Dow, S&P Erase Weekly Gains as U.S.-Iran Tensions Spike

Oil prices hit nine-month highs in response

Oil prices hit nine-month highs in response

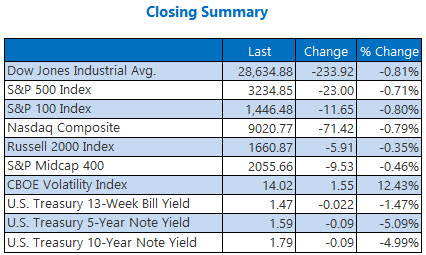

The Dow limped into the weekend with a 233-point loss, pressured by geopolitical tensions and weaker-than-expected economic data. The blue-chip index was down over 368 points at its session low in the morning, after a U.S. airstrike killed top Iranian military commander, Qassem Soleimani. Plus, investors also digested the latest manufacturing data that fell to a 10-year low in December. But while the Dow and S&P slipped into the red on a weekly basis, the Nasdaq held on to a modest week-over-week win.

Continue reading for more on today's market, including:

Stay away from this FAANG stock to start 2020.Tesla's Model 3 update resulted in a new record close.Plus, a retail stock to avoid; checking in with two airliners; and a bull note for Humana.The Dow Jones Industrial Average (DJI - 28,634.88) shed 233.9 points, or 0.8%. Only United Technologies (UTX) finished with a win today, up 0.1%. Dow Inc (DOW) led the 28 losers with a 2.5% fall, while Walgreens Boots Alliance (WBA) broke even. The blue-chip index finished marginally lower on the week.

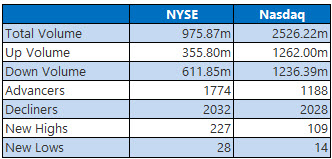

The S&P 500 Index (SPX - 3,234.85) settled 23.1 points, or 0.7%, lower,while the Nasdaq Composite (IXIC - 9,020.77) lost 71.4 points, or 0.8%. The S&P posted a 0.1% weekly loss, while the Nasdaq added 0.2% on the week.

The Cboe Volatility Index (VIX - 14.02) gained 1.6 points, or 12.4%. It added 4.4% on the week.

5 Items on Our Radar Today

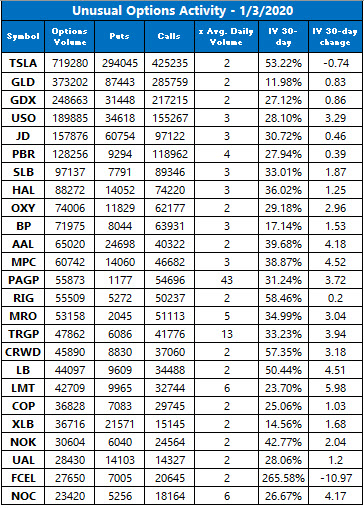

In the immediate aftermath of an airstrike against Iran, the U.S. deployed more than 3,500 soldiers to the Middle East. The new troops will be sent to Iraq, Kuwait, and surrounding areas, although defense officials assert it is not a direct response to Soleimani's death. (CNBC)Starting on Monday, the exporting of artificial intelligence technology from the U.S. will require a license. The move is part of the Trump administration's efforts to keep certain technology out of China. (Reuters)History says this retail stock could struggle in Q1.Options traders blasted AAL and DAL amid a down day.J.P. Morgan Securities has high hopes for Humana stock.There are no earnings of note today.

Data courtesy of Trade-Alert

Middle East Tensions Send Oil, Gold Soaring

Oil exploded higher today, as Wall Street weighed potential output disruptions amid heightened Middle East tensions. February-dated crude futures added $1.87 cents, or 3.1%, to end at $63.05 per barrel, the highest settlement since May. Black gold gained 2.2% on the week.

Gold made it eight straight wins today, as investors flocked to safe-haven assets during the risk-off session. February gold futures settled up $24.30, or 1.6%, to end at $1,552.40 an ounce. Gold also logged a weekly win of 2.3%, its second straight.