Dow Kicks Off December on Sour Note

Disappointing U.S. manufacturing data had the Dow closing 268 points lower

Disappointing U.S. manufacturing data had the Dow closing 268 points lower

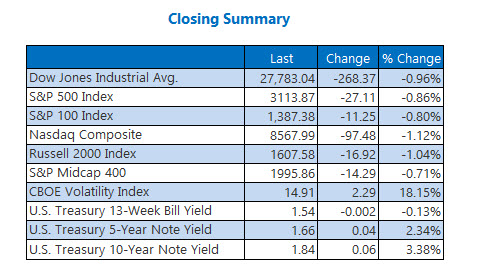

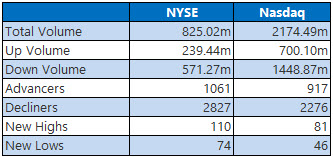

The Dow took another hit today, shedding over 260 points -- its biggest one-day drop since Oct. 8 -- after disappointing U.S. manufacturing data was released earlier in the day. Traders also reacted to reports of new Trump administration tariffs, which offset this weekend's strong holiday shopping numbers. The Nasdaq and S&P also slipped, suffering their worst days since early October. In contrast, today's sharp decline had the Cboe Volatility Index notching its biggest one-day percentage gain since August.

Continue reading for more on today's market, including:.

Call options look good for this FAANG stock in December. Why options bears might want to board Carnival Cruise stock right now. Plus, a red-hot bank stock; FUN drops on bearish analyst attention; and the $50 million news that sent XENE stock soaring.The Dow Jones Industrial Average (DJI - 27,783.04) lost 268.4 points, or nearly 1%. Only six of the 30 blue chips ended higher, with Coca-Cola (KO) pacing the gainers with its 0.7% pop. Boeing (BA) sunk to the bottom of the barrel on its 3% dip.

The S&P 500 Index (SPX - 3,113.87) shed 27.1 points, or 0.9%, and the Nasdaq Composite (IXIC - 8,567.99) sloughed off 97.5 points, or 1.1%.

The Cboe Volatility Index (VIX - 14.91) saw its highest close in over a month, adding adding 2.3 points, or 18.2%.

5 Items on Our Radar Today

A new Second Amendment case was taken to the Supreme Court today, challenging a New York City ruling that bans the transportation of handguns outside city limits. While conservative Justices Neil Gorsuch and Samuel Alito initially wanted to bend the case to address recent gun law controversy in the U.S., it looks as if the case will eventually be dismissed. (CNBC)According to J.P. Morgan Securities analyst Samik Chatterjee, Apple (AAPL) will be expected to release four new iPhones, with a range of screen sizes, in the fall of next year. The smartphones are expected to have 5G connectivity, and could mark the beginning of a new launch strategy for the tech titan, which is projected to begin staggering its phone productions. (MarketWatch)This financial stock is red-hot ahead of next week's Fed meeting. Why this amusement park stock is sputtering out. The $50 million agreement that sent Xenon stock soaring.There are no earnings of note today.

OPEC Optimism Boosts Oil Prices

Optimism over the Organization of the Petroleum Exporting Countries (OPEC) and its allies' plans to potentially deepen output cuts during this week's meeting had oil settling higher today. January-dated crude futures were up 79 cents, or 1.4%, to settle at $55.96 a barrel.

Gold prices dipped on Monday, as traders digested global manufacturing data. February gold futures dropped $3.50 , or 0.2%, to close at $1,469.20 an ounce.