Dow Deep in the Red as Oil Surges

The S&P 500 and Nasdaq are also hit with sharp losses at midday

The S&P 500 and Nasdaq are also hit with sharp losses at midday

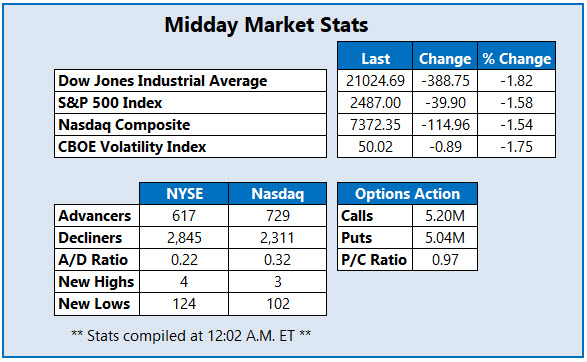

The Dow Jones Industrial Average (DJI) is sitting with modest lossesat midday, down nearly 400 points. The Nasdaq Composite (IXIC) and S&P 500 Index (SPX) are following the Dow's lead with steep slides, as the Labor Department's nonfarm payrolls report fell by 701,000 in March for the first jobs decline in a decade.

The coronavirus pandemic continues to wreak havoc, with New York governor Andrew Cuomo reporting the state's biggest one-day spike in deathsyesterday. Meanwhile, energy stocks continue to be in the spotlight as oil prices rise, with May-dated crude up 4.9% at $26.60 per barrel at last check.

Continue reading for more on today's market, including:

Apple is keeping its U.S. stores closed until early May.White House pressure is weighing on 3M stock.Plus, HUYA calls being sold; Live Nation stock floundering; and FC roars higher post-earnings.

One stock seeing notable options trading activity today is HUYA Inc (NYSE:HUYA). The Guangzhou-based broadcasting namewas last seen down 3.5% to trade at $16.40. At last check, nearly 2,500 HUYA calls have changed hands, double the average intraday amount. The weekly 4/9 17-strike call is leading the charge, where it looks like sell-to-close activity is detected. Elsewhere, new positions are being sold to open at the weekly 4/3 17.50-strike call.

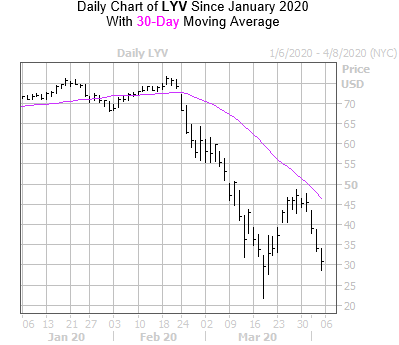

One stock that unsurprisingly finds itself at the bottom of the S&P 500 this morning is ticket selling giant Live Nation Entertainment (NASDAQ: LYV), down 6% to trade at $31.91 at last check. LYV's fall from grace comes as global lock-downs force live events to be postponed or altogether cancelled, effectively eradicating the entertainment ticket industry. Echoing this is LYV's chart position, with its 20-day moving average acting as a stiff ceiling to the stock's recent breakout.

Meanwhile, one stock flying high today is Franklin Covey Co (NYSE:FC), last seen up 9.6% to trade at $16.84 at last check. Currently, FC is set to close above its 20-day moving average for the first time since late February. A second quarter earnings beat is powering today's breakout, but the stock is still down almost 50% year-to-date.