Dow Crushed By U.S.-China Trade Deal Doubts

The U.S. is reportedly still trying to limit capital flows to China

The U.S. is reportedly still trying to limit capital flows to China

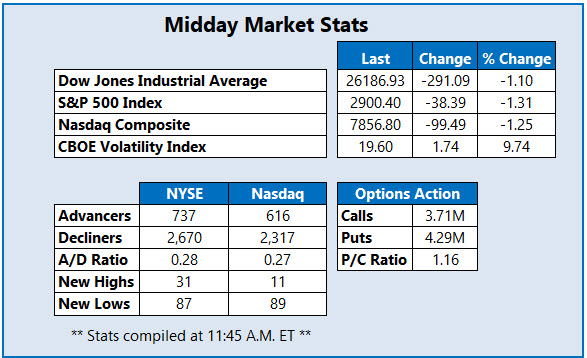

The Dow Jones Industrial Average (DJI) is getting shelled today -- heading toward its second straight loss -- as the prospects of a U.S.-China trade resolution later this week fade. The blue-chip index nursed a more than 300-point drop at its session lows, after the Trump administration blacklisted several Chinese artificial intelligence companies, while a Bloomberg report indicated the White House is still exploring a limit on capital flows to China. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also deep in the red, with the tech sector under particular pressure in anticipation of Chinese blacklist retaliation. Meanwhile, Wall Street's "fear index" -- the Cboe Volatility Index (VIX) -- is headed for the key 20 level.

Continue reading for more on today's market, including:

Boeing stock is grounded amid the latest 737 drama.2 new healthcare stocks to grab now. Plus, options bears eye General Motors amid strike; Barrick Gold bucks broad-market sell-off; and Nvidia leads a chip stock pullback.

One name seeing unusual options volume today is General Motors Company (NYSE:GM), with 21,000 puts crossing the tape so far -- triple the average intraday amount, and volume pacing for the 97th percentile of its annual range. Most of this attention is on the November 30 put, where new positions are being opened. The auto stock is down 2.4% to trade at $33.93, at last check - set for its lowest close since early June -- as worker strike headwinds persists, and it appears options traders are targeting more downside in the coming month.

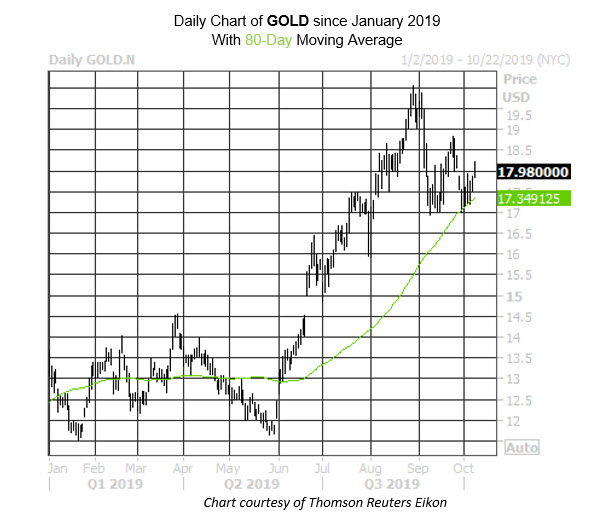

Barrick Gold Corp (NYSE:GOLD) stock is bucking the broad-market trend lower today, up 1.6% to trade at $17.99, as gold prices climb amid trade uncertainty. The gold stock is up 33.4% in 2019, and a pullback earlier this month found support at its 80-day moving average.

One day removed from a bull note, Nvidia Corporation (NASDAQ:NVDA) stock is down 3.9% to trade at $177.21 today, with the semiconductor sector weighed down by trade headwinds. NVDA is set to snap a three-day winning streak, and a short-term ceiling has emerged at the $185 level.