Economy Cooling While Silver Getting Hotter, Makes First Majestic Worth a Look

Ron Struthers writes that the economy continues to weaken, and elevated prices mean continued stagflation. Silver prices are rising after significant chart breakouts, so a silver stock like First Majestic might be worth a look. Equinox completed its merger with Calibre today, which Struthers believes makes Equinox a strong gold production growth story.

Ron Struthers writes that the economy continues to weaken, and elevated prices mean continued stagflation. Silver prices are rising after significant chart breakouts, so a silver stock like First Majestic might be worth a look. Equinox completed its merger with Calibre today, which Struthers believes makes Equinox a strong gold production growth story.

Numerous economic data points out today were not very good. Retail sales fell 0.9% last month, the largest decrease since January, after a downwardly revised 0.1% dip in April, the Commerce Department's Census Bureau reported today. Economists polled by Reuters had forecast retail sales to decrease 0.7% after a previously reported 0.1% gain in April.

Industrial production fell 0.2 in May, the Fed reported today. It is the second decline in three months, and a sign that the flurry of activity in the first quarter has cooled. The drop was slightly steeper than the 0.1% drop forecast by economists surveyed by The Wall Street Journal. Motor vehicles and parts output jumped 4.9% after a 2.3% fall in April. Excluding autos, manufacturing fell 0.3%.

Capacity utilization dropped to 77.4% in May, down from 77.7% in the prior month. That's the lowest rate since January.

Homebuilder confidence sank to a two-year low as buyers continue to shun the housing market. Builders are upping price cuts in an effort to bring them back. Home prices also remain elevated, making home ownership an unaffordable prospect. Economic uncertainty also continues to weigh on home buyers.

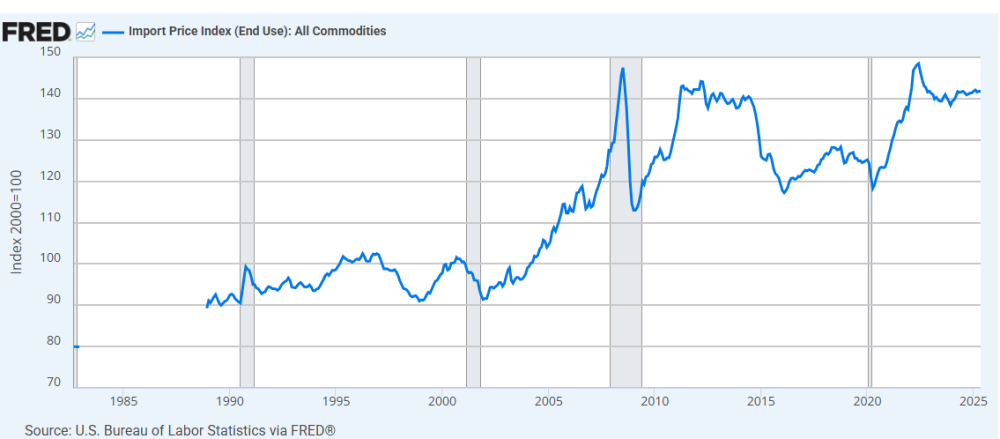

U.S. import prices were unchanged in May, the U.S. Bureau of Labor Statistics reported today, following a 0.1% increase in April. This is something to watch to see how tariffs influence prices. The BLS does not account for tariff amounts in prices used for calculating the U.S. Import and Export Price Indexes. However, all other things being equal, the U.S. Import and Export Price Indexes show the supply- and demand-based price changes that result from tariffs being announced or imposed.

Import prices have been pretty flat since the 2022/23 energy price rise and then correction. Not the rise from 2003 to 2008, which was commodity-driven. Commodity prices can have a big effect on import prices. If these prices rise in a slowing economy, that is bad news, more stagflation.

World Gold Council reported pretty bullish news from Central Banks. Their survey set a new benchmark, drawing in 73 responses - the highest since the survey commenced eight years ago. The sample is highly representative of the overall central bank community, both geographically and in terms of gold owned.

95% believe that global central bank gold reserves will increase over the next 12 monthsA record 43% of respondents also believe that their own gold reserves will increase over the same period, and none anticipate a decline in gold holdings.As you know, I follow the market cycles in detail and strive to be on the right side in the long run. Major asset classes like stocks, commodities, bonds, and gold tend to move in secular trends lasting decades. Stocks generally move in cycles of 15-20 years, while bonds can trend for as long as 30-40 years. Historically, gold's last two secular bull markets lasted about 10-11 years.

Right now, the bond market is in a secular bear phase, which is a rare event; only one such period has occurred in the past 100 years (1965-1982). A lot of that period was hallmarked by stagflation, like today. Stocks are nearing the end of their long-term bull market, creating a setup reminiscent of the late 1960s and 1970s when gold and silver soared.

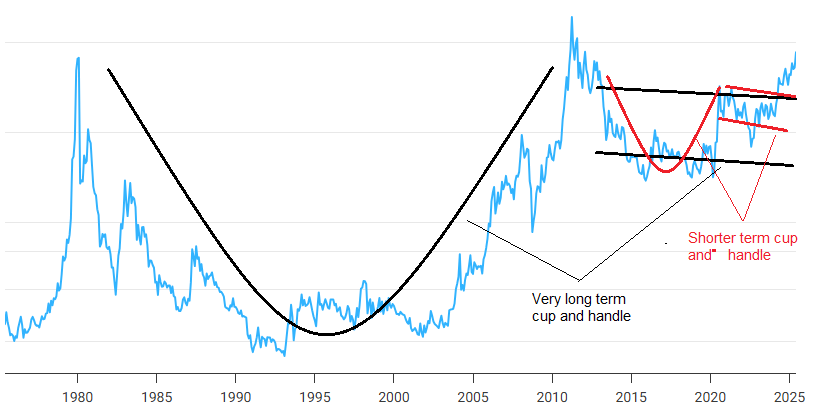

Gold has already confirmed its breakout from a 13-year cup-and-handle pattern, and once the stock market finally rolls over, we can expect an explosive move in gold, silver, and commodities. I pointed out the shorter-term breakout in silver from a cup and handle chart pattern in late 2024, and this chart also shows the longer-term breakout for a cup and handle pattern.

First Majestic

Recent Price - $11.45

Entry Price - $6.45

Opinion - Hold/Buy

I have last updated First Majestic Silver Corp. (AG:TSX; AG:NYSE; FMV:FSE) on February 18.

This was when silver was breaking out and AG was a good buy at support around $7.75, with silver on the move, it's a good time for another update.

They reported excellent Q1 results, a gold/silver discovery at Santa Elena, and the stock broke out on the chart.

FIRST QUARTER HIGHLIGHTS announced on May 7

Record Cash Position: The Company ended the quarter with the highest cash and restricted cash balance in its history of $462.6 million, consisting of $351.3 million in cash and cash equivalents and $111.3 million in restricted cash. The company's liquidity position has further improved to a record $544.4 million, consisting of $404.8 million of working capital and $139.6 million of undrawn revolving credit facility, and excluding $111.3 million held in restricted cash.Record Silver Production (+88% Y/Y): The company produced 7.7 million silver equivalent ("AgEq") ounces in Q1 2025 representing 26% of the mid-point of the Company's 2025 production guidance, including a quarterly silver production record of 3.7 million silver ounces, an 88% increase when compared to 2.0 million silver ounces produced in Q1 2024. Gold production also increased by 1% to 36,469 ounces.Record Quarterly Revenue (+130% Y/Y): The company generated record quarterly revenue of $243.9 million in the first quarter (57% from silver sales), representing a 130% increase compared to $106.0 million in the first quarter of 2024.Held Inventory: The company held 620,043 silver ounces in finished goods inventory as at March 31, 2025, inclusive of coins and bullion. The fair value of this inventory as at March 31, 2025 was $21.1 million, which was not included in revenue during the first quarter.End of May, AG reported a second significant discovery of vein-hosted gold and silver mineralization within a year at the Santa Elena property in Sonora, Mexico. The near-surface, newly identified Santo Ni?o vein, located approximately one kilometer south of the Santa Elena mine, marks a significant addition to the district.

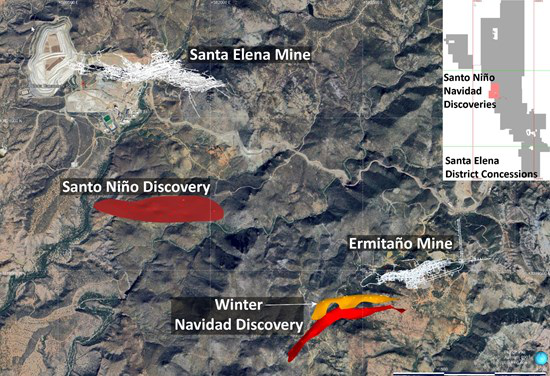

Exploration drilling approximately 900 meters ("m") south of the Santa Elena processing plant has discovered the Santo Ni?o vein a large, epithermal quartz-adularia vein hosting gold ("Au") and silver ("Ag") within a newly identified fault zone. Exploration drilling to date has traced the vein over one kilometer ("km") of strike and 400 m down-dip, with thirteen intercepts to date returning significant gold and silver grades.

The intersects are some of the highest-grade mineralization ever encountered on the Santa Elena Property: 6.8 m grading 14.8 g/t Au and 642 g/t Ag for an AgEq grade of 1,898 g/t.includes 1.2 m at 29.5 g/t Au and 919 g/t Ag for 3,427 g/t AgEq;and 2.5m at 21.2 g/t Au and 1,093 g/t Ag for 2,897 g/t AgEq.This map gives you a good picture of proximity to their mines:

The stock broke out of a wedge pattern in June and just recently broke above resistance.

Continue to hold the stock, and if you don't own any, I still see it as a good buy for this silver bull market.

Equinox Gold

Recent Price - $8.35

Entry Price - $5.35

Opinion - Buy

Today, Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A) and Calibre Mining Corp. (CXB:TSX; CXBMF:OTCQX) announced the successful completion of the previously announced business combination pursuant to which Equinox Gold has acquired all of the issued and outstanding common shares of Calibre. The Transaction has created an Americas-focused diversified gold producer with a portfolio of mines in five countries anchored by two high-quality, long-life, Canadian gold mines: the Greenstone Gold Mine ("Greenstone") in Ontario and the Valentine Gold Mine ("Valentine") in Newfoundland & Labrador. Valentine is in the final stages of construction and plant commissioning, with first gold expected by the end of Q3 2025. With Greenstone and Valentine at nameplate capacity, Equinox Gold will become the second-largest gold producer in Canada.

Ross Beaty, Chair of the Equinox Gold Board of Directors, commented: "On behalf of the entire Equinox Gold team, I extend our sincere thanks to outgoing directors Gordon Campbell and Dr. Sally Eyre, Doug Reddy, outgoing Chief Operating Officer, and Scott Heffernan, outgoing Executive Vice President Exploration, for their valuable contributions to Equinox Gold over the last several years."

We bought Calibre Mining at a great price of $1.63 so ended up in about one year with 83% gain at today's price. I averaged the buy price of Equinox with our Calibre buy price based on the 0.35 shares EQX for each CXB share, so it lowered our buy price on Equinox to $5.35.

I still see EQX among the better Buys among gold stocks with their Greenstone expansion underway and the new Valentine mine starting this year. Right now you can buy the stock near the bottom of it's up trend channel.

| Want to be the first to know about interestingSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of First Majestic.Ron Struthers: I, or members of my immediate household or family, own securities of: First Majestic and Equinox Gold. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.