Dow, Nasdaq Add Triple Digits as Volatile Week Wraps Up

Bank earnings drove early upside in today's session

Bank earnings drove early upside in today's session

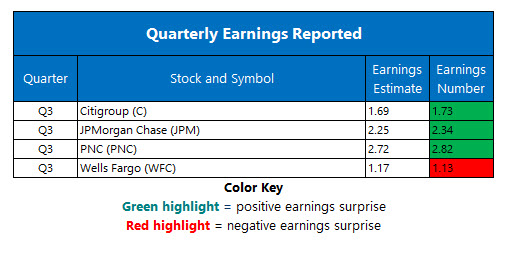

Following this week's brutal two-day sell-off, U.S. stocks managed to finish today comfortably higher. The Dow got an early boost from well-received JPMorgan earnings -- though the blue-chip bank erased its gains by the close -- and FAANG stocks also snapped back from their recent losses. However, sentiment remained skittish, with the major equity indexes taking a dive back toward breakeven around midday. In fact, despite a downturn in today's trading, the VIX posted its biggest weekly advance since March.

Continue reading for more on today's market, including:

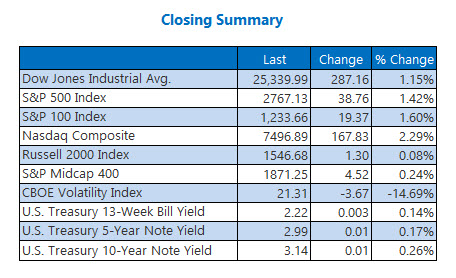

Sentiment signal flashes for the sixth time since 2009.Apple stock bounces from a key level after the sell-off.Plus, Bank of America draws bulls before earnings; analyst says to buy the Square stock dip; and 2 popping drug stocks.The Dow Jones Industrial Average (DJI - 25,339.99) added 287.2 points, or 1.2%, for the day. For the week, the blue-chip index shed 4.2% -- its worst weekly performance since late March. Refreshingly, 26 Dow stocks closed higher, with Visa (V) taking the lead on a 4.7% gain. Pacing the four losers was JPM, which closed 1.1% lower.

The S&P 500 Index (SPX - 2,767.13) gained 38.8 points, or 1.4%, while the Nasdaq Composite (IXIC - 7,496.89) managed to add 167.8 points, or 2.3% on the day. For the week, however, the indexes shed 4.1%, and 3.7%, respectively -- both indexes also posting their worst weekly performances since March.

After a volatile week, the Cboe Volatility Index (VIX - 21.31) snapped its daily gaining streak, shedding 3.7 points, or 14.7%, on the day. However, the fear gauge did manage to post an impressive weekly gain of 44% -- its best since March 23.

5 Items on our Radar Today

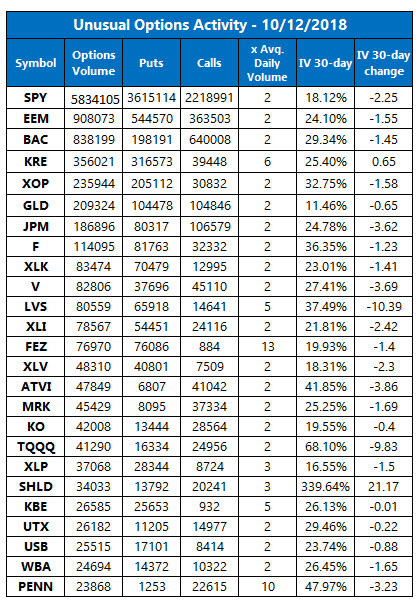

The Food and Drug Administration (FDA) is once again cracking down on e-cigarette companies, this time having sent letters to roughly 21 manufacturers, demanding proof that the sales of any new products are legal. The regulators have already obtained information from Juul, the e-cig market leader. (CNBC)Facebook (FB) announced in a letter today that 30 million users -- not the 50 million previously thought-- suffered from last month's data breach. However, about half of the 30 million were subject to the hackers' swipe of personal information, including phone numbers, search history, and the recent places users have checked in. (Bloomberg)Call options are hot on Bank of America stock before earnings.Analyst: Bet on Square bounce. Bull notes sent 2 drug stocks soaring.

Data courtesy of Trade-Alert

Gold Pulls Back as Stock Market Stabilizes

Crude futures finished today slightly higher, after a report out of the International Energy Agency (IEA) described the current supply as "adequate," and was accompanied by the firm lowering its forecast for demand. For today, November-dated oil added 37 cents, or 0.5%, to close at $71.34 per barrel. More broadly, oil fell 4% for the week.

Gold pulled back today as global markets settled, reducing the collective appetite for "safe haven" investments. December-dated gold shed $5.60, or 0.5%, to close at $1,222 per ounce for the day, but managed to add 1.4% for the week.