Dynacor Gold Mines: One Main Risk Factor Seems To Be Contained Now

On Aug. 19, 2019, Dynacor released updated production guidance for the second half of the year.

As a result, despite pretty poor 1H 2019 production figures, it looks like 2H 2019 should be much better.

One of the main risk factors, the ore supply, seems to be contained now.

The company continues its two investor-friendly initiatives: the dividend and share buyback programs.

In my opinion, Dynacor still offers interesting upside potential for conservative investors looking for indirect exposure to precious metals.

In my last article on Dynacor Gold Mines (OTCPK:DNGDF) I hhad the following conclusion:

"In my opinion, a few days ago, Dynacor's management made a good decision to include the Tumipampa property in the company's production process. As a result, there's a good chance that the ore supply problems, discussed above, could be finally solved."

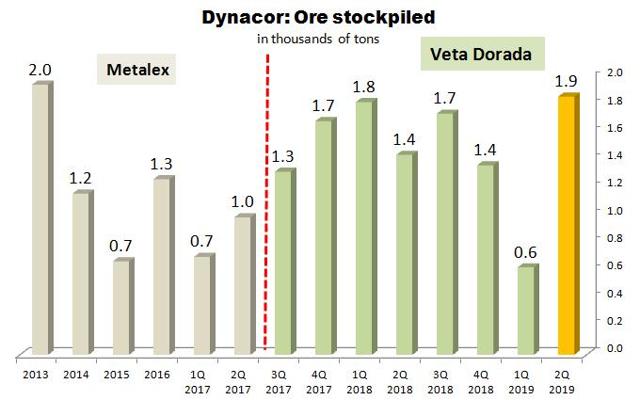

A few days ago the company released its 2Q 2019 report and it looks like my thesis was well grounded. Please, look at the chart below:

Source: Simple Digressions

The chart documents the ore stockpiled by the company since 2013. And indeed, at the end of the second quarter of 2019 Dynacor had 1.9 thousand tons of ore (the bar marked in orange) stockpiled at Veta Dorada (the company's processing facility), the highest figure since 2014.

What's more, according to the company (2Q 2019 Management Discussion, page 21):

"Subsequent to quarter-end, we registered in July, our highest month ever in terms of volume of ore purchased with over 10,000 tons."

In other words, it looks like one of the highest risk factors Dynacor faced in the past is now contained.

Introduction - how this business works

The company's business is pretty simple - it purchases ore from small-scale miners (artisanal miners) across Peru, processes it at the Veta Dorada mill, and sells the extracted gold and silver on the market. As a result, the profitability of this business depends on two factors:

A margin between the price of ore purchased and the market price of gold - the higher the margin the better Throughput (the amount of ore processed) - the higher throughput the better2Q 2019 results

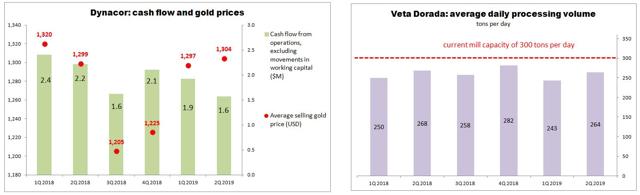

Definitely, Dynacor is not a high-gear company. Instead of fast growth, the company's management is focused on steady development and a few investor-friendly initiatives. For example, at a gold price ranging from $1,205 to $1,320 per ounce the company has been able to deliver steady (or even flat) cash flow from operations (excluding working capital issues) of $1.6 - 2.4M per quarter (the panel on the left):

Source: Simple Digressions

Interestingly, one of the most critical issues Dynacor faces are the decreasing gold grades of the ore processed at Veta Dorada. Hence, to keep production growing, the company has to process more and more ore. And here's another problem because, as the panel on the right shows, in 2Q 2019 the daily throughput (264 tons per day) was well below the mill's name plate capacity of 300 tons per day. Fortunately, as discussed above, there's a good chance that the ore supply problem has been just solved.

The updated production guidance for 2019

In 1H 2019 Dynacor produced 34.1 thousand ounces of gold, well below its half year production guidance of 41 - 46 thousand ounces of gold. However, on Aug. 19, 2019, the company released the updated guidance for 2019. According to this release, Dynacor plans to produce 44 - 46 thousand ounces of gold in 2H 2019. If that were the case, the total 2019 production would have stood at 78 - 80 thousand ounces, only slightly below the initial plan (82 - 92 thousand ounces).

Now, although these figures may restore investors' faith in the company, I think that there's something more important in yesterday's release. Please, read this excerpt:

"The plan focuses on four significant measures:

On May 2, 2019, Dynacor signed an ASM mining agreement authorizing a group of local miners to carry out underground extraction work on the Corporation's Tumipampa exploration project. To date fifteen new high-grade deliveries of 544 tonnes averaging 1.44 oz/t Au have made its way to the Corporation's ore-processing plant near Chala, Peru"

Well, I'm intrigued because the grades cited by the company (1.44 oz/t or 44.8 g/t) seem to be much higher than those disclosed on Dynacor's website in the section on Tumipampa (21.1 g/t). In other words, it looks like the ore fed from Tumipampa has been of much better quality than the most optimistic estimates. At least so far. If that's the case, there's a good chance that the second half of 2019 can be one of the best periods in Dynacor's history.

Investor friendly initiatives

As discussed in my previous reports, most recently Dynacor has introduced two investor-friendly initiatives: The dividend and share buyback programs.

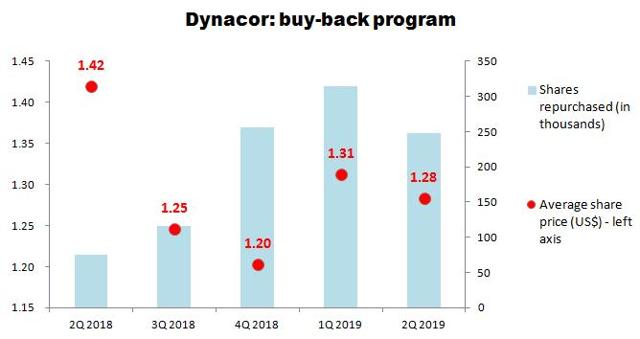

Share buyback program

The chart below documents the share buyback program:

Source: Simple Digressions

In my opinion, the share buyback program realized by Dynacor has been one of the best in the entire industry so far. Why? First of all, the company did not overpay - the average price it paid for a share purchased was always below its book value. Secondly, as the chart above shows, it looks like over the last three quarters the program intensified, compared to 2Q and 3Q 2018. As a result, I think that a price of $1.2 -$1.3 a share can be considered a natural floor price, significantly reducing the risk of investing in Dynacor shares.

Dividend program

To be honest, I'm a bit disappointed with this initiative. The company started its dividend program in 4Q 2018, declaring a quarterly dividend of C$0.01 a share. At the current share price of US$1.36 it translates into a dividend yield of 2.8% a year. Although it's quite a decent yield, I'm pretty sure that Dynacor could afford a bit more generous dividend, particularly after the latest updated production guidance for 2019. Additionally, the company has no debt, generates substantial free cash flow and holds a lot of cash ($13M).

Summary

Despite a bit disappointing 1H 2019 production figures, the second half of the year should be much better. What's more, one of the main risk factors the company has been facing so far, the ore supply, seems to be contained. As a result, in my opinion, Dynacor offers interesting long-term upside potential for conservative investors looking for indirect exposure to precious metals. This thesis is additionally magnified by two investor-friendly initiatives (the dividend and share buyback programs).

Of course, there are also a few risk factors any investor interested in Dynacor should keep in mind:

Pretty small trading volume - The year-to-date trading volume stands at a mere 4.8 thousand shares a day (the North American OTC market). Fortunately, due to the share buyback program, over the last two months the average trading volume has jumped to 6.2 thousand shares One of the main sources or ore supply is the Tumipampa deposit in Peru. Unfortunately, despite a few drilling programs conducted at this property, Dynacor has not released a mineral resource / reserve estimate for this property. As a result, the grades or metal recoveries are hard to predict in the long term, creating an additional risk factorFinal note

Did you like this article? If your answer is "Yes", please visit my Marketplace service, Unorthodox Mining Investing where I run a portfolio of up to 10 mining picks, discuss new investment ideas, and provide subscribers with a medium-term outlook on a few financial markets (particularly the base/precious metals market).

Disclosure: I am/we are long CEF, GDX, SAND, DNGDF, HCHDF, ARREF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I also hold a long position in gold, silver and copper futures

Follow Simple Digressions and get email alerts