Eldorado Gold Shocks Positively: Its Share Price Soars

Eldorado Gold unexpectedly changed its Kisladag development plans.

The heap-leach mining will resume in Q1, without the need to build the expensive mill.

Eldorado Gold should produce 390,000-420,000 toz gold this year and 520,000-550,000 toz gold next year.

With the improved cash flow and no Kisladag mill expenditures, a range of new options opens up for Eldorado Gold.

Shares of Eldorado Gold (EGO) jumped up by more than 25% early during Thursday trading hours, after the company prepared a positive shock. The company was long haunted by various problems, from technical issues at its Turkish Kisladag mine, to problems with the Greek government that denies granting permits for the Skouries mine, despite the fact that an arbitration ruled in Eldorado's favor. All of the negative developments pressured Eldorado's share price down over the last two years.

Data by YCharts

Data by YCharts

In 2018, Eldorado Gold lost more than 50% of its market value and the company had to make a 5:1 stock reverse-split. Eldorado's share price declined approximately by 80% since early 2017 and almost by 90% since the summer of 2016. However, there is some hope that a new uptrend has started today.

Eldorado Gold announced a surprising decision to resume heap-leach mining at its Kisladag mine. The mining operations at Kisladag were suspended earlier last year, due to declining recoveries. Eldorado made several studies and decided that a mill will be needed to improve the recoveries. The problem is that the CAPEX to build the mill was estimated at $384 million plus $136 million for pre-stripping and contingency. However, Eldorado held cash of only $293 million as of the end of 2018. It also has an undrawn credit line of $250 million at its disposal which means that the current cash position is very comfortable. On the other hand, on December 15, 2020, Eldorado's senior notes worth $600 million will mature.

Investing $500 million in the Kisladag mill construction while trying to refinance the debt of $600 million could be pretty complicated. This is why today's news that the heap-leach mining will be restarted (i.e. Eldorado will not build any mill at Kisladag) was welcomed with huge relief. According to Eldorado Gold's CEO George Burns:

The decision to restart mining and heap leaching at Kisladag is supported by improved heap leach recoveries and confirmed by a revised heap leaching plan developed in early 2019. The revised heap leaching plan results in favorable economics when compared to milling, without the risks associated with the construction and financing of a $500 million project.

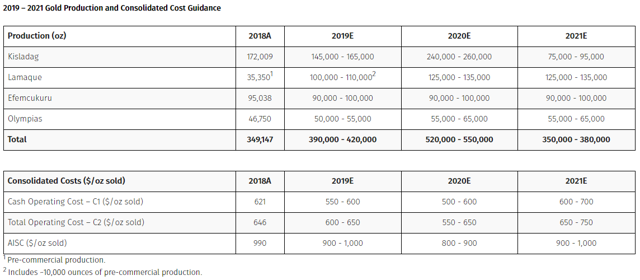

It seems that a significantly extended leach cycle delivers notably better recoveries. The original leach cycle of 90 days was expected to lead to 40% gold recoveries, while an extended 250-day cycle leads to 58% gold recoveries. The mining operations at Kisladag should resume this quarter and 145,000-165,000 toz gold should be produced this year. Further 240,000-260,000 toz gold should be produced next year and 75,000-95,000 toz gold in 2021.

Eldorado Gold also released some positive news related to the Lamaque mine. First gold was poured in December and commercial production is expected to be declared later this quarter. Lamaque should produce 100,000-110,000 toz gold this year and 125,000-135,000 toz gold in 2020, as well as in 2021.

Due to the positive developments at Kisladaq and Lamaque, the 2019 and 2020 production guidance is much better than expected only several days ago. The company is expected to produce 390,000-420,000 toz gold at an AISC of $900-1,000 in 2019. Even better results are expected in 2020 when the gold production should climb to 520,000-550,000 toz gold at an AISC of $800-900/toz. On the other hand, in 2021, the numbers should decline to 350,000-380,000 toz gold at an AISC of $900-1,000/toz.

If everything goes as projected and Kisladag doesn't disappoint again, Eldorado Gold should be finally on the way to get out of the problems. At a gold price of $1,250/toz (the gold price is $1,321/toz right now), Eldorado should be able to generate cash flow over $100 million in 2019 and even over $200 million in 2020. Together with the current cash position of approximately $290 million, some brand new options open up for Eldorado.

There is some potential that the $600 million debt could be completely repaid (or at least significantly reduced). Another option is to refinance (and/or partially repay) the debt and use the cash and undrawn credit line to fund organic growth (Certej or Skouries) or to make an acquisition (hopefully, not a too expensive one).

Conclusion

Eldorado Gold finally delivered some positive news. Although the radical change of the Kisladag development plans was unexpected, it is very good news. If everything goes well, Kisladag should generate significant cash flows over the next three years, without the need to expend more than $500 million on the mill construction. This decision significantly reduces the financial risks related to Eldorado Gold. The company should have enough time to reduce its debt-load and to focus on organic growth.

Parliamentary elections will take place in October in Greece and the opinion polls indicate that the Syriza party should be defeated by a wide margin. If a new business-friendly government grants all of the permits, the Skouries development may resume as soon as next year. Without the Kisladaq mill expenditures, Eldorado Gold should be able to finance the remaining $700 million Scouries CAPEX. It seems like Eldorado Gold has finally, although a little unexpectedly, turned the corner and better times are ahead for the company and its investors. However, after the setbacks experienced over the last two years, several good quarters are needed before it is possible to definitely conclude that the bad times are really over.

Disclosure: I am/we are long EGO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Peter Arendas and get email alerts