Eldorado Gold: The Path To Paradise Begins In Hell

Eldorado Gold released on January 31, 2019, a substantial production update that changed its fair valuation profoundly and outlook of the company from 2019 to 2020.

One crucial decision is undoubtedly the resolution to shelve the K????lada?? mill and resume mining instead.

EGO experienced Thursday a decisive breakout of the descending wedge pattern. EGO should improve substantially in 2019.

Image: Durante degli Alighieri (known as just Dante) "e quindi uscimmo a riveder le stelle." Source: Pinterest - Painter: Domenico Petarlini.

Image: Durante degli Alighieri (known as just Dante) "e quindi uscimmo a riveder le stelle." Source: Pinterest - Painter: Domenico Petarlini.

Investment Thesis

This article is an update to my preceding article on Eldorado Gold (EGO). The company is an enigmatic mid-tier Canadian gold miner with several international operations located in Brazil, Romania, Turkey, Greece, and more recently in Quebec, with its Lamaque mine which is about to be declared commercial the first quarter of 2019 with a production for the first year expected to be around 100k Oz of gold.

One highly controversial mine that has severely weakened the stock for almost a year now is the K????lada?? gold mine in Turkey and the exorbitant CapEx attached to a new mill that was considered necessary until now.

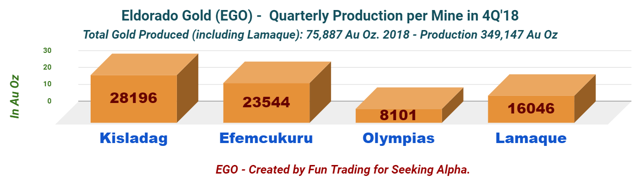

The company has released its production recently for the 4Q'18 and will soon release the year-end results. Most of Eldorado Gold's output comes from its two mines in Turkey, as the graph below is showing:

More importantly, Eldorado Gold released on January 31, 2019, a substantial production update that changed its fair valuation profoundly and outlook of the company from 2019 to 2020, which is the main topic of this article.

In light of these new elements, I believe the stock has found the support that justifies a much higher valuation, despite the lingering Greece issues, including permit delays for the Skouries mine and Olympias production. Problems remained though, and the company has not answered my question about the cash spent.

However, I believe EGO could eventually start a new trend up assuming a bullish gold price in 2019 and could even be an excellent acquisition candidate offering tremendous synergies as I suggested in my previous article.

Furthermore, management led by George Burns, CEO, seems to have paid heed to the harsh critics and finally realized that Eldorado Gold should focus on shareholder value:

The Company remains focused on shareholder value in its capital allocation decisions, taking into account the interests and expectations of all stakeholders.

Data by YCharts

Data by YCharts

Discussion about the news update including the decision to shelve the K????lada?? mill and other issues.

The news update released on January 31, 2019, is a piece of good news and alleviates most of the future financial hurdles which have darkened the future outlook of Eldorado Gold since October 2017 and earlier.

One crucial decision is undoubtedly the resolution to shelve the K????lada?? mill and resume mining instead.

the Company will resume mining, crushing, stacking and heap leaching at its Kisladag gold mine in Turkey. Advancement of the previously announced mill project has been suspended.

In my preceding article, I noted,

The decision came in October 2018 to go ahead and build a mill "as the operation transitions away from its heap leaching roots" with a total investment of $520 million including a mill cost of $384 million.

The Mill Project is expected to cost $520 million, including $384 million for the mill, $75 million for pre-stripping, and $61 million in contingency and growth allowance.

The heap leach mine in Turkey remained the company flagship operation until mining stopped abruptly in April 2018. Until last year, K????lada?? gold mine has provided a significant and steady cash flow since coming into production in July 2006.

The new update changes radically the mining strategy at the K????lada?? mine.

It is not necessary to enter the technical details because I am sure only a few can understand those nuances, but the fact is that $520 million in CapEx that was a huge burden financially has been eliminated and it "Lower[s] financing risks, as mining and heap leaching will not require external funding."

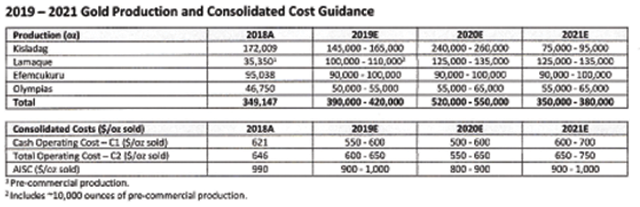

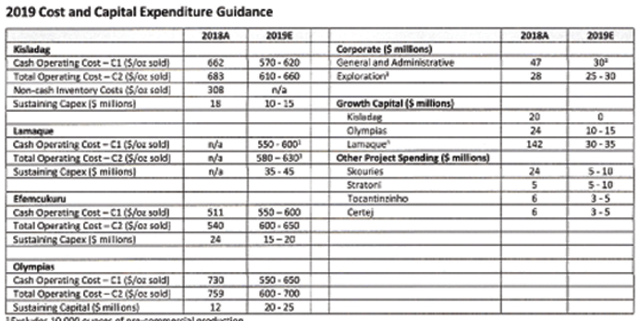

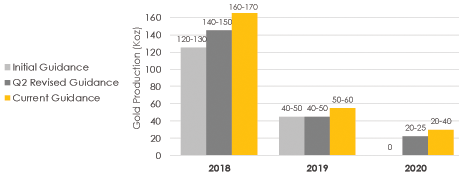

The immediate consequence is that mining will resume at the end of the first quarter and production guidance is now revised to a range of 145K Oz/165K Oz, which is much higher than the previous guidance of 50K-60K Oz in 2019, including the mill completed in 2020. The difference is even more remarkable for 2020 when EGO's previous guidance was 20K-40K Oz and is now a whopping 240K-260K Oz.

First guidance before the news update. Source: EGO Q3 revised guidance.

New guidance. Source: Eldorado Gold 01/31/2018

The issue raised by analysts is that we do not know what will happen after 2021 and if the mill is not coming back to haunt us? It is perhaps an issue, but it is much too early to discuss it now, in my opinion.

Lamaque is about to be declared commercial with a production of 100K-110K Oz in 2019 increasing to 125K-130K Oz in 2020-2021.

In 2019, Lamaque is expected to declare commercial production during the first quarter and is planning to mine and process over 500,000 tonnes of ore at an average grade of 7.0 grams per tonne gold. Production is expected to be 100,000-110,000 ounces of gold (including pre-commercial production), at cash operating costs of $550-600 per ounce of gold sold.

The good news is that guidance has been quite stable and the company may deliver on Lamaque expectation with great cash operating costs below $600 per ounce. On important indication about possible extra-cash spending at Lamaque is that:

The increase relates primarily to the purchase of certain pieces of mobile equipment as opposed to leasing, additional costs associated with underground development, further work on the existing tailings dam to increase storage capacity

Finally, the company said that the Sigma Mill capacity can be expanded to 5k TPD:

The recent exploration success at Lamaque has provided the opportunity to review options for increasing throughput at the Sigma Mill. The mill has a refurbished nameplate capacity of 2,200 tonnes per day and the potential to expand to its former capacity of 5,000 tonnes per day

In this case, I believe it is a good move from the company. The commerciality reached soon at the Lamaque mine is a massive step for the valuation of the mine and consequently for Eldorado Gold's fair value. It is quite surprising that despite this milestone within reach, the stock is still lingering below $5?

Greece is still a work in process. Olympias is not doing great with a potential non-cash impairment for the mine.

1 - Olympias mine

Production is an issue that the company has to resolve. However, Eldorado Gold "expects the variability in ore blending to stabilize at Olympias." and "Mining performance is expected to improve." However, this problematic ramp-up is coming with a potential impairment to be recorded soon.

As part of the Company's 2018 financial year-end, the valuation assumptions for Olympias are under review and there is a likelihood that an impairment charge will be recorded.

2 - Skouries mine

The mine has been placed on care and maintenance when the Greek Government refused (illegally?) to deliver routine permits last year. The costs of the C&M are "estimated to be $5-10 million per year for 2019, including $2-4 million of direct site costs and its portion of country overhead costs."

Please, read my previous article about the legal issue here.

The ongoing dispute is related to the metallurgical plant of Madem-Lakkos and the rejection by the Greek Minister of Energy (twice) of the technical study presented by Eldorado Gold.

However, Eldorado Gold has indeed claimed in September 2017 that the MoE cannot refuse technical approval to a project that was already environmentally approved. The issue is more political than anything else and will be resolved when the Syriza Government will be ousted in 2019.

However, it is essential to know that nothing is directly related to the two secondary installation permits that forced Eldorado Gold to put the Skouries mine in care & maintenance. Even so, the "flash smelting issue" was the reason behind it anyway:

Electro-mechanical installation permit Antiquities relocation permitNote: The antiquities relocation permit is not given by the MoE but by the Central Archaeological Council. The CAC has correlated its decision with the approval of the technical study for the metallurgical plant.

An important milestone will be achieved early February when the Council of State [CoS] will be reviewing the case and probably deliver another ruling in favor of Eldorado Gold.

The miner also initiated legal actions against the government in order to enforce and protect its rights in Greece. The measures include three lawsuits against minister Stathakis for failing to issue routine installation permits, which Eldorado said caused unjustifiable delays to the development of Skouries

3 - Romania Certej and Bolcana Project

These two projects are very controversial and will not be solved quickly.

I consider the situation in Romania against mining even worse than what is going on in Greece. However, after the recent decision to suspend the Permit PUZ, I thought that Certej was "dead in the water," but what the company said in this new update seems encouraging for the future.

In January 2019, the Company received notice that the Urban Zonal Permit (PUZ), originally issued in 2010 for the Certej project in Romania, was suspended. The Company will appeal after the reasoning behind the ruling has been received, which can take up to a month. This suspension is not expected to have a significant impact on development at Certej.

4 - Tocantinzhino mine

George Burns said in the conference call following the news update that Tocantinzhino mine is "shovel-ready-project" and indicated that the project is considered as a potential divestiture. The CFO Phillip Yee corroborated this opinion.

The question was raised in connexion with the $600 million note maturity issue and the fact that Kisladag mine future after 2021 is still uncertain.

Conclusion and technical analysis

This news update followed by a conference call was very positive and has been appreciated by the market. Perhaps Eldorado management slowly understands that communicating with the market and making timely decisions that are financially beneficial for the company and its shareholders are now the way to go and a condition sine qua non for the company's long-term success.

Yes, financial issues remain and the $600 million note due in December 2020 is something that will have to be solved. The company seems focused on paying off part of the debt and refinance the rest later.

However, the immediate situation offers some optimism, especially with the price of gold in a bullish trend.

Technical Analysis

EGO experienced Thursday a decisive breakout of the descending wedge pattern. With only one day trading, the new line support should be $3.50 and next line resistance is $4.50 (at which point I recommend selling part of your position assuming a profit). After a day like today, it is difficult to establish a new pattern, and we will need a few more day tradings to decide on the new investing/trading best strategy applied to EGO.

I am expecting more upside that will probably be triggered by some analysts upgrade too.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I am/we are long EGO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I mostly trade EGO

Follow Fun Trading and get email alerts