Dow Completes 800-Point Comeback

Another dismal weekly jobless claims report weighed on stocks earlier

Another dismal weekly jobless claims report weighed on stocks earlier

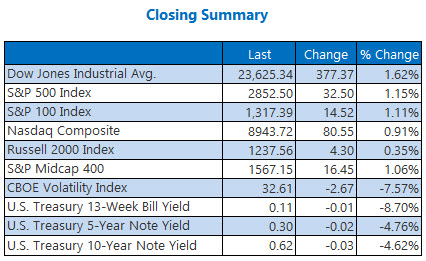

The Dow staged a big comeback today, ending over 375 points higher as it steadily distanced itself from a morning spent deep in the red andanother round of depressing jobs data. Strength in the financial sector was responsible for the blue-chip index's rebound, while the S&P and Nasdaq also enjoyed a bounce, settling modestly higher on Thursday. Meanwhile, the Cboe Market Volatility Index (VIX) reversed course, ending over 7% lower.

Continue reading for more on today's market, including:

Why getting in on this surging coronavirus test-kit maker's stock with options might be a prudent play for bulls. Checking back in with this one banking ETF as options bears swarm.Plus, Delta stock's dramatic dip; MKC gets a bull note; and ALLO announces positive drug data.

The Dow Jones Industrial Average (DJI - 23,625.34) tacked on 377.4 points, or 1.6% on Tuesday. Twenty-six of the 30 index members finished higher, with American Express (AXP) in the lead on a 7.4% pop, while Coca-Cola (KO) dropped to the bottom on a 0.5% loss.

The S&P 500 Index (SPX - 2,852.50) added 32.5 points for the day, or 1.2%. Meanwhile, the Nasdaq Composite (IXIC - 8,943.72) ended 80.6 points, or 0.9%, higher.

The Cboe Volatility Index (VIX - 32.61) lost 2.7 points, or 7.6%.

5 Items on Our Radar Today

The Internal Revenue Service (IRS) said it would let workers change their health plans and flexible spending accounts mid-year in its new guidelines,in light of the coronavirus pandemic. (CNBC)Data from recommendation engine TasteDive American's interest in classical music has gone up by nearly 13% since early March, while interest in dance and electronic music has slid by 20%, based on recommendations from over 80 million users. (MarketWatch)How Delta stock fared today after ditching the Boeing 777. The home cooking staple stock Credit Suisse is eyeing. Promising drug data gave ALLO a jolt.

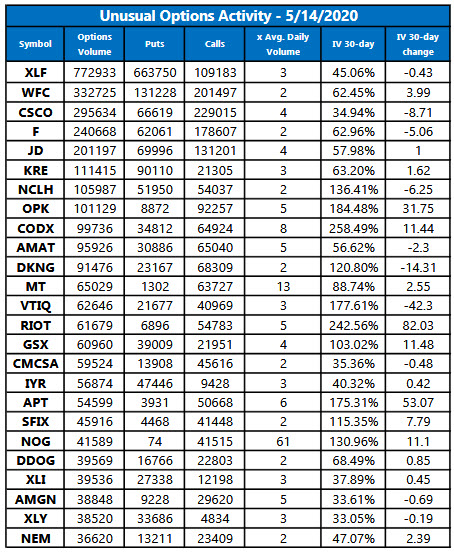

Data courtesy of Trade-Alert

Oil Logs Best Close in Five Weeks; Gold Stays Hot

Oil futures enjoyed a sizable win today, given a boost by lockdown leniency in some U.S. states, and the recently announced promise of crude production cuts. June-dated crude dropped added, or 9%, to settle at $27.56 a barrel -- its highest close since April 3.

Gold futures notched their third daily win to end at a three-week high, after another round of dismal jobs data sent more investors turning toward the safe haven asset. Gold for June delivery added $24.50, or 1.4%, to settle at $1,740.90 an ounce.