Dow Swings to Triple-Digit Loss After Powell Presser

The S&P and Nasdaq logged their third straight loss

The S&P and Nasdaq logged their third straight loss

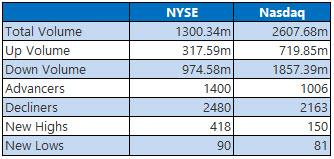

Stocks started the session higher -- with the Dow up more than 83 points at its intraday peak -- on a blowout earnings report for Apple (AAPL) and upbeat jobs data. Markets held modest gains through midday, before turning sharply lower in the wake of this afternoon's Fed announcement. While the central bank issued a 25-basis-point rate cut and said it will end quantitative tightening measures two months early, Fed Chair Jerome Powell noted in a subsequent press conference today's move marked a "mid-cycle adjustment" -- a comment Wall Street assumed to be hawkish. As a result, the Dow swung to a triple-digit loss, while the S&P and Nasdaq brought their daily losing streaks to three.

Continue reading for more on today's market, including:

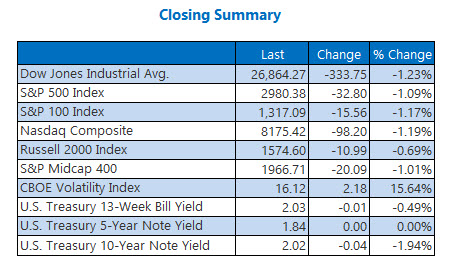

This chip stock sailed to new highs after earnings.History suggests Humana's rally isn't over yet.Spruce Point labeled this healthcare stock a "strong sell".Plus, BHGE stock sounds sell signal; AMD price targets adjusted post-earnings; and Citron thinks this stock could quadruple.The Dow Jones Industrial Average (DJI - 26,864.27) explored a 562-point range, eventually closing down down 333.8 points, or 1.2%. Microsoft (MSFT) paced the 26 decliners with its 2.9% drop, while Apple (AAPL) led the four advancers with its 2% gain. For July, the Dow rose 1%.

The S&P 500 Index (SPX - 2,980.38) gave back 32.8 points, or 1.1%, while the Nasdaq Composite (IXIC - 8,175.42) shed 98.2 points, or 1.2%. Month-over-month, the SPX and IXIC rallied 1.3% and 2.1%, respectively.

The Cboe Volatility Index (VIX - 16.12) added 2.2 points, or 15.6%, for its highest settlement since June 26. On a monthly basis, the market's "fear gauge" rose 6.9%.

5 Items on our Radar Today

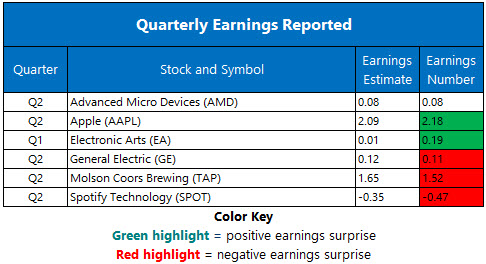

Apple (AAPL) reported fiscal third-quarter earnings of $2.18 per share on $53.8 billion in revenue, more than analysts were expecting -- "record revenue for Q3," according to CEO Tim Cook. However, iPhone revenue of $25.99 billion and services revenue of $11.46 billion fell short of estimates. (CNBC)Canada-based cannabis name CannTrust said it will undergo a strategic review, which includes a possible sale. This follows a C-suite shakeup earlier this month following media reports of illegal grow rooms. CTST stock jumped 9.5% on the news. (MarketWatch)BHGE stock sounded a sell signal after earnings.AMD saw several post-earnings price-target adjustments.Citron thinks this stock could quadruple.

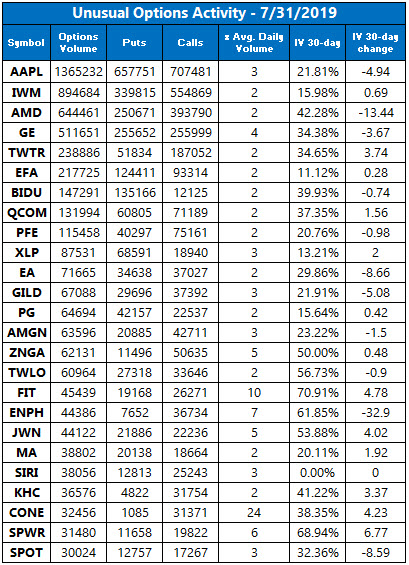

Data courtesy of Trade-Alert

Oil Brings Win Streak to 5

Oil rose for a fifth straight day, boosted by a wider-than-expected drawdown in domestic crude inventories. Crude for September delivery gained 53 cents, or 0.9%, to settle at $58.58 per barrel. For the month, oil prices rose 0.04%.

Gold futures snapped their three-day win streak ahead of the Fed announcement, with December-dated gold closing down $4, or 0.3%, at $1,437.80 an ounce -- paring its monthly gain to 1.7%. The most active contract extended this downside in electronic trading, last seen off 0.3%.