Don't Hurry To Buy Gold - Part 2

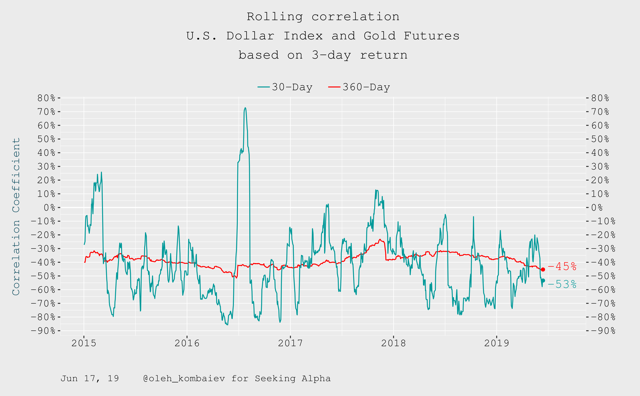

The dollar plays a direct role in the fate of gold.

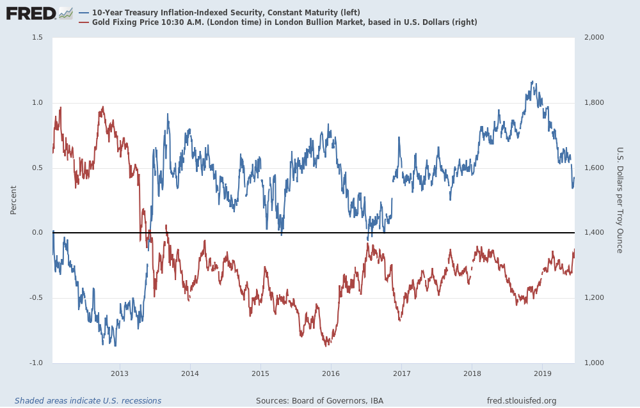

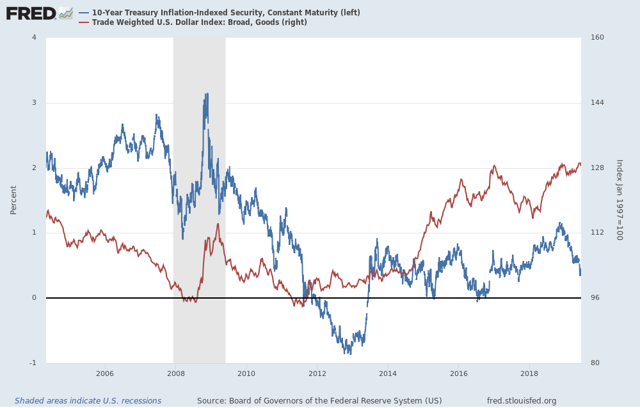

There is a steady inverse correlation between gold and the U.S. real interest rate.

Let's look at gold, assuming that its price is a function in which the independent variables are the U.S. dollar index and the level of the U.S. real interest rate.

A week ago, I published an article about gold, in which I pointed out that there are not enough drivers for the SPDR Gold Trust ETF (GLD) price movement to go up. Today, I want to continue this topic.

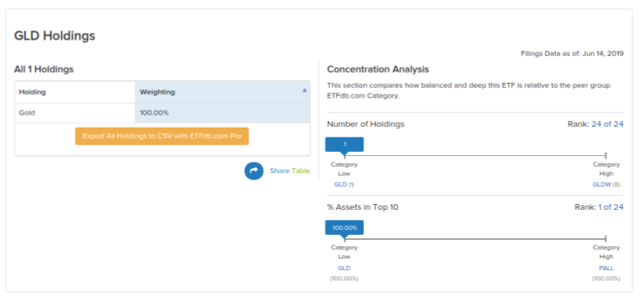

The price of the SPDR Gold Trust ETF is 100% tied to the price of gold, so when speaking of the prospects for this ETF, there is no other way than to analyze the gold market.

(Source: ETFDB.com)

Let's look at gold, assuming that its price is a function in which the independent variables are the U.S. dollar index and the level of the U.S. real interest rate. Despite this simplification, such a view on the price of gold is justified in many ways.

Firstly, because there is a strong and stable long-term correlation between gold and the U.S. dollar index. This indicates that the dollar index plays a direct role in the fate of gold:

Secondly, there is also a steady inverse correlation between gold and the U.S. real interest rate:

Gold is a defensive asset, the demand for which grows when macroeconomic uncertainty increases. But the same factor influences the value of the dollar index and the U.S. real interest rate, and therefore, it should not be additionally taken into account when predicting the price of gold.

It is also important that there is no strong internal relationship between the U.S. dollar index and the U.S. real interest rate. It's highly welcome for independent parameters in a statistical model.

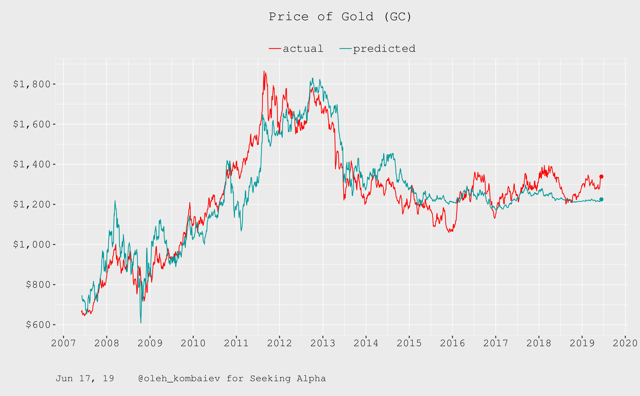

So, now let's build a statistical model that predicts the price of gold based on the U.S. dollar index, the level of the U.S. real interest rate, and the combined effect of these two parameters. But please don't overestimate the significance of this model and treat it as a kind of smart average.

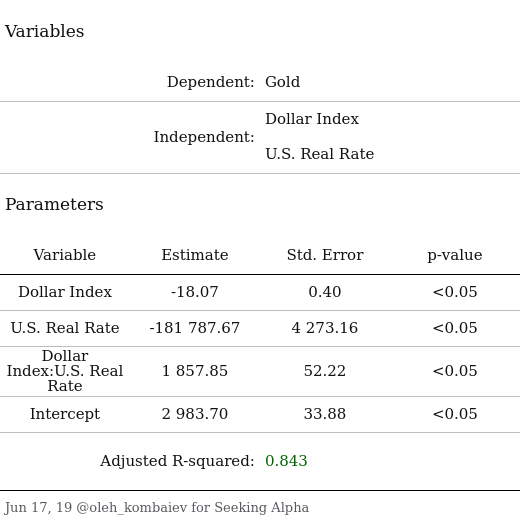

So, now let's build a statistical model that predicts the price of gold based on the U.S. dollar index, the level of the U.S. real interest rate, and the combined effect of these two parameters. But please don't overestimate the significance of this model and treat it as a kind of smart average.

Here the model itself:

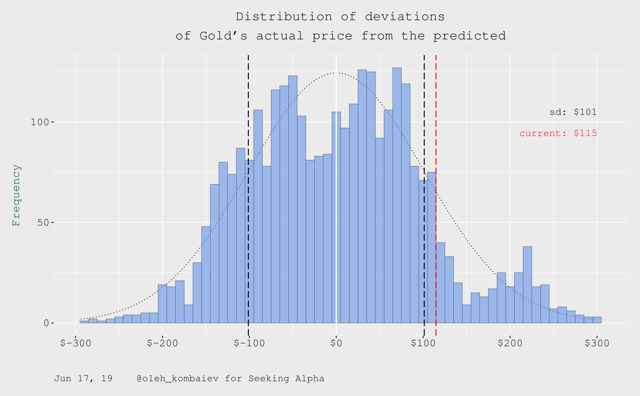

First of all, we have to admit that such a model, built on the basis of data for the last twelve years, turns out to be really high-quality (R2>0.84 and p-value <0.05):

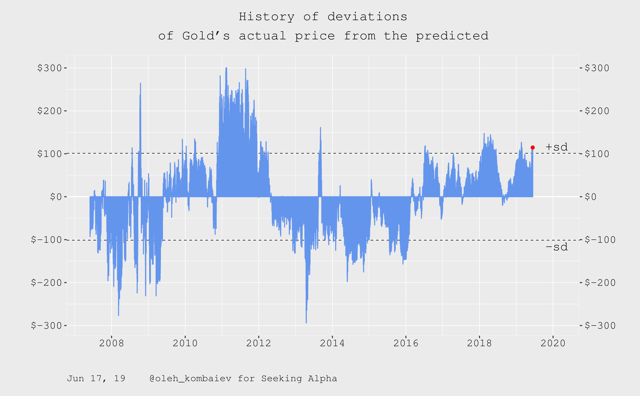

It is very important to note that for the past five years, the price of gold hasn't significantly deviated from the simulated level beyond the standard deviation. It once again confirms the high quality of the model:

Now let's back to the model.

Please pay attention to the fact that the expected price of gold within the bounds of the proposed model has remained almost unchanged throughout the year. But at the same time, the current actual price of gold deviates from the forecasted level already beyond the standard deviation, i.e., it has gone beyond the scope of natural volatility:

Bottom line

The main conclusion we can draw is that the increase in the price of gold observed since mid-May is not supported by changes in fundamental factors and, therefore, is unlikely to be long-term.

Applying the foregoing to GLD (a fund that tracks the price of gold), I believe that the price of the fund is prone to a correction at the level of $123.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Oleh Kombaiev and get email alerts