Ekati Eyes 5M Carats as Production Resumes

RAPAPORT... The new owners of the Ekati mine are planning production of 4.5 million carats in 2021 after the deposit spent the past 10 months on care and maintenance.Arctic Canadian Diamond Company took over the operation in December as former owner Dominion Diamond Mines filed for bankruptcy protection in April 2020. Dominion was unable to meet its repayment obligations for debts that had swollen to CAD 1.2 billion ($820 million) when rough sales froze due to Covid-19. Its 40% stake in the Diavik mine remains part of the Dominion bankruptcy proceedings. Arctic, which is made up of three of Dominion's bondholders - DDJ Capital, Brigade Capital and Western Asset Management - assumed $70 million of Dominion's debt and injected $85 million of working capital into Ekati. That enabled the mine to resume operations in late January 2021, with the current plan extending operations to 2028, Arctic's interim president, Rory Moore, told Rapaport News. The full interview with Moore and an analysis about Arctic's plans are presented in the March issue of the Rapaport Research Report."Our focus right now is 100% on getting Ekati's production back to a steady state," Moore said. "We started [the reboot] in the dead of winter up in the Arctic, which is pretty hostile, but we are ramping up to full production."Operations are currently focused on the Sable and Pigeon open pits, as well as the Misery underground. Pigeon has one year of mining left, while Sable will run through 2024, Moore reported. Plans are in place to develop the Point Lake pipe, with production there scheduled to begin in 2023. These projects, together with stockpiles of ore, will ensure that mining can continue through 2028, he explained.The mine will yield 4.5 million carats this year and ramp up to 5 million carats in 2022, Moore added.Meanwhile, Arctic is planning its first sale of Ekati-only rough in April or May, according to Kristal Kaye, the company's chief financial officer. The first sale will be via auction, although Arctic plans to continue selling its customized parcels to long-term clients.Under Dominion, lots included a blend of goods from the Diavik and Ekati deposits. However, this will no longer be the case, since the two mines are now in separate portfolios.Arctic will nevertheless replicate Dominion's model, supplying to long-standing clients without the mutual commitments that come with long-term contracts of the De Beers and Alrosa variety, she explained. Every sale will be handled as a stand-alone transaction, with assortments tailored to each customer's requirements.Sales - whether by auction or direct to clients - will take place 10 times a year in Antwerp after the goods have been sorted in Mumbai. Much of the focus this year will be on establishing the Arctic brand and creating awareness of its assets, which include the Canadamark hallmarking program as well as Ekati. "That's a question of understanding who we are and what our long-term strategy [is] for the mine and as a company," Kaye said.Subscribe to the Rapaport Research Report here.

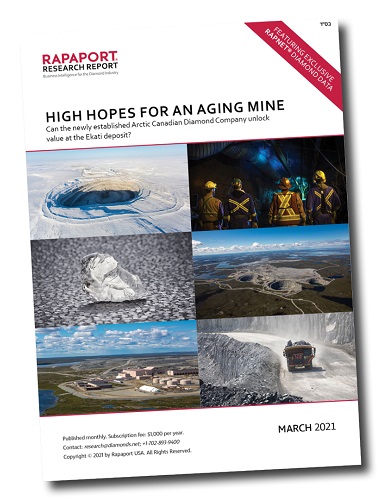

Arctic, which is made up of three of Dominion's bondholders - DDJ Capital, Brigade Capital and Western Asset Management - assumed $70 million of Dominion's debt and injected $85 million of working capital into Ekati. That enabled the mine to resume operations in late January 2021, with the current plan extending operations to 2028, Arctic's interim president, Rory Moore, told Rapaport News. The full interview with Moore and an analysis about Arctic's plans are presented in the March issue of the Rapaport Research Report."Our focus right now is 100% on getting Ekati's production back to a steady state," Moore said. "We started [the reboot] in the dead of winter up in the Arctic, which is pretty hostile, but we are ramping up to full production."Operations are currently focused on the Sable and Pigeon open pits, as well as the Misery underground. Pigeon has one year of mining left, while Sable will run through 2024, Moore reported. Plans are in place to develop the Point Lake pipe, with production there scheduled to begin in 2023. These projects, together with stockpiles of ore, will ensure that mining can continue through 2028, he explained.The mine will yield 4.5 million carats this year and ramp up to 5 million carats in 2022, Moore added.Meanwhile, Arctic is planning its first sale of Ekati-only rough in April or May, according to Kristal Kaye, the company's chief financial officer. The first sale will be via auction, although Arctic plans to continue selling its customized parcels to long-term clients.Under Dominion, lots included a blend of goods from the Diavik and Ekati deposits. However, this will no longer be the case, since the two mines are now in separate portfolios.Arctic will nevertheless replicate Dominion's model, supplying to long-standing clients without the mutual commitments that come with long-term contracts of the De Beers and Alrosa variety, she explained. Every sale will be handled as a stand-alone transaction, with assortments tailored to each customer's requirements.Sales - whether by auction or direct to clients - will take place 10 times a year in Antwerp after the goods have been sorted in Mumbai. Much of the focus this year will be on establishing the Arctic brand and creating awareness of its assets, which include the Canadamark hallmarking program as well as Ekati. "That's a question of understanding who we are and what our long-term strategy [is] for the mine and as a company," Kaye said.Subscribe to the Rapaport Research Report here.