Dow Ekes Out Win Ahead of Fed Meeting

A surging tech sector propped up Wall Street today

A surging tech sector propped up Wall Street today

The Dow started Fed week on the right foot, finishing modestly higher. A surging tech sector -- including Cisco Systems (CSCO) -- helped power gains today, while offsetting lackluster manufacturing and housing data. Trade tensions with China remain elevated, however, especially after Commerce Secretary Wilbur Ross said President Donald Trump is "perfectly happy" to add more tariffs if the two sides can't reach a deal. Elsewhere, investors are bracing for the start of tomorrow's Fed meeting, and traders will dissect Wednesday's policy statement for clues about a possible rate cut in July.

Continue reading for more on today's market, including:

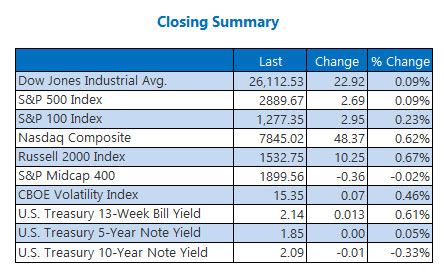

This Chinese social media stock is heading toward a key trendline.2 rallying biotech stocks that saw crazy options volume.More bullish buzz for CarMax stock ahead of earnings.Plus, a rare bear note for PAYS; big NASH data for a drug stock; and frenzied options activity ahead of Facebook's cryptocurrency plans.The Dow Jones Industrial Average (DJI - 26,112.53) gained 22.9 points, or 0.1%, in today's trading. Boeing (BA) led the 14 winners with a 2.2% gain, while Dow (DOW) paced the 16 losers once again with a 3.5% drop.

The S&P 500 Index (SPX - 2,889.67) added 2.7 points, or 0.1%, while the Nasdaq Composite (IXIC - 7,845.02) tacked on 48.4 points, or 0.6%.

The Cboe Volatility Index (VIX - 15.35) added 0.07 point, or 0.5%.

5 Items on our Radar Today

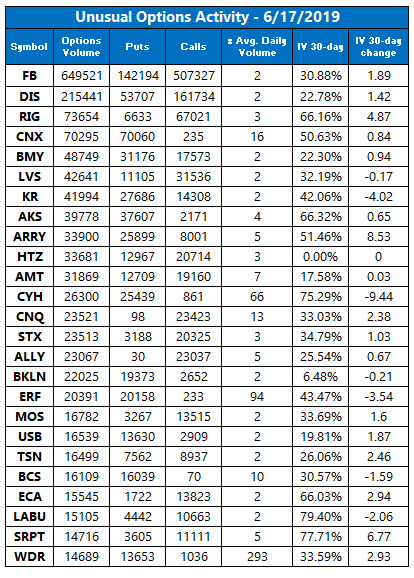

Tensions in the Middle East remain high, after Iran warned it would exceed its uranium enrichment ceiling -- imposed via a 2015 international accord -- within 10 days. The Trump administration has called the announcement "nuclear blackmail," and it only adds to recent U.S.-Iran drama after oiltanker attacks last week. (Reuters)The U.S. ban on Huawei is taking a greater toll on the Chinese tech giant than expected. Specifically, Huawei slashed growth expectations for the fiscal year, and CEO Ren Zhengfei estimated that the ban will hurt revenue by $30 billion. This is the first time the impact of the ban has been publicly quantified. (Reuters)One analyst called a top on red-hot Paysign stock.The drug stock that soared on upbeat NASH data.Options are red-hot around Facebook stock ahead of its cryptocurrency reveal.There is no earnings chart today.

Data courtesy of Trade-Alert

Oil, Gold Pull Back

Oil slipped today, as worries about a global economic slowdown -- exacerbated by subpar data out of the U.S. and China -- overshadowed last week's tanker attacks in the Gulf of Oman. By the close, July-dated crude lost 58 cents, or 1.1%, to end at $51.93 per barrel.

Gold pulled back as well today, snapping a four-day winning streak.August-delivered gold added $1.60, or 0.1%, to settle at $1,342.90 an ounce.