Electric vehicles, higher prices to boost global copper output - report

Global copper production will spike over the next decade as rising prices and increasing demand from the electric vehicles sector encourage project development, a new reports shows.

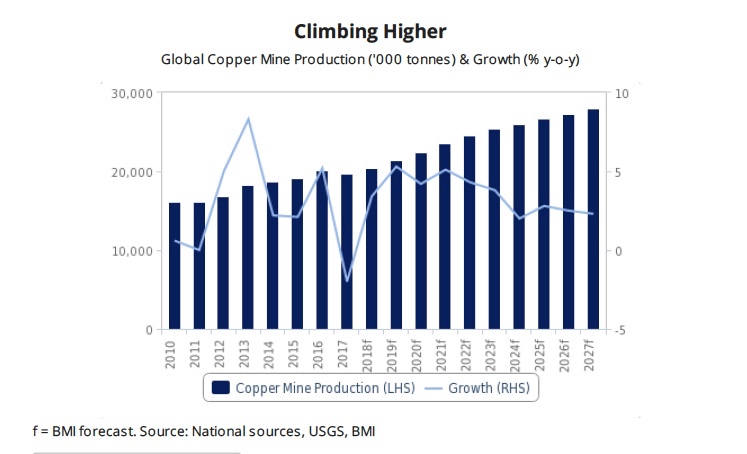

According to analysts at BMI Research, output for the red metal worldwide will grow an average annual rate of 3.6% over 2018 - 2027 thanks to a number of major projects come online, particularly in Peru and Australia.

As a result, the experts anticipate global copper output to climb from 20.4 million tonnes this year to 28 million tonnes by 2027.

Global copper output is expected to climb from 20.4 million tonnes this year to 28 million tonnes by 2027.Production in Chile, the world's top miner of the industrial metal, will return to growth in 2018, following a 4% contraction in 2017 due to strikes and operational disruptions, BMI expects.

The consultancy forecast Chile's output will increase from 5.4 million tonnes in 2018 to 6.6 million tonnes by 2027, averaging 2.3% annual growth as state-owned miner Codelco moves forward with key developments.

In January, the firm was granted environmental approval for the expansion project at El Teniente, which contributes the most copper to Codelco's production profile. The miner also submitted an environmental impact assessment for a $250 million- expansion at its Andina division.

In addition, mining giant BHP has begun working on a $2.5 billion expansion at its Spence mine, which extend the lifespan of the operation and increase production capacity.

Peru's copper sector growth will be supported by a strong project pipeline and competitive operating costs, BMI says.

The analysts expect the country's copper output to increase from 2.5 Mt in 2018 to 3.7 Mt by 2027, averaging 4.4% annual growth.

In 2017, MMG Ltd's Las Bambas mine produced 454 kt of copper in its first full year of production, however the firm expects production in 2018 to be between 410 - 430 kt due to lower ore grades as the mine is developed.

The report also highlights projects to come into production in China, the Democratic Republic of Congo and the US, all of which will add to global annual copper production numbers.

The report also highlights projects to come into production in China, the Democratic Republic of Congo and the US, all of which will add to global annual copper production numbers.

BMI's predictions are supported by a series of other recent studies that highlight the needs of the booming electric vehicles (EVs) sector.

An EV needs about four times more copper than a traditional ICE (internal combustion engine) vehicle, and as much as five times if the charging infrastructure is included.

Following those reports, just by shifting 10m unit sales per year of traditional cars into EVs by 2030 would create an additional copper demand of 100,000 tonnes per year. A more aggressive scenario of 25m EV sales per year sees that figure jump to over 300,000 tonnes.