Dollar's Response To Trade News Is Good For Gold

The dollar weakened in response to progress on U.S.-China trade.

This suggests that gold will benefit from an end to the trade war.

Gold fund flows suggest plenty of healthy skepticism for gold.

A commonly held belief among investors and analysts is that the gold price will suffer if the U.S.-China trade dispute is amicably resolved. This view is so widely circulated in commentaries on the gold price to the point where it has become almost conventional wisdom. However, last week's action in the gold and currency markets provides a contrasting view, namely that an end to the trade war will benefit gold and weaken the U.S. dollar. We'll discuss this scenario in today's report.

One of this biggest news headlines heading into the latest week concerns the progress reportedly being made on the trade tariff front. Trade negotiators from the U.S. and China were said to be hashing out the details of an agreement that would effectively end the trade tariff dispute between them. With a looming March 1 deadline before tariffs on billions worth of Chinese goods kicks in, both nations have an extra incentive to deliver a workable compromise and thereby end a major source of uncertainty for the global economy.

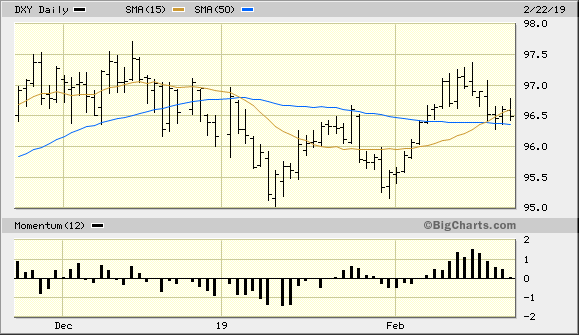

What went largely unnoticed last week was the dollar's reaction to the news of progress on the trade front. The U.S. dollar index (DXY) had its first decisive downside week since January and closed slightly under its 15-day moving average, which puts the greenback's immediate-term (1-3 week) trend in question.

Source: BigCharts

Even more significant, though, is the fact that the dollar showed weakness in response to the trade war progress reports last week. While we must be careful not to read too much into a single week's action, the dollar's negative response to the news suggests the counterintuitive possibility that an end to the trade war would actually hurt the greenback while boosting the gold price. If we allow that DXY's strength in recent months has been largely a result of foreign investors seeking the relative safety and stability of the dollar, this scenario isn't as far-fetched as it seems. For a trade war resolution would then end the "ripple effect" of U.S.-China trade tensions and improve the global economic outlook, in turn allowing the currencies of export-dependent nations to strengthen.

If the reports of progress being made on the trade front are true, we should eventually see a downside move in DXY that forces the index below its widely-followed 50-day moving average (blue line in the above graph) on a weekly closing basis. This in turn would pave the way for gold's next rally phase in its intermediate-term (3-9 month) recovery process which began last fall.

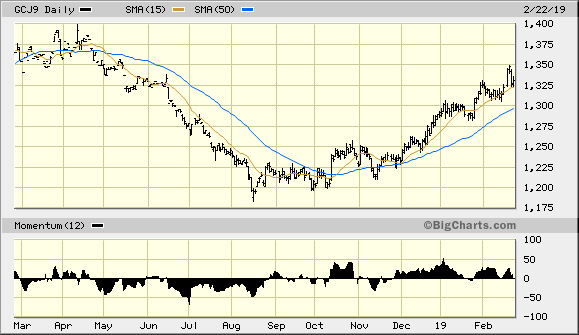

Speaking of gold, the yellow metal settled with an 0.8% weekly gain after hitting a 10-month recovery high on Feb. 20. Gold's 6-month price graph (below) is a picture of technical strength as the price has stubbornly remained above its rising 15-day and 50-day moving averages for the last three months. The rules of my trading discipline favor a bullish bias for gold as long as both trend lines remain unbroken on a weekly closing basis.

Source: BigCharts

Investor sentiment also remains favorable for a continuation of gold's rising trend. Last week there was an outflow of of 3.7 tons from various gold ETFs, with total outflows in February to date at around 24 tons. Sizable outflows were specifically reported recently in the popular SPDR Gold Shares ETF (GLD). Coming as it does at a multi-month high, these outflows can be interpreted as a combination of normal profit-taking and also apprehension among investors who believe that gold's price has risen too fast, too far. From a contrarian's perspective, gold ETF outflows at or near a major price are normally a case of retail traders taking an unjustifiably dim view of the metal's intermediate-term outlook. Thus, the outflows can be viewed as a sign that gold's "wall of worry" remains intact, which supports higher prices.

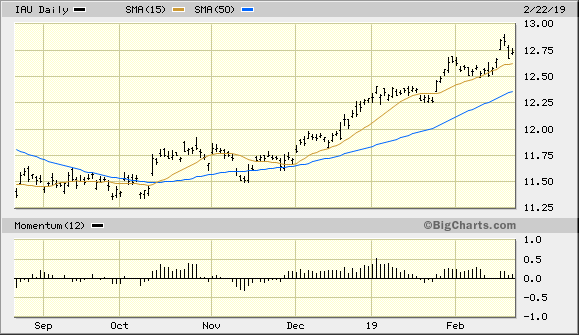

While we're on the subject of gold ETFs, my favorite gold-tracking fund, the iShares Gold Trust (IAU), continues its winning ways as we enter the final week of February. While there has been a noticeable slowdown in IAU's price momentum (see chart below), the most important consideration is that the ETF continues to make higher highs and lows. The basis of a good money management discipline is to let your profits ride and let the market itself confirm when a trend reversal takes place instead of trying to anticipate it. Therefore, as long as IAU remains above the $12.50 level on an intraday basis (the nearest short-term pivotal level), I recommend that we maintain a long position in this ETF.

Source: BigCharts

In closing, gold's intermediate-term outlook still looks strong despite the possibility of an end to the U.S.-China trade dispute. As I've argued here, an end to the trade war would likely hurt the U.S. dollar and thereby boost gold's price due to its strengthened currency component. Moreover, recent gold ETF outflows even as gold made a 10-month high suggest that retail traders are becoming fearful. That's usually a good sign since worry tends to strengthen gold's upside prospects by discouraging weak-handed participants from getting into the market and thereby increasing volatility. Investors are therefore justified in maintaining a bullish bias on gold.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts