EDF and MHI to collaborate on Atmea joint venture

The Atmea joint venture between France's Areva and Japan's Mitsubishi Heavy Industries (MHI) is to be reorganised following the sale of Areva's reactor business to EDF, MHI and Assystem. Atmea was created in 2007 to develop, market, license and sell the 1100 MWe Atmea-1 pressurised water reactor combining both companies' technologies.

|

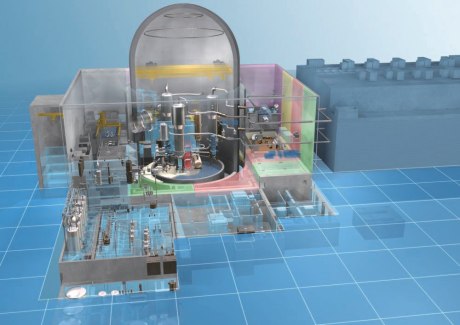

| A cutaway of a nuclear power plant based on the Atmea 1 reactor (Image: Atmea) |

The sale of Areva's reactor business, which had been transferred to a wholly-owned subsidiary of Areva NP referred to as 'New NP', was completed on 31 December. As a result, New NP became 75.5% owned by EDF, 19.5% by MHI and 5% by Assystem. Yesterday it was announced that New NP had been renamed Framatome.

"The completion of the investment will result in a reorganisation of Atmea," MHI said today. "Under the new structure, there will be fifty-fifty ownership of Atmea between MHI and EDF, along with a special share owned by Framatome."

MHI noted, "Under the new arrangement, MHI, EDF and Framatome will collaborate in promoting worldwide sales of the Atmea-1 reactor." The company added, "Prospects for the sale of the Atmea-1 have been expanding worldwide, especially in emerging economies, where new nuclear power plant construction plans are moving ahead."

"MHI has been a key player in cooperation between Japan and France in the development of nuclear power generation technologies for many years," said MHI president and CEO Shunichi Miyanaga. "With the completion of our investment into Framatome, a new structure has been created that will further strengthen the ties between our nuclear energy industries, and I am confident this new relationship will enable further improvement in technologies to ensure the long-term sustainability and reliability of nuclear energy."

In 1991, MHI and Areva formed a joint venture in the nuclear fuel cycle business, and in 2006 they concluded an agreement on broader collaboration in the field of nuclear energy. That agreement led to the creation in 2007 of the Atmea 50-50 joint venture. Turkey's second nuclear power plant, at Sinop on its Black Sea coast, is proposed to feature four Atmea 1 reactors.

In 2009, Areva and Mitsubishi agreed to establish a joint venture company in the nuclear fuel fabrication business. The new company was established by restructuring the existing Mitsubishi Nuclear Fuel (MNF) company, with Areva NP taking a 30% stake in the new company.

Since 2005, the Japanese company has received orders for 15 replacement steam generators for French nuclear power plants operated by EDF. In June 2016, MHI and EDF signed a memorandum of understanding (MOU) on cooperation in the field of nuclear energy. The MOU called for EDF's marketing, technological and other support of Atmea's business, as well as broad-based cooperation in global markets making use of the two companies' technological capabilities and specialised strengths.

MHI is also scheduled to acquire a 5% equity stake in New Areva Holding (formerly referred to as 'NewCo'), a company primarily focused on the nuclear fuel cycle business. The investment is due to be completed at the end of this month.

MHI said further cooperative ties between France and Japan's nuclear power industries will be strengthened in areas including equipment supply to nuclear power plants, after-sale servicing and decommissioning work.

"Going forward, through the increasingly close ties forged with EDF, Framatome and Areva Group, MHI will promote the development of global markets for a broad range of nuclear power generation-related technologies," MHI said. "In this way, MHI will contribute to the formation of a worldwide structure enabling stable acquisition and supply of energy with low emissions."

Researched and writtenby World Nuclear News