Elon Musk's Nightmare Just Came True

So, has anything interesting happened to Tesla lately?

Unless you've been living under a rock, which might be a possibility given the pandemic climate we find ourselves trading in today, it's a safe bet that you've seen a story or two regarding the world's best hype man.

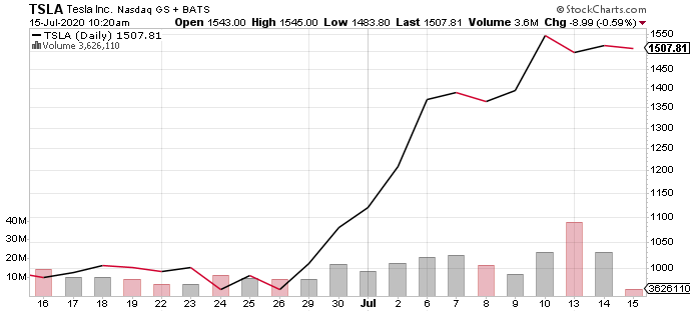

Tesla's stock move recently was nothing short of spectacular:

Was the move justified? Of course not.

The sentimental valuation spiked as nearly 40,000 Merry Men fanboys in Sherwood forest couldn't get enough of the stock.

After all, it's the popular bet these days, isn't it?

Why wouldn't they believe that?

Not long after the wild swing higher, some of Wall Street is screaming that Tesla's stock is going to move even higher. Piper Sandler boosted its price target to $2,322 earlier this week.

For the sake of the tulip holders at $1,794.99, let's hope the hype train finds a new round of suckers.

Just think, Tesla's market cap zoomed past $300 billion, surpassing Exxon's 2019 value, just pay no mind to the fact that Exxon generated almost 10 times more revenue than Tesla last year.

No, the sentimental traders expect to ride this "sure thing" to mars... again.

But will they? Maybe not.

You see, Elon has a secret.

In fact, it's one that has been hiding in plain sight for years.

And despite rocketing past of Warren Buffett on the billionaire's list, after the $6 billion uptick, he received last Friday, this recent stock leap should be utterly frightening for Musk.

Musk's public answer to this momentous stock move was a simple, "Wow."

Yet, his stoic, humble response is a far cry to the internal stress that is now most likely shaking him to his core.

For Elon Musk, the nightmare has just started.

Now he HAS to deliver.

The Best Free Investment You'll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

We never spam! View our Privacy Policy You'll also get our free report, "Lithium Outlook 2020: Bottoming Prices Signal a Bullish Future."Elon Musk's Nightmare Just Came True

Look, I want to believe too.

Musk's plan to build a plant in Shanghai to churn out Model 3 cars would directly tap into China's domination of the global EV market.

He even has some ambitious expansions goals here in the U.S.

Last month, Tesla snapped up about $5 million worth of land near Austin to set the stage for a new factory.

The company even got a nice $14.7 million in tax breaks from Travis County, Texas.

Pushing the current pandemic crisis aside, there are some legitimate reasons to be bullish on Tesla's future... maybe not enough to warrant shares costing $1,794.99 apiece, but I understand the growth potential.

So why is Musk secretly in such distress?

The elephant in the room that nobody wants to bring up is the extraordinary amount of energy metals that will be needed to build tomorrow's electric vehicles.

If the biggest investment in the energy sector over the last decade was tight oil, it's clear that the next 10 years will be ALL about batteries -- and the energy metals they're made of!

Here's how just a few of the essential ingredients to building batteries will perform between now and 2030:

Musk knows this, and it's the reason why Tesla and automakers around the world are each making strong transitions toward all-electric fleets -- and desperately trying to secure their own supplies of these resources.

Most investors can tell me what Elon's latest tweet was, yet they had no idea that Tesla inked a crucial long term deal, a few weeks ago to buy cobalt from Glencore directly.

Not only will more companies follow Tesla's lead, but it's one of the best ways that individual investors like us can take advantage of Musk's growing addiction.

What's your next step?

Until next time,

Keith Kohl

A true insider in the energy markets, Keith is one of few financial reporters to have visited the Alberta oil sands. His research has helped thousands of investors capitalize from the rapidly changing face of energy. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital as well as Investment Director of Angel Publishing's Energy Investor. For years, Keith has been providing in-depth coverage of the Bakken, the Haynesville Shale, and the Marcellus natural gas formations - all ahead of the mainstream media. For more on Keith, go to his editor's page.

@KeithKohl1 on Twitter

@KeithKohl1 on Twitter