Endeavour Silver: In The Medium Term, Just An Option On Silver/Gold Prices

Endeavour Silver plans to increase production and cut costs this year.

In my opinion, it can be difficult to meet 2018 production guidance.

I believe that the company's shares are fairly valued now; as such, they are simple options on silver/gold prices and nothing more.

However, in the long term the company's value depends on the Terronera project.

On January 25, 2018, Endeavour Silver (EXK), a silver/gold producer, released production and cost guidance for 2018. After a tough year 2017, this year the company plans to increase its metal production and improve financial results. Let me discuss Endeavour's plans.

2017 results

Last year Endeavour produced fewer metals than in 2016:

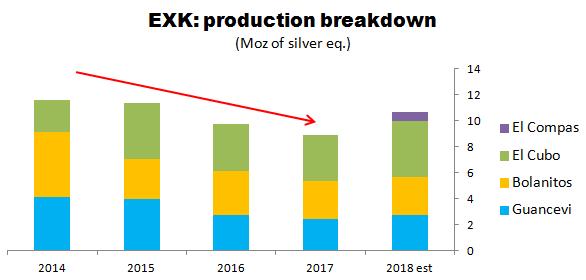

Silver production went down from 5.4 million ounces in 2016 to 4.9 million in 2017 Gold production went down from 57.4 thousand ounces in 2016 to 53.0 thousand in 2017The chart below shows historical production using the silver equivalent approach (for comparison reasons, gold ounces produced by the company have been recalculated into silver ounces):

Chart 1

Source: Simple Digressions

2018 guidance

As Chart 1 shows, between 2014 and 2017 the company's production has been going down. However, this year Endeavour plans to increase production and cut costs of production. For example, production should go up from 8.9 million ounces of silver equivalent to 10.2 - 11.2 million. What is more, an all-in sustaining cost of production is supposed to go down from $17.7 per ounce of silver during the first nine months of 2017 to $15.8 in 2018.

Note: the company reports its costs using a by- and co-product costing method. Due to the fact that Endeavour produces comparable amounts of silver and gold, I have chosen the co-product method as a more appropriate approach.

Now, it looks like many investors are betting on Endeavour Silver this year.

Let me check whether their expectations are rational. To do it, I will look at El Cubo, the mine standing behind the largest expected growth in production. Then, applying a few simplified assumptions, I will calculate free cash flow to be delivered by the four operating mines.

Production breakdown

The table below gives a breakdown of the production figures:

Table 1

Source: Simple Digressions and Endeavour Silver

Note: production figures for 2018 are disclosed at their average values

As the table shows, this year Endeavour plans to increase production by 1.8 million ounces of silver equivalent. The largest increase should be attributed to the El Cubo mine (0.8 million ounces) and a new project, called El Compas (0.7 million).

El Cubo - grades and head grades

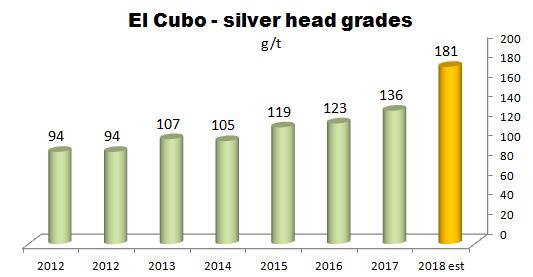

Now, according to Endeavour, this year El Cubo is supposed to process 1,300-1,450 tons of ore per day and produce 4.2-4.5 million ounces of silver equivalent. I have made a few simple calculations and found out that the company plans to increase the average silver head grade from 128 grams of silver per ton of ore reported during the first nine months of 2017 to 181 g/t in 2018 (assuming the average silver recovery of 87.8%). Well, it is a huge surge in grades, compared to previous years:

Chart 2

Source: Simple Digressions

The company explains:

At El Cubo, mine production and plant throughput will also continue steady at 1,400 tpd from the V-Asunci??n, Dolores, and San Nicolas veins. Ore grades should increase considerably as a higher grade area of the V-Asuncion orebody is scheduled for mining this year. Metal recoveries should rise incrementally after modifying the flotation circuit late last year"

I have looked into the technical report for El Cubo and found that the veins the company is referring to are located as follows:

San Nicolas Vein traversing El Cubo from East to West Dolores, Dolores Alto and Desp. Dolores in the Dolores Vein System Asuncion in the Villapando South AreaThese veins are one of the highest-grade veins at El Cubo. According to the technical report, they contain the following amounts of silver:

Resources: 52.8 thousand tons of ore grading 260 g/t (440.9 thousand ounces of silver) Reserves: 50.8 thousand tons of ore grading 178 g/t (290.4 thousand ounces of silver)Note: mineral resources are estimated exclusive of mineral reserves.

So, yes, if Endeavour is mining in the above-listed zones, the grades look much higher than in the past.

However, there is a problem because in order to arrive at head grades (the grades at the processing plant) a recovery rate has to be applied. According to the technical report for El Cubo, a model recovery rate is 87.8%. As a result, the head grade should stand at 156.3 g/t (178 g/t x 87.8%), which is well below 181 g/t assumed by the company (look at Chart 2). So it looks like Endeavour is overly optimistic about high grades at El Cubo, at least when mineral reserves are concerned.

What about mineral resources? The average grade at which the ore is to be extracted at high-grade zones (listed above) is 260 g/t. However, this grade does not take into account dilution factors (and, as in the case of reserves, recovery rate), which are extremely important as far as epithermal deposits are concerned. According to the table 15-3 (technical report for El Cubo), the average dilution factor applied to mineral reserves is 30%. Applying this figure to mineral resources, I can very easily arrive at the average head grade of 159.8 g/t (260 g/t x dilution factor of 30% x silver recovery of 87.8%). So the ore fed from the zones defined as mineral resources should grade 159.8 g/t at the mill, which is only slightly above the average head grade calculated for mineral reserves.

Summarizing - I think that the company's management could be too optimistic when releasing production guidance for 2018. Hard figures stand behind more pessimistic development and if I am correct this year the El Cubo mine could have delivered 2.1-2.4 million ounces of silver instead of 2.5-2.7 million projected by the company. Note that my estimates are also optimistic because I assume that other zones report similar high grades as the veins listed in the beginning of this section.

Applying the same methodology as in the case of silver grades, I have arrived at gold production of 18.3-20.5 thousand ounces of gold attributable to 1.3-1.5 million of silver equivalent (gold/silver ratio of 75:1).

Summarizing - in my opinion, this year the El Cubo mine is supposed to deliver not more than 3.5-3.9 million ounces of silver equivalent instead of 4.2-4.5 million estimated by the company.

Free cash flow

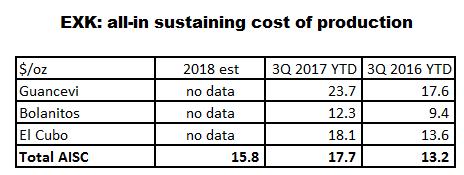

Apart from higher production, this year Endeavour plans to cut costs of production significantly. Let me take an all-in sustaining cost of production as an example. The table below lists these costs:

Table 2

Source: Simple Digressions

Note: the costs depicted in the table above were calculated using a co-product approach

Unfortunately, the company has not disclosed the costs estimates attributable to each mine. The only data we have is the total cost, which should be reduced from $17.7 per ounce of silver during the first nine months of 2017 to $15.5-16.0 ($15.8 on average) in 2018 (a decrease of 10.7%).

Now, taking the following assumptions:

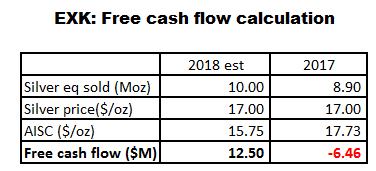

The average price of silver: $17.0 per ounce All metals produced are going to be sold Production at Guancevi, Bolanitos and El Compas set at average figures declared by the company Average production at El Cubo - 3.7 million ounces of silver equivalent Total 2018 production: 10.0 million ounces of silver equivalent The average AISC of $15.75 per ounceI can calculate free cash flow to be delivered by the company in 2018. Here is the appropriate formula:

Free cash flow = (silver price - AISC) x silver eq. produced

And here are the results:

Table 3

Source: Simple Digressions

As the table shows, this year Endeavour should generate a free cash flow of $12.5 million.

For comparison reasons, using the actual production data for 2017 and the same price of silver as that applied for 2018 ($17.0 per ounce), I have arrived at the 2017 free cash outflow of $6.5 million. It means that this year we should see significant improvement, compared to 2017 (free cash flow of $12.5 million vs. an outflow of $6.5 million in 2017).

However, there is another question - is free cash flow of $12.5 million large enough to validate an investment in Endeavour Silver shares? Let me make a final and very simplified calculation of the company's value.

Using a discount rate of 5% and assuming that this year's free cash flow will be repeated next year and then into infinity (yes, I know it is a very simplified approach) I have arrived at the company value of $250M (free cash flow of $12.5 million divided by a discount rate of 5%).

Now, keeping in mind that at the end of September 2017 (the latest data available) the company held cash of $44M and debt of $2M, the theoretical value of Endeavour's equity is $292M or $2.29 a share.

Today the company's shares are trading at $2.23; so, generally, they are fairly valued. In other words, it looks like Endeavour's potential is not attributed to current operations (unless the management is able to improve them significantly) but somewhere else. In my opinion, it is the Terronera project that should unlock the company's value in the coming years (Endeavour plans to put it online in 2019). However, it is a subject for another article.

Summary

In my opinion, this year Endeavour is going to produce 10.0 million ounces of silver equivalent instead of 10.7 million estimated by the management. As I discussed above, the grades at El Cubo, a main growth factor, should be below the company's estimates. Hence, lower production.

What is more, it looks like Endeavour's shares are fairly valued now. It means that a short or medium-term investor purchasing these shares acquires an option on silver/gold prices. In other words, the company's short or medium-term value depends only on the prices of silver and gold.

However, I think that Endeavour's long-term potential should be unlocked when the Terronera project is online (2019).

Did you like this article? If yes, please, visit my Unorthodox Mining Investing section where I manage a portfolio of up to ten mining picks, discuss new investment ideas and provide my subscribers with a medium-term outlook on a few financial markets (particularly the base/precious metals market). Most recently I have introduced a new section called "Developers." This service is dedicated to mining companies planning to open new mines within one or two years.

Disclosure: I am/we are long GDX, CEF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.