Dow Snaps Win Streak on U.S.-China Trade Concerns

President Trump said trade talks were going well, though

President Trump said trade talks were going well, though

The Dow was up 195 points at its session peak, but erased these gains by the close after Bloomberg News suggested some U.S. officials are concerned China could have second thoughts on certain trade concessions. This offset assurances from President Donald Trump that, "Talks with China are going very well," given at a press conference earlier today, and a Wall Street Journal report that said U.S.-China trade negotiations are in the final stages. While the Dow missed out on its longest daily winning streak since the start of the year, the Nasdaq muscled to a third straight win on semiconductor strength. Looking ahead, investors are awaiting the conclusion of the Fed's two-day policy meeting, with the central bank's statementdue at 2 p.m. ET tomorrow.

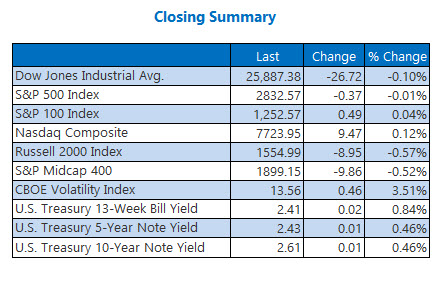

Why Raymond James expects major upside for Chesapeake Energy.Signal says to scoop up this chemical stock.What this March Madness indicator means for stocks.Plus, 2 weed stocks in the news; Wall Street blasted with video game buzz; and U.K. stocks' surprising strength.The Dow Jones Industrial Average (DJI - 25,887.38) swung to a 26.7-point, or 0.1%, loss. Walt Disney (DIS) paced the 15 Dow decliners with its 2.8% drop, while Pfizer (PFE) and Walgreens Boots Alliance (WBA) led the 15 advancers, gaining 1.1% apiece.

The S&P 500 Index (SPX - 2,832.57) erased its intraday gains to settle fractionally lower. The Nasdaq Composite (IXIC - 7,723.95) outpaced its peers, adding 9.5 points, or 0.1%.

The Cboe Volatility Index (VIX - 13.56) added 0.5 point, or 3.5%.

5 Items on our Radar Today

The Commerce Department said U.S. factory orders rose 0.1% in January, less than the 0.3% rise economists were expecting. Shipments, meanwhile, fell for a fourth consecutive month -- the longest such stretch since mid-2015 -- declining 0.4%. (Reuters)Norwegian aluminum producer Norsk Hydro said it was the "victim of an extensive cyberattack in the early hours of Tuesday." The metals giant said it switched to manual operations to "prevent the encryption virus from spreading between computer servers," and said the impact of the attack was "severe." (CBS News)These 2 weed stocks were in the news today.Nvidia, Alphabet, and Electronic Arts all reacted to video game buzz today.Founder and CEO Bernie Schaeffer checks out the surprising strength in U.K. stocks.

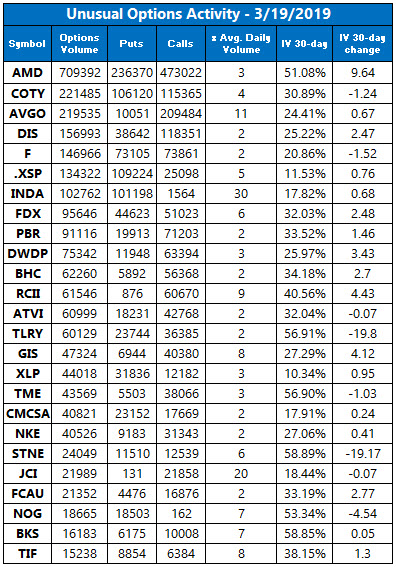

Data courtesy of Trade-Alert

Oil Prices Slip, While Gold Gains

Oil took a breather today. After settling at a four-month high on Monday, April-dated crude futures gave back 6 cents, or 0.1%, to close at $59.03 per barrel.

Gold gained ground today, on expectations the Fed will stand pat on interest rates. Gold for April delivery added $5, or 0.4%, to settle at $1,306.50 an ounce.