EA Stock Brushes Off Earnings Beat

Entertainment Arts' fourth-quarter revenue outlook missed the mark

Entertainment Arts' fourth-quarter revenue outlook missed the mark

Video game specialist Electronic Arts Inc. (NASDAQ:EA) just stepped into the earnings confessional last night, and sentiment surrounding the firm's fiscal third-quarter report is mixed. While EA did post profits of $2.52 per share and revenue of $1.98 billion, both of which beat analysts' estimates, the stock can't shake its less-than-stellar fourth-quarter adjusted revenue forecast, which was weaker than expected amid a delayed launch of its basketball game "NBA Live." In response, EA is down 4.4% to trade at $106.69. Below, we'll dig into how the rest of Wall Street is responding to EA's quarterly confessional.

Despite the stock's dip, the brokerage bunch is brimming with even more optimism. No less than six analysts raised their price targets, including Wedbush, which lifted its price target to $135. This put the consensus 12-month price target at $118.24, which is still at a solid 10.8% premium to current levels. Coming in to today, 15 analysts in coverage considered the Madden creator a "buy" or better, while eight said "hold."

Options traders have chimed in today too, with 9,568 calls and 7,810 puts across the tape so far -- three times what's typically seen at this point. The February 115-strike call is seeing quite a bit of action, followed by the weekly 3/13 98.50-strike put, which positions being purchased at the latter.

A tendency toward bullish bets is the norm, with 7,504 calls and 5,121 puts across the tape in the last 10 days. However, an interest in long puts has been picking up steam, as evidence by EA's 10-day put/call volume ratio of 0.68 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits higher than 88% of all other readings from this past year.

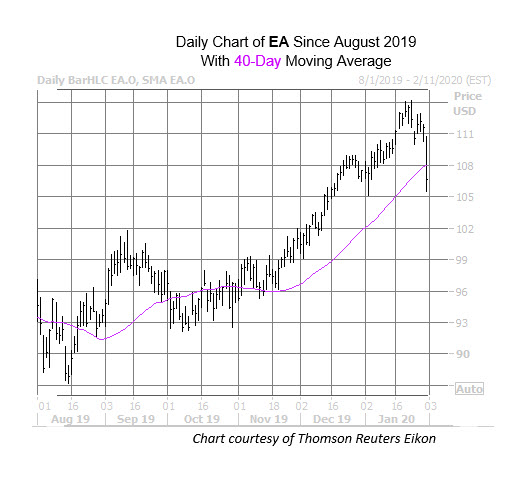

Taking a look at the charts, this could mark Electronic Arts' lowest close since mid-December, should these losses hold. Plus, EA just breached its 40-day moving average -- a trendline that served as support for the equity back in November. Year-over-year, however, EA still boasts a roughly 15% gain.