Eldorado Gold: A Dig Into The Q3 Results

Eldorado Gold reported its Q3 results this week, and continues to track near its 2019 guidance provided in February.

The Lamaque Mine PEA is due later this year, with the potential for a slight expansion in annual production.

The company is on track to deliver on guidance, but it remains inferior to its peers fundamentally given its operations in mostly tier-3 jurisdictions, and high costs.

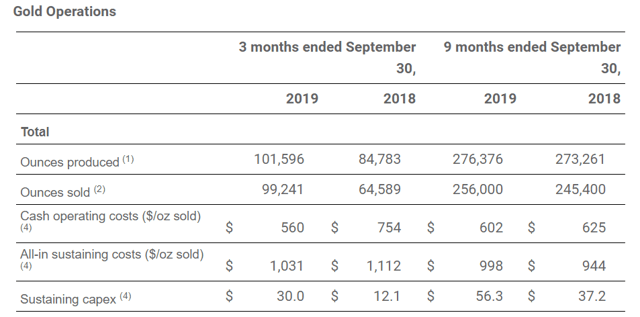

It's been a busy week for investors in the metals complex, with earnings season have finally kicked off in full swing. Eldorado Gold (EGO) was the most recent company to release its Q3 earnings report, and results were mostly in line with what analysts were expecting. The company produced 101,596 ounces in the quarter and is on track to meet annual production guidance of 390,000 to 420,000 ounces. All-in sustaining cost guidance is tracking a little higher than expected but could reach the range provided with a strong Q4. While Eldorado Gold managed to put up a decent quarter, despite slight misses on the top and bottom line, I continue to see the stock as inferior to its peers based on its three-year guidance, and higher cost profile vs. other intermediate producers. The stock should do fine in a rising gold (GLD) price environment, but I would rank the stock as a Sector Perform. This means that it should perform in line with the Gold Miners Index (GDX), but the Gold Miners Index provides lower risk due to its diversification.

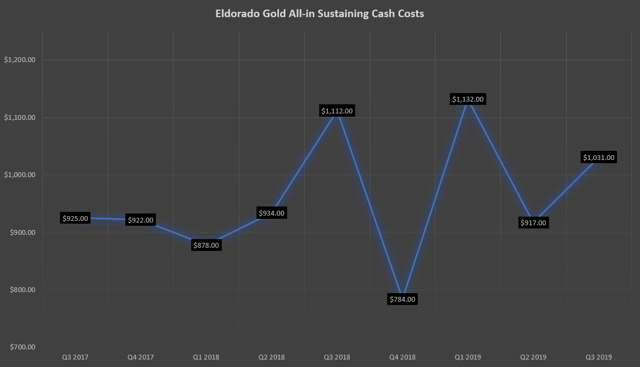

Eldorado Gold has come a long way from the depths of its bear market in 2018 and has managed to pull costs down from two horrendous quarters in Q3 2018 and Q1 2019, of $1,112/oz and $1,132/oz, respectively. All-in sustaining costs for Q3 2019 came in at $1,031/oz, and all-in sustaining costs for the first nine months of 2019 are sitting at $998/oz. These figures are roughly 5% above guidance provided in February of $950/oz for the year, and it's certainly possible the company could meet this guidance. Annual production guidance is sitting at 276,376 ounces to finish Q3, and the company will need 113,000 ounces of production to meet the low end of its guidance. The company reiterated its guidance in the release and plans on meeting this guidance.

(Source: Company News Release)

(Source: Company News Release)

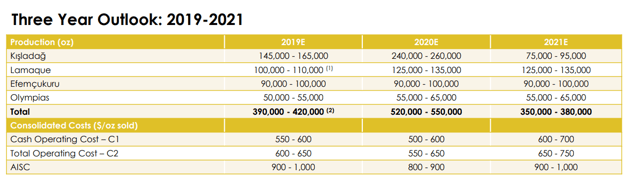

As we can see from the below chart, Eldorado Gold's all-in sustaining costs have been all over the place the past two years but should trend down next year with the higher expected production from Kisladag. All-in sustaining cost guidance is projected at $850/oz at the mid-point for FY-2020 based on their three-year plan, and this is good news for the company. The problem, however, is that FY-2020 is expected to be a one-off, with production dropping off again in FY-2020. The recent test results at Kisladag suggest that there's a possibility for an extension past the three-year guidance, and this would be positive for the company. However, as it stands, Kisladag production is expected to drop off massively in 2021 to 85,000 ounces, from 250,000 ounces anticipated for 2020.

(Source: YCharts.com, Author's Chart)

(Source: YCharts.com, Author's Chart)

Based on the fact that Kisladag is the company's highest-margin operating mine by a significant amount, any extension at Kisladag will be a very welcome sign. The three-year outlook below also does not include possible increased throughput at Lamaque, which could bump production from 130,000 ounces per year to 170,000 ounces.

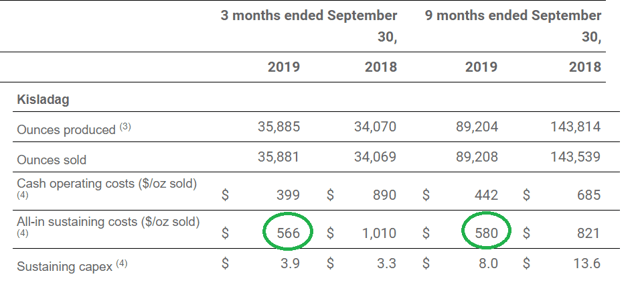

Currently, the company's Kisladag ounces are providing a margin of nearly $900/oz with the trailing-nine-month average all-in sustaining cost of $580/oz and a gold price resting near the $1,500/oz level. This figure is almost $300/oz better than the $866/oz in the same period at Efemcukuru, and the $968/oz all-in sustaining costs at Lamaque. These costs are well above the $717/oz projected in the 2018 technical study done by Eldorado Gold and could come down further in the future.

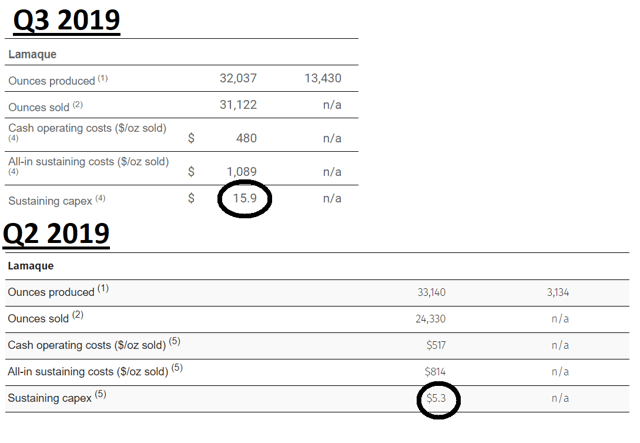

For the company's new Lamaque Mine, it was a higher-cost quarter, with all-in sustaining costs coming in at $1,089/oz vs. $814/oz in the mine's first quarter of commercial production (Q2). The higher costs were mostly attributed to nearly three times more sustaining capital in the quarter, with $5.3 million spent in Q2 2019. The key for investors will be to see what full-year 2019 production looks like and if the company can pull costs lower with the higher throughput planned in the upcoming PEA. While I would not expect FY-2019 all-in sustaining costs to come in at the projected numbers of $720/oz, it would be nice if the company could get these costs below the $800/oz level. The project was supposed to drag down Eldorado Gold's consolidated cost guidance, but thus far hasn't made any progress in this department. However, the first two quarters of commercial production are too early to judge what the ultimate results from here will look like long-term.

(Source: Company News Release)

(Source: Company News Release)

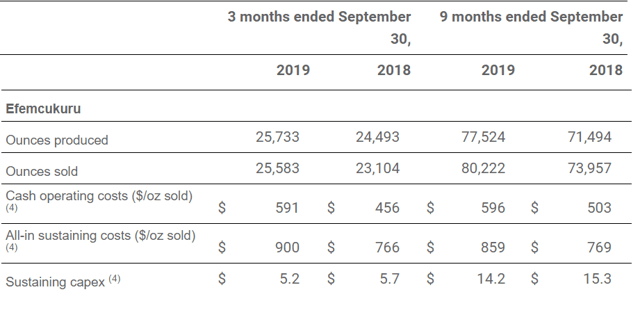

Finally, the company's Efemcukuru Mine contributed roughly 25% of the quarterly production and just over 30% of production year-to-date with slightly above 80,000 ounces. All-in sustaining costs are roughly 13% higher than last year despite lower sustaining capital in the same period. While still reasonable all-in sustaining costs at $859/oz, they are not nearly as attractive as the $769/oz reported in the first nine months of 2019. This is likely due to a slightly higher penalty rate for impurities at the mine.

(Source: Company News Release)

(Source: Company News Release)

So how has all of this impacted the company's growth metrics? Let's take a look below:

Taking a look at Eldorado's annual earnings per share [EPS], we can see that FY-2019 earnings estimates are currently sitting at $0.18. This would mark the first return to positive earnings per share after a net loss in FY-2018 of (-) $0.18. However, the market is most interested in FY-2020 and FY-2021, as the market is always forward-looking by twelve to eighteen months. FY-2020 annual EPS estimates are currently seeing forecasts of $0.87, which would translate to the company's highest earnings per share since FY-2015 ($0.35). If the company could hit these numbers, this would be a significant development, and new highs above the $10.00 level are undoubtedly possible.

The issue, however, is that analysts have FY-2021 estimates pegged at $0.54, a massive drop-off from the $0.87 expected to be reported next year. This is likely due to the company's three-year guidance outline, which shows significantly lower production at higher costs for FY-2021. While test results could favorably impact this at Kisladag or the expansion case at Lamaque, analysts remain conservative for now and are expecting a drop-off. Based on this, it significantly dampens the massive earnings growth for FY-2020. This is because the earnings growth is expected to be a one-off from the information we have currently.

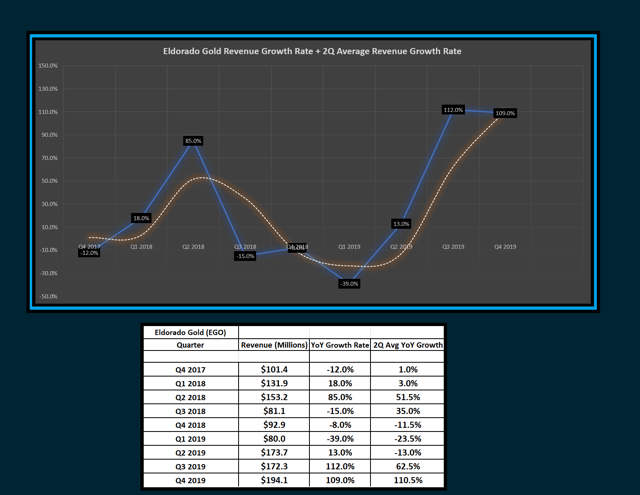

If we look at revenue growth rates, Q2 revenue came in slightly below estimates at $173.7 million for the quarter. This figure translated to a 112% increase year-over-year from Q3 2018's $81.1 million. However, it's worth noting that this was one of the worst quarters for the company in the past two years, and therefore Eldorado Gold was up against easy comparisons. To illustrate my point, the average trailing-twelve-month revenue going into Q3 2018 was $129.7 million, and Q3 2018 came in at $81.1 million. Therefore, when compared to the trailing-twelve-month average leading up to Q3 2018, it was a low revenue quarter. Based on this, we would expect a blow-out quarter for Q3 2019. Having said that, the revenue growth is a good sign, whether the company slightly missed on estimates or not.

Looking forward to Q4 2019, revenue estimates are currently sitting at $194.1 million, forecasting 109% growth year-over-year. If the company can meet or beat these estimates, this would string together two consecutive quarters of triple-digit sales growth, an impressive development. Investors are going to want to see a minimum of $185.8 million for Q4 2019 revenue to achieve two consecutive triple-digit growth quarters.

(Source: YCharts.com, Author's Chart)

(Source: YCharts.com, Author's Chart)

Based on earnings per share expected to grow substantially in FY-2020 and strong sales growth, the company is certainly more attractive than its been in recent years; hence my upgrade to a Market Perform for the stock. However, the one issue is that the company is going to need to deliver at Kisladag or Lamaque to fix the 2021 production drop-off. If neither Lamaque or Kisladag can bring up the rear and improve the current guidance of 350,000 ounces to 380,000 ounces for FY-2021, the strong FY-2020 Eldorado Gold should see will be a one-off. If guidance can't be fixed and they can't bring up the production numbers, FY-2021 would see a significant deceleration in sales growth and earnings, barring a massive move higher in the gold price to offset this.

While it's a positive sign that Eldorado Gold should be able to meet its 2019 cost and production guidance, I continue to see the stock as inferior compared to its peers. This is because the company operates out of tier 3 jurisdictions, except their Lamaque Mine in Quebec. Also, the company's long-term costs continue to remain 8% above the industry average of $900/oz, or 5% above if they can meet guidance. If a company has two inferior designations in the form of higher costs than peers and worse jurisdictions than peers, it cannot be labeled as a leader.

So how do the technicals look?

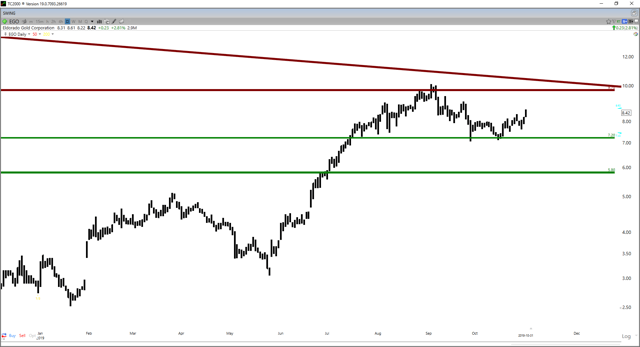

Eldorado Gold currently has short-term support at $7.20, with strong support at $5.80. As long as the bulls defend the $7.20 level on a weekly close, there's no reason to entertain a drop down to the $5.80 level. However, strong resistance lies overhead at $9.70 on a weekly close, and I continue to see this as a sticky spot for the stock into rallies. If I were long the stock and had bought the dip, I continue to see the $9.70 - $10.30 zone as a wise area to cash out, as I discussed in my previous article "Eldorado Gold: Time To Take Some Profits".

If Eldorado Gold can increase long-term guidance at Kisladag and deliver on their expected throughput increase at Lamaque, new highs above the $12.00 level are possible in 2020. However, we currently don't have clarity on either of these developments and until then, I view rallies to $9.70 to $10.30 as profit-taking opportunities. For now, I continue to see both gold majors and intermediate producer peers as more attractive.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts