Economic Data Keeps a Lid on Stock Market Gains

Apple headwinds also pulled indexes off their session highs

Apple headwinds also pulled indexes off their session highs

The Dow jumped to a 279-point lead in early trading, as Wall Street cheered stabilizing bond yields following last week's post-Fed recession scare. Optimism ahead of high-level U.S.-China trade talks and a bouncing bank sector also buoyed stocks. The Dow, S&P 500, and Nasdaq all settled well off their intraday highs, though, on a batch of relatively weak economic data -- including a dreary reading on housing starts -- and a bearish reversal from Apple (AAPL), which swung lower after a U.S. trade judge suggested an import ban on certain iPhone models in a patent infringement case with Qualcomm (QCOM).

Continue reading for more on today's market, including:

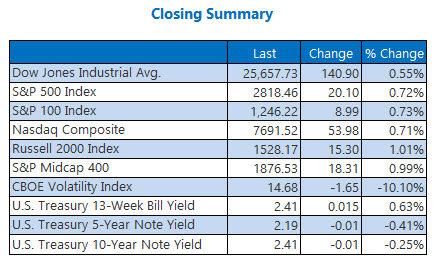

The FAANG stock for short-term bears.Lululemon options price in a big earnings move.Plus, more on today's economic reports; red-hot Nvidia rises again; and behind Bed Bath & Beyond's best day in years.The Dow Jones Industrial Average (DJI - 25,657.73) closed up 140.9 points, or 0.6%. Walt Disney (DIS) paced the 25 Dow advancers with its 2.2% gain, while UnitedHealth (UNH) led the five decliners with its 1.4% drop.

The S&P 500 Index (SPX - 2,818.46) added 20.1 points, or 0.7%, but stopped just shy of the 2,820 level. The Nasdaq Composite (IXIC - 7,691.52) rose 53.9 points, or 0.7%.

The Cboe Volatility Index (VIX - 14.68) slipped 1.7 points, or 10.1%.

5 Items on our Radar Today

Following this morning's dismal reading on housing starts, data showed home prices rose at a seasonally adjusted 3.6% in January -- the slowest year-over-year growth in six years. Elsewhere on the economic front, the Conference Board said consumer confidence unexpectedly fell in February to 124.1, marking its fourth decline in five months. (MarketWatch; Bloomberg)Lyft is reportedly planning to set the range for its initial public offering between $62 and $68 per share, which would value the ride-hailing service at more than $23 billion. Lyft is expected to price its shares late Thursday, and begin trading on the Nasdaq on Friday under the ticker LYFT. (MarketWatch)This pharma stock was the target of a bullish options trade.Red-hot Nvidia notched another win on the back of a fresh bull note.The buzz that sent Bed Bath & Beyond to its best day in years.

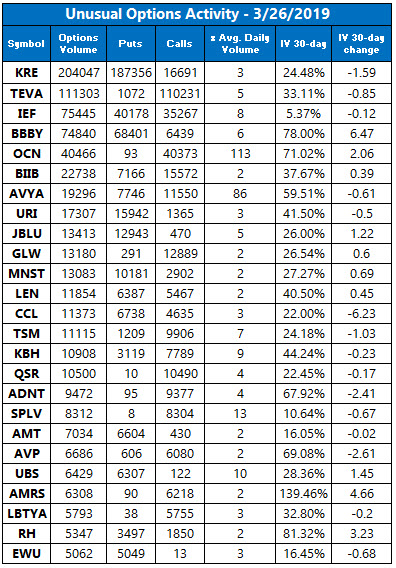

Data courtesy of Trade-Alert

Gold Drops as Stocks Climb

Oil prices gained on optimism this week's inventories updates will show declines in domestic crude supplies. By the close, May-dated crude was up $1.12, or 1.9%, to settle at $59.94 per barrel.

Gold gave back some of its recent gains as investors' appetite for riskier assets grew and the U.S. dollar strengthened. Gold for April delivery fell $7.60, or 0.6%, to close at $1,315 an ounce.