Drill Results Show 'Potential Beyond Upcoming Maiden Resource'

These latest assays from Liberty Gold's Black Pine project are reviewed in a PI Financial report.

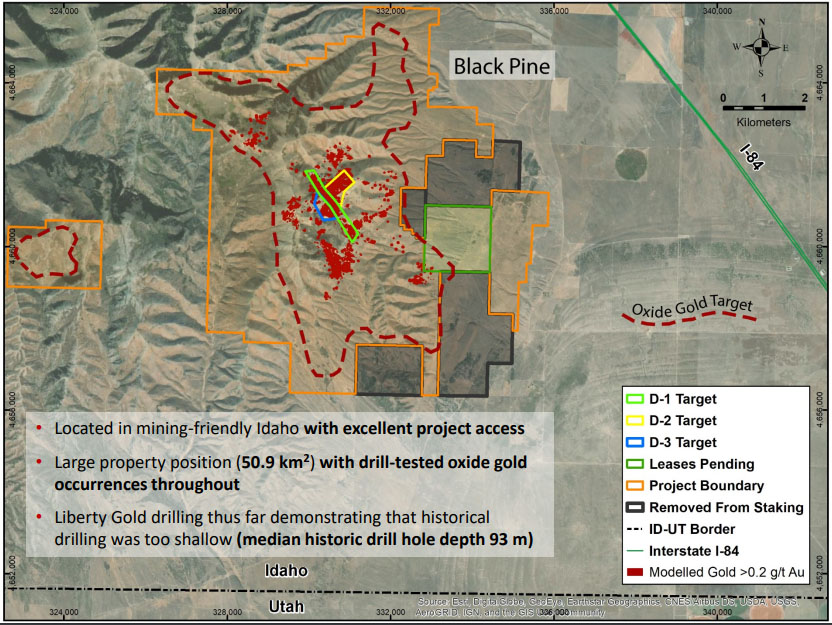

In a Dec. 22 research note, PI Financial analyst Chris Thompson reported that new drill results from Liberty Gold Corp.'s (LGD:TSX; LGDTF:OTCQB) Black Pine project "reflect the potential to significantly expand the resource with additional near-surface oxide tons."

The newly reported findings are from five targets that are located up to roughly 1.5 kilometers away from and surround the Discovery Focus area, the basis of Black Pine's maiden resource estimate due out in Q1/21. Four of these drill tested regions showed prospectivity, Thompson noted and summarized the results from each. They are the:

1) F zone: Liberty Gold purports that this area of mineralization, with a 600 meter strike, runs parallel to the D-1 zone. The highlight assay from F is 62.5 meters (62.5m) of 0.64 grams per ton gold (0.64 g/t Au) starting at 40 meters. Mineralization is thoroughly oxidized, based on its high cyanide solubility on testing.

2) Rangefront zone: This is an area, 500 meters by 250 meters in size, that remains open in all directions. It yielded 36.6 meters of 0.76 g/t Au from 93 meters. Mineralization there shows high cyanide solubility.

3) M zone: The highlight intercept from this 250 meters by 80 meter area is 25.9m grading 2 g/t Au starting at 126.5 meters. Mineralization, which remains open in all directions, has high cyanide solubility at higher elevations and low solubility at lower elevations.

4) Southwest Extension: This zone is in an area where there is a large gold-in-soil anomaly but drilling has not been done, southwest of the historical CD and I Pit complex. In the Southwest Extension the drill bit encountered 15.2m of 0.58 g/t Au from surface. Cyanide solubility of the mineralization is high.

The J zone is an area about 250 meters from the historical A Pit and the D-2 zone. "The highlight intercept of 50.3 m @ 0.97 g/t Au from 18.3 m is encouraging, though reduced cyanide solubility should be noted," the analyst stated.

Liberty Gold will focus on the first four targets in its 2021 drill program, Thompson relayed. As for the company's 2020 campaign, which included infill, resource and regional drilling, although it is finished, the final 48 assays are pending.

PI Financial has a Buy rating and a CA$2.80 per share target price on Liberty Gold, the stock of which is currently trading at about CA$1.67 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Liberty Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Liberty Gold, a company mentioned in this article.