Dow Futures Fall on Trade Uncertainty

China may not be ready to sign any type of trade agreement

China may not be ready to sign any type of trade agreement

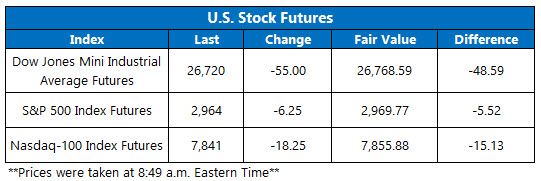

Dow Jones Industrial Average (DJI) futures are trading below fair value this morning. Stocks look set to cool from last week's trade-induced rally, with Bloomberg reporting that China may want more talks later this month with the U.S. before it formally commits to any type of deal. Aside from trade buzz, there's little else on the schedule today that could cause an outsized move in stocks, as many investors likely prepare for the start of third-quarter earnings season tomorrow.

Continue reading for more on today's market, including:

An analyst went bullish on Johnson & Johnson's litigation troubles. 2 reasons options traders jumped on this fast food stock. Plus, housing stock downgraded; CrowdStrike hit by another bear note; and expectations cut on pot stock.

5 Things You Need to Know Today

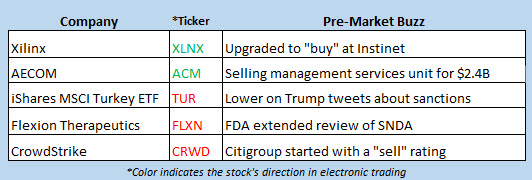

The Cboe Options Exchange (CBOE) saw 1.56 million call contracts traded on Friday, compared to 790,926 put contracts. The single-session equity put/call ratio moved down to 0.51, while the 21-day moving average was 0.69.The housing sector has outperformed in 2019, recently getting a boost from Lennar's (LEN) strong earnings. However, Susquehanna this morning downgraded Toll Brothers Inc (NYSE:TOL) to "neutral" from "positive," as the shares test the $39-$40 area that previously served as resistance earlier this year. Another analyst is saying to sell CrowdStrike Holdings Inc (NASDAQ:CRWD), with Citigroup starting coverage with a "sell" rating and $43 price target. Goldman Sachs on Friday also said to sell the cybersecurity stock. Down 7.2% pre-market, CRWD could test record lows today. Aurora Cannabis Inc (NYSE:ACB) received a bear note from MKM Partners, which wrote that pricing has softened in the pot industry, and the gap between legal and illegal weed is growing. The brokerage firm expects the marijuana company's fiscal first-quarter results to come in weaker than expected. The economic schedule is bare today, but the earnings schedule ramps up tomorrow.Asian Markets Rise on Trade Hopes

Asian markets closed higher, as investors cheered signs of progress on the U.S.-China trade front. China's Shanghai Composite outpaced its regional peers, adding 1.2% after weaker-than-anticipated import and export data for September. Meanwhile, surging chip stocks created tailwinds in South Korea, with the Kospi climbing 1.1%, while Hong Kong's Hang Seng added 0.8%. Japan's Nikkei was closed for holiday.

Stocks in Europe have turned lower at midday, as speculators fret about a lack of details in both the partial trade deal between Washington and Beijing, as well as the Brexit plans put forth by U.K. Prime Minister Boris Johnson. At last check, London's FTSE 100 is down 0.4%, the German DAX is off 0.6%, and the French CAC 40 is 0.7% lower.