Dow Dips Nearly 1,800 Points as Steep Selloff Continues

Major indexes are still in the red

Major indexes are still in the red

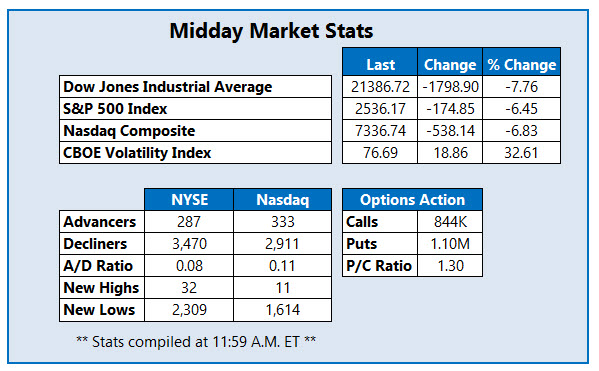

The Dow Jones Industrial Average (DJI) is extending its losses this afternoon, continuing to give back the ground it gained on Friday's bounce -- down around 1,700 points at last check. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are still deep in the red as well, though losses were pared slightly after Wall Street's selloff triggered another circuit breaker. In efforts to cushion coronavirus' economic blow, the Federal Reserve Sunday cut interest rates to nearly zero, though the move has done little to ease investor concerns.

Continue reading for more on today's market, including:

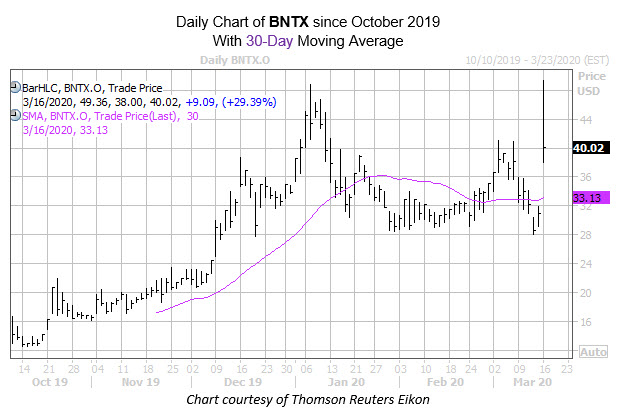

One stock scaling the Nasdaq Composite (IXIC) today is BioNTech SE (NASDAQ:BNTX), up 28.1% to trade at $39.64. This comes after news broke that the Germany-based biotech is collaborating with Shanghai Fosun Pharmaceutical to market a potential coronavirus vaccine. BNTX is up 21.5% year-to-date, breaking above the former resistance of the 30-day moving average.

Situated near the bottom of the Nasdaq is Gaming and Leisure Properties Inc (NASDAQ:GLPI). Though the main catalyst behind the stock's pullback is unclear, the spread of coronavirus has hit community-based sectors such as casinos, as people move toward social distancing. GLPI's stock is down 33% to trade at $22.27, earlier hitting a record low of $19.54.

One stock making a comeback in the New York Stock Exchange (NYSE) is Blue Apron Holdings Inc (NYSE:APRN). The meal plan delivery service is up 42.1% to trade at $3.24 as desire for at-home meal prep surges alongside voluntary and required quarantine in the U.S. The equity recently touched a record low of $2.01 on March 9, and is still down 43% year-to-date, though today's surge has APRN back above it's 30-day moving average's ceiling of resistance.