200 meters long, so that's a lot of ground and a lot of potential for more ounces.

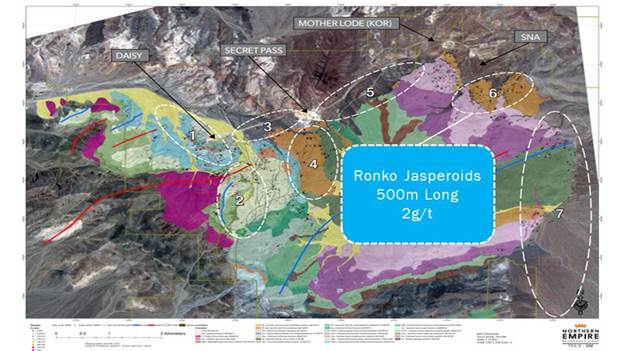

Number six and number seven are more, what I would say generative targets. The Ronko Jasperoids are something that we've been looking at, and we discovered. It was simply a boot leather mapping and sampling exercise where one of our geologists went out and started mapping outcrops. It's a significant system. It's 500 meters long, up to two grams per ton at surface. There's no drilling out there.

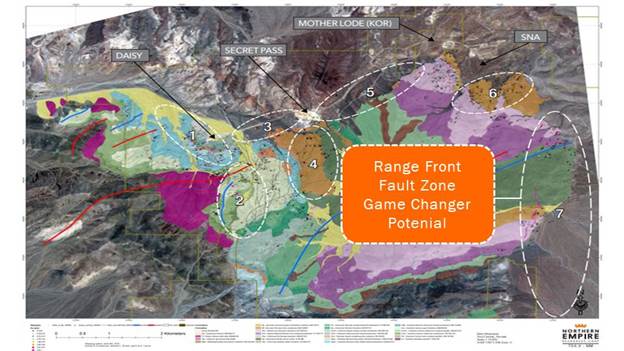

Also, the range front fault zone is very interesting because this is where you get truly long ball potential. If you look at some of the bigger deposits in the state of Nevada, particularly the Carlin ones, they exist at these range front faults where you've got structures intercepting favorable host rocks. We've identified these structures through our mapping and through our geophysics. Then, the favorable host rock is also there. This is something that we've been looking at and are eager to get our team more onto the ground, and get them exploring there, because that is truly a game changer type geology out there.

Maurice Jackson: Northern Empire's technical team has over 80 years of experience in Nevada, and you've stated that the Sterling Gold Project resembles a Carlin type of mineralization. That's a pretty significant comment from you for current and prospective shareholders to consider.

Michael Allen: It's not something that we say flippantly. We've got guys that are on the ground that are 30-year Nevada geos. They know what they're looking at. What gets them out of bed in the morning is they see the potential for a truly significant Carlin-type discovery. The significant thing for shareholders that need to understand the non-technical people is the Carlin-type deposits in the state of Nevada are the truly big ones. These are the company makers and are the backbone for the big companies like Barrick, Newmont and Kinross that operate in the state of Nevada. They have the potential to be the five, ten million ounce multi-year, 100,000 ounce a year to 200,000 ounce a year production profiles that really make companies. What excites us about the property is that potential for those big, big new discoveries.

Maurice Jackson: What is the next unanswered question for Northern Empire? When should we expect results and what will determine success?

Michael Allen: I guess the unanswered question is how big can we make this? We've got four deposits on the property already: the permitted Sterling mine, Daisy, Secret Pass, SNA. How big can we make those four deposits? There's also the wild card of this: Can we make that new discovery? Given the evidence that we're starting to see coming in from the field, you get a sense of confidence that a new discovery is potential or is possible on this project. We are actively drilling on the site right now. We do have three rigs going. They're moving around to all the different deposits and the exploration targets. There is news flow that's going to be coming out pretty much constantly over the next several months as we advance the project.

Maurice Jackson: What will determine success?

Michael Allen: Ultimately, success is that new discovery. That is going to be the key part of success for the company.

Maurice Jackson: What is the worst case scenario if we don't get a favorable outcome? What is plan B?

Michael Allen: I love this question, because this is actually speaks to the strength of the Board and the team at Northern Empire. When the Board and I were designing Northern and deciding what we wanted to do with it, it wasn't that we were going to essentially take our shareholder money and buy lottery tickets. We were making a business plan as to what we wanted to do with the company. That's actually one of the reasons why we got the Sterling asset; there is a backstop of shareholder value there. The permanent Sterling mine is a key part of the company. We don't talk a lot about it, but it does put an underlying base value into the company.

If we do not have any additional exploration success, we do have a fundamental core business that we can take the company and build off going forward. That is the permitted Sterling mine, which is a high-grade, open-pit heap-leach project in the state of Nevada. We think that substantially de-risks the company for the investors. In terms of the design of the company and going forward, there's a lot of upside, but there's not a lot of downside for the investor right now.

Maurice Jackson: What keeps you up at night that we don't know about?

Michael Allen: For me, as the CEO of Northern Empire, the thing that keeps me up at night is the responsibility for the people on site. We've got about 25 to 30 people actively working on the project right now. We've got drillers, geologists out in the field, people moving around in trucks. For me, safety is the number one thing for us to consider. I don't ever want to have to face a situation where somebody got hurt. That safety culture comes from me down.

We talk about safety on a daily basis. We manage risks as best we can, but there are a lot of moving parts. That is, for me, the thing that keeps me up at night is I don't want to see any of the people on our project get hurt. That is my nightmare scenario.

Maurice Jackson: I can re-emphasize that ethos there. We were there at the earlier site visit this month. The first thing was safety first, safety first, and safety first. Finally, what question did I forget to ask, sir?

Michael Allen: I think that one of the things that I'd like to emphasize with the company is that it is something that we did put a lot of thought to in terms of designing and de-risking. My job is to de-risk the company. When we bought the asset, we have that backstop of value with great exploration upside. The risks or the technical risks, because these are past producing and modern assets, were eliminated.

Maurice Jackson: For someone who wants to get more information regarding Northern Empire, please share the contact details.

Michael Allen: The website is www.NorthernEMP.com. There are links in the website to contact us and it's myself or Dylan Berg, our manager of IR.

Maurice Jackson: For direct inquiries, please contact Dylan Berg. His phone number is 604-646-4522. Email is info@NorthernEMP.com. Michael Allen of Northern Empire Resource Corp, thank you for joining us today on Proven and Probable.

Last but not least, please visit our website www.provenandprobable.com where we interview the most respected names in the natural resource space. You may reach us at contact@provenandprobable.com.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Allen: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Northern Empire Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Northern Empire Resources.

2) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Northern Empire Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Northern Empire Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images provided by the author.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.