Downside Risk in Precious Metals / Commodities / Gold & Silver 2020

Last week we noted that the risks in preciousmetals were primarily technical.

Sentiment and technicals urge caution over theshort-term.

The net speculative position in Gold hasremained high for months while the 21-day daily sentiment index (DSI) hit 81%.Since the sector peak five months ago, Silver and the gold stocks havecorrected in price while Gold has made a new high.

That non-confirmation has persisted and evenrecently as odds for rate cuts have increased. Last Friday, the market wasshowing an 89% chance of at least one cut and 61% chance of at least twocuts.

Perhaps those figures have underpinnedprecious metals during the larger correction and consolidation. Ultimately, ifthe Fed is going to cut rates twice this year, precious metals (and gold stocksand Silver specifically) will react more favorably.

A rate cut is not imminent and perhaps that iswhy gold stocks are not a threat to breakout until spring at the earliest.

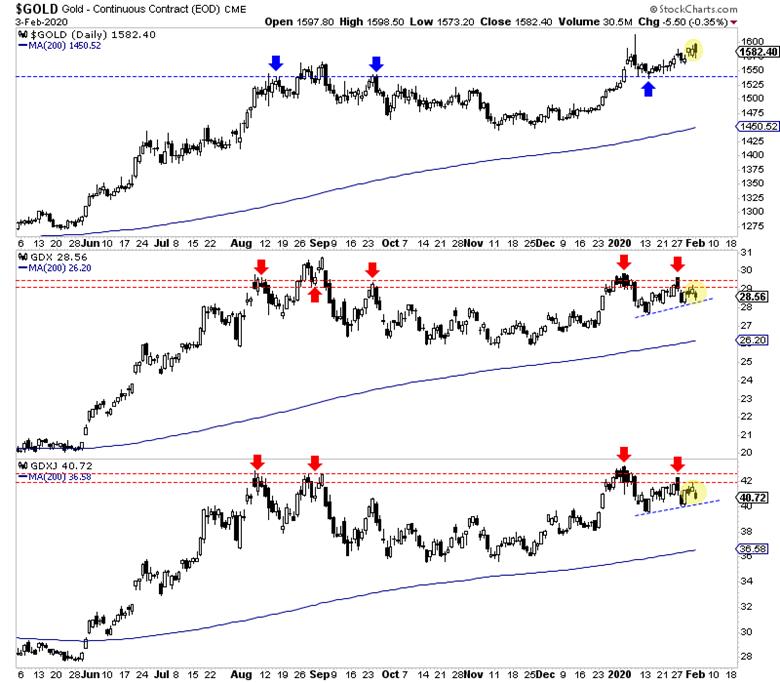

We plot Gold, GDX and GDXJ in the chart below.

The action since January 13 augurs forcaution. Since then, Gold pushed back above its September 2019 high while thegold stocks failed to surpass both their early January and September 2019highs.

If GDX and GDXJ break the blue trendlinesconvincingly then the risk would be a test of their 200-day moving averages.

From mid October through December the silverstocks (plotted below with Silver) performed very well and hinted at thestrength to come in the rest of the sector.

However, since the start of the year, theyhave been weak in both nominal and relative terms. Now, a move in SIL below $30could bring about a test of the 200-day moving average near $28.

Meanwhile, Silver has tried and failed tosurpass resistance in the low $18s.

The fundamentals for Gold, as we noted lastweek remain very encouraging but if the Fed is going to cut rates again, it hasto be closer to imminent before precious metals respond. Sentiment and nowshort-term technicals are flashing some warning signs.

The good news is the uptrends are well-intactand will remain so even if these markets correct more and test their 200-daymoving averages. Some stocks would correct with the sector and some may not.

We continue to focus on identifying and accumulating the juniors with significant upside potential in 2020.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.