Ecuador anticipates $4 billion in mining investments by 2021

Fruta del Norte, discovered in 2006, is one of the world's biggest recent gold findings. (Image courtesy of Lundin Gold)

Ecuador is quickly gaining ground as a mining investment destination in Latin America thanks to a revised regulatory framework and a major investor engagement campaign that has already attracted around 420 applications for concessions in less than a year.

Getting to this point, however, has not been easy for a nation that has traditionally based its economy on oil, bananas, cacao and coffee exports, but that it is rather foreign to mining, admits the country's mining minister Javier C??rdova.

Speaking to MINING.com on the sidelines of the Prospectors and Developers Association of Canada (PDAC) conference, held in Toronto this week, C??rdova says one of the main mistakes Ecuador made in the past was to apply legislation designed for the oil sector to miners, which just didn't work.

But what really triggered the recent overhaul of the country's mining regulations was the exit of Canada's Kinross Gold (TSX:K) (NYSE:KGC) from Ecuador in 2013, after failing to reach an agreement with authorities over the terms for developing its Fruta del Norte project, one of Latin America's biggest undeveloped gold deposits.

Shortly before that, IAMGOLD, another Canadian miner as well as International Minerals had both sold their projects and left the Andean nation.

The government has received 420 applications for mining concessions since opening up the country for exploration in July 2016."We knew we had a resource-rich country and we knew several firms where interested in exploiting them, but what we didn't know was why firms kept leaving," he says.

The government then hired consultants Wood Mackenzie to provide recommendations and swiftly implemented changes. One of the most crucial ones was the standardization of the unpopular windfall profits tax, a 70% levy on excess profits, the terms of which - such as what constitutes excess profits - had previously been subject to negotiation between company and government.

That levy is no longer based on a pre-negotiated base price on a project-by-project basis, but on the average commodity price for the past decade, C??rdova explains. It also doesn't apply once a mine begins production, but four years after a company has recovered its full capital investment.

Now Ecuador's net tax take is in line with other countries in the region. "We aren't as cheap as Chile, but we are not the most expensive either," C??rdova says. What's more, the minister believes such unpopular tax will likely be eliminated way before any of the current projects has to start paying it.

From promise to reality

Since opening up the country for exploration in July 2016, mining minister Javier C??rdova has already granted 160 licences. (Image courtesy of Ecuador Mining Ministry via Flickr)

Another measure recently taken by Ecuador was the creation of a mining ministry. Before 2015, the oil and gas ministry regulated the activity and, as such, it was quite neglected, the minister says.

C??rdova also notes that when his country came to PDAC for the first time, two years ago, it brought just promises. Last year, it was able to present some concrete progress and now it can show that some of the main global mining players, including Fortescue Metals (ASX:FMG) and Newcrest (ASX:NCM), are already setting foot in the country.

"Companies trust that everything we promise, we later deliver," he says, and as an example of such trust he says his ministry has received 420 applications for mining concessions since opening up the country for exploration in July 2016.

From those requests, 160 has already been granted and the minister says it has secured more than $100 million in investment to explore those gold, copper, silver and molybdenum-rich areas.

Currently, Ecuador's mining sector employs 3,700 people, a figure that is estimated to rise to about 16,000 for the period 2017-2020.

Ecuador expects mining investments to increase 360% in the next four years compared to the period 2013-2016, totalling more than $4 billion.The nation also expects mining investments to increase 360% in the next four years compared to the period 2013-2016, totalling more than $4 billion.

The most important of those projects, C??rdova acknowledges, continues to be Fruta del Norte, now property of Lundin Gold (TSX:LUG), which the firm acquired it in 2015 and late last year reached a key agreement with authorities that includes an investment protection contract.

The asset, discovered in 2006, is expected to generate 340,000 ounces of gold a year during its mine life. First production is expected in the first quarter of 2020, with full operations beginning in 2021.

There also are other projects worth keeping an eye on it, two of which are being developed by Chinese companies - the large-scale Mirador copper mine, controlled by the CRRC-Tongguan consortium, and R?-o Blanco, also a copper project now operated by Junefield Mineral Resources.

Growing pains

But with success also come growing pains, C??rdova admits, such as conflicts with local communities.

In that respect, the minister thinks is "regrettable and irresponsible" as well as "illegal and against the constitution" the decision of the city of Cuenca to ban mining in the municipality.

"What is happening in Cuenca is purely political and related to the upcoming elections," he notes. "I'm sure that after the elections many of these conflicts will wean off."

Asked about the potential effects of the upcoming presidential elections in the country's growing mining sector, C??rdova says that given the industry's relevance to the country's economy, he does not anticipate major changes in terms of policies.

"If our candidate [Lenin Moreno] wins, nothing is going to change. If the right-win candidate wins, which we obviously hope is not the case, we don't think it will affect miners as [Guillermo Lasso] is very pro-businesses."

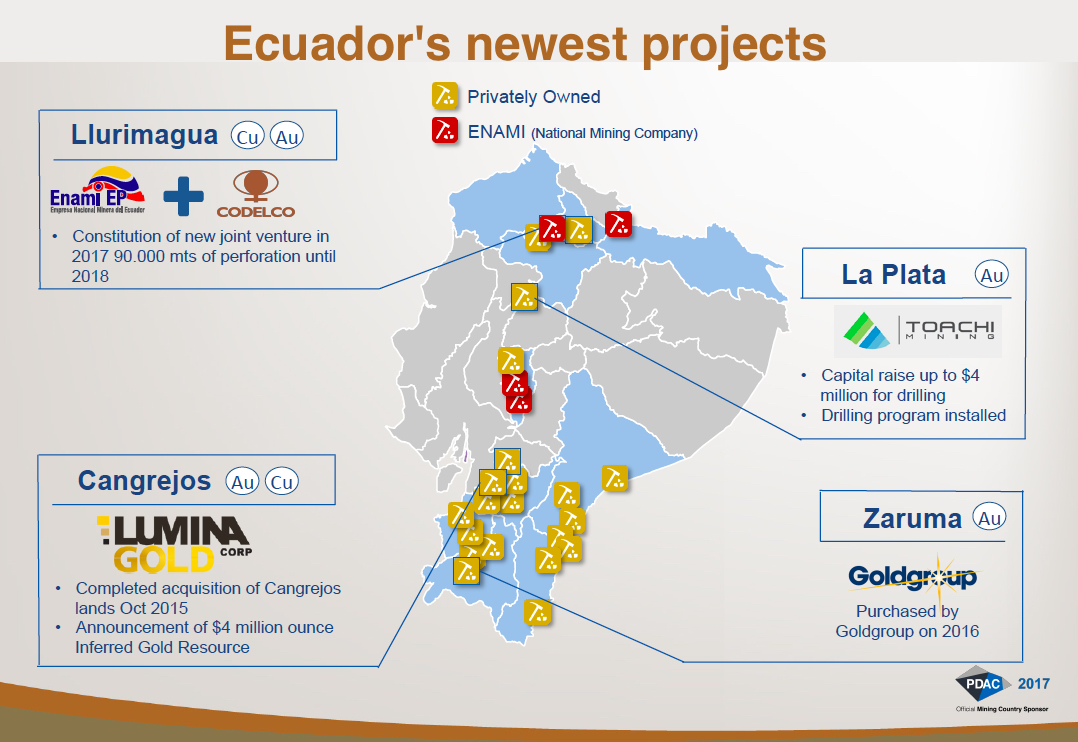

(Courtesy of Ecuador Mining Minister | Presentation at PDAC 2017.)