Dow Rally Builds at Midday

Senator Bernie Sanders is dropping out of the 2020 presidential race

Senator Bernie Sanders is dropping out of the 2020 presidential race

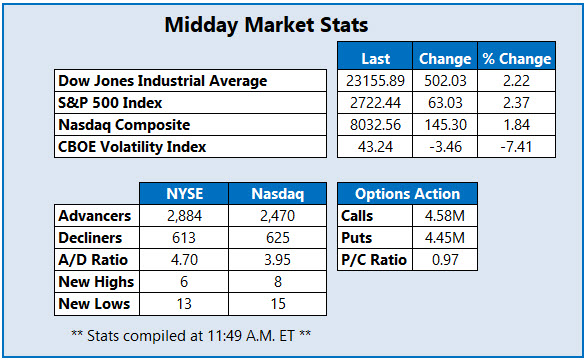

The Dow Jones Industrial Average (DJI) is extending its gains at midday, currently up over 500 points, as investors react to news that Senator Bernie Sanders officially dropped out of the 2020 presidential race. The Nasdaq Composite (IXIC) and S&P 500 Index (SPX) are also experiencing rises, despite mixed messages regarding the coronavirus pandemic. Dr. Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, predicted a turnaround in the COVID-19 fatality rate could occur as early as next week, but also warned that virus containment efforts should continue to be intensified.

Continue reading for more on today's market, including:

Dick's Sporting Goods is providing benefits for its furloughed workers.Tesla stock is rallying on COVID-19 production plans.Plus, NVAX calls popping; FVRR stock is soaring; and energy stock takes a breather.

One stock seeing notable options action today is Novavax, Inc (NASDAQ:NVAX). The clinical-stage vaccine company was last seen up 21.4% to trade at $18.09. At last check, over 8,400 NVAX calls have been exchanged, four times the usual intraday amount. The weekly 4/9 17-strike call is the most popular, with over 2,300 contracts exchanged and new positions being opened. Novavax announced today it will begin Phase 1 trials for a COVID-19 vaccine in May.

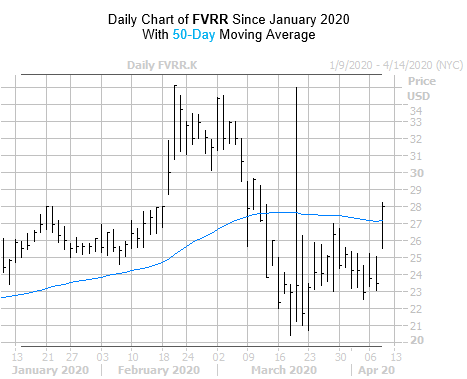

One stock soaring on the New York Stock Exchange (NYSE) this morning is Israel-based digital service provider Fiverr International Ltd (NYSE:FVRR), up 18.7% to trade at $27.80 at last check. This surge comes despite reports that the company has seen a significant decline in activity across the platform due to the coronavirus. FVRR just toppled its 50-day moving average for the first time since March 10.

Meanwhile, Cabot Oil & Gas Corporation (NYSE:COG) was last seen down 2.2% to trade at $17.99. The energy stock is weighed down by a price-target cut to $19 from $20 at Scotiabank. COG is still hanging on to its year-to-date breakeven level,