Endeavour Silver: Waiting For Savior, Waiting For Terronera

Endeavour Silver performed poorly in Q1, as its AISC increased well above the current silver price.

The Terronera mine should be highly profitable at the current metals prices.

Terronera should help Endeavour Silver to survive the current period of weak silver prices.

The sizeable silver resources and high-cost operations provide significant leverage to growing silver prices, while Terronera provides downside protection, turning Endeavour into something like a call option on silver, with an expiration of at least 14-15 years.

Endeavour Silver (EXK) is facing hard times right now. The silver prices remain weak, which, in combination with high production costs caused by some operational issues, lead to poor financial results. If the silver price doesn't improve, the hard times will last for the foreseeable future. The market reaction is understandable and Endeavour's share price is close to its 2015-2016 lows.

Data by YCharts

Data by YCharts

However, there seems to be a savior on the horizon. Its name is Terronera. Terronera is Endeavour's silver-gold project that is fully permitted and with a little luck, the mine construction could start by the end of this year. After it reaches production (the mine construction should take 18 months), it should boost Endeavour's production by more than 50%. Moreover, it should be highly profitable also at the current metals prices, with AISC projected at $1.36/toz silver or $8.35/toz of silver equivalent.

The current state of Endeavour Silver

Endeavour Silver has four operating mines (Guanacevi, El Compas, Bolanitos, EL Cubo). All of them are located in Mexico. But they don't do very well right now. The biggest one of the mines is Guanacevi. In Q1 2019, it produced 549,184 toz of silver equivalent (458,144 toz silver and 1,138 toz gold), at an AISC of $27.56/toz silver. At a gold price in the $15-16/toz range, this result is a disaster. However, things should improve in the coming quarters, as new high-grade ore should start to be mined. The 2019 Guanacevi production is projected at 3-3.4 million toz of silver equivalent which means that the Q2-Q4 production should average at 817,000-950,000 toz of silver equivalent per quarter in order to meet the guidance. Of course, with higher production, the AISC should decline. However, it is only to be seen how much.

The Bolanitos mine encountered operational issues as well. Higher arsenic levels forced Endeavour to re-sequence the mine plan which resulted in a lower production volume. However, the operations should revert back to plan by the end of Q3. Only 196,010 toz silver and 4,430 toz gold were produced in Q1. The AISC climbed to $16.36/toz silver.

The El Cubo mine reduced its throughput rate by 50% in Q1, as the reserves are nearing depletion. However, the company is working on expanding EL Cubo mine life. In Q1, the mine produced 413,983 toz silver and 4,145 toz gold, at an AISC of $11.43/toz silver.

The El Compas mine started production in late 2018. But the ramp-up wasn't too smooth. The mine was shut down for 7 weeks due to the mill failure. However, it seems like the problems have been overcome and commercial production was reached in March. As a result, the El Compas Q1 results are not too impressive, producing only 100,000 toz silver and 10,000 toz gold. However, the mine should be fully contributing to Endeavour's results from Q2 on. The 2019 production is projected at 0.8-1 million toz of silver equivalent.

Various issues and low metals prices resulted in poor Q1 financial results. The overall production was only 1,071,355 toz silver and 10,055 toz gold. The revenues declined to $29.1 million. Mine operating cash flow decreased to $4.6 million and the company recorded a net loss of $13.3 million (or $0.1 per share). According to Brad Cooke, Endeavour Silver's CEO:

We experienced a challenging start to the year in operations, with no improvement of the systemic issues at Guanacevi and unexpected events such as the seven-week shut-down at El Compas due to a mill failure. However, Endeavour management has dealt with similar issues before, we successfully cut costs across the board to address similar operational and economic challenges in 2008 and 2013. The Company emerged financially stronger and more profitable as a result.

Although the current operations underperformed in Q1, the situation should improve in the coming quarters. However, if the silver price remains low, it is hard to expect any spectacular profits.

Source: own processing, using data of Endeavour Silver

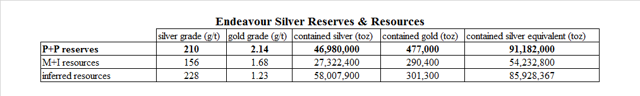

Despite the current issues, Endeavour Silver holds sizeable silver and gold reserves and resource. The overall company-wide reserves include 46.98 million toz silver and 477,000 toz gold, which equals to 91.182 million toz of silver equivalent at the current metals prices of $15/toz silver and $1,390/toz gold. Moreover, in addition to reserves, there are also measured and indicated resources (not including reserves) of 54.233 million toz of silver equivalent and inferred resources of 85.928 million toz of silver equivalent.

The current high-cost operations provide high leverage to growing silver prices. However, Endeavour Silver needs to endure the current low-price environment. And here comes Terronera that should be highly profitable at the current metals prices and that should become Endeavour Silver's cornerstone asset in the near future.

The Terronera Project

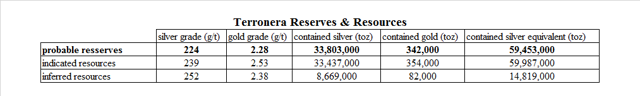

The Terronera Project is located in Mexico, near Puerto Vallarta. The deposit contains reserves of 33.8 million toz silver at a silver grade of 224 g/t and 342,000 toz gold at a gold grade of 2.28 g/t. According to the resource and reserves estimate that used gold-silver ratio of 75, the volume of contained silver equivalent equals 59.453 million toz. However, at the current metals prices of $1,390/toz gold and $15/toz silver, it is 65.5 million toz of silver equivalent.

Source: own processing, using data of Endeavour Silver

Source: own processing, using data of Endeavour Silver

Besides reserves, there are also indicated resources that contain 33.44 million toz silver at a silver grade of 239 g/t and 354,000 toz gold, at a gold grade of 2.53 g/t. The silver equivalent equals 60 million toz (or 66.2 million toz at the current metals prices). And there are also inferred resources that contain 8.7 million toz silver and 82,000 toz gold, or 14.8 million toz of silver equivalent (16.27 million toz at the current metals prices).

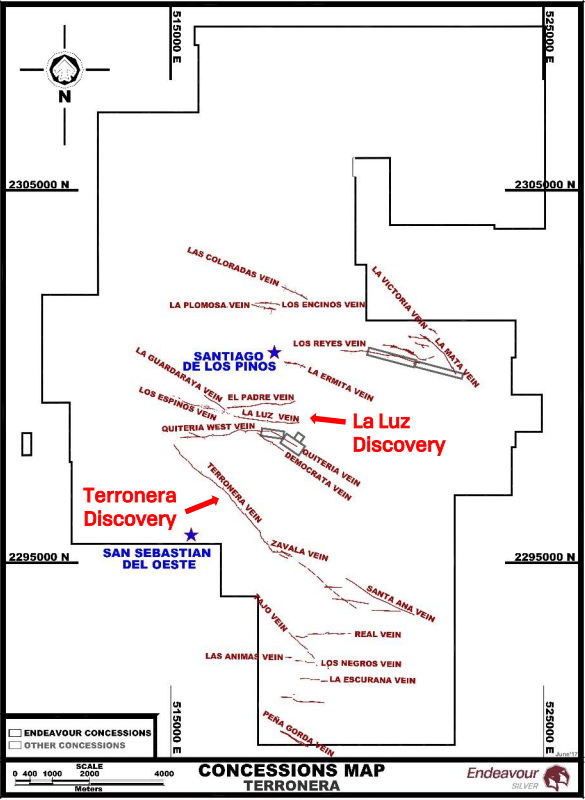

Source: Endeavour Silver

Source: Endeavour Silver

As can be seen in the map above, the Terronera property is full of known silver veins. According to Endeavour Silver, there used to be 50 mines that extracted silver from 20 known veins. Despite it, Endeavour is still able to find more veins and grow the resources. It means that there is a chance for further discoveries on the property.

The Terronera mine should be developed in two stages according to the 2018 updated PFS. The first stage will have a throughput rate of 750 tpd. In year 3, it will be expanded to 1,500 tpd. As a result, Endeavour was able to keep the initial CAPEX at a very reasonable level of $75.8 million. The average annual production should be around 2.9 million toz silver and 28,000 toz gold, or 5.1 million toz of silver equivalent, over initial 12-year mine life. What is important, the AISC should be only $1.36/toz silver or $8.35/toz of silver equivalent. At a silver price of $17/toz and a gold price of $1,275/toz, the after-tax NPV(5%) equals $117.8 million and the after-tax IRR equals 23.5%. Although the current silver price is lower compared to the updated PFS base-case scenario, the gold price is higher enough to compensate for it.

If everything goes well, Terronera should get into production sometime in 2021. The mine construction hasn't started yet, but a major hurdle was overcome only several weeks ago. On June 18, Endeavour Silver received the final permits for the Terronera mine. According to the company:

Now that the Terronera mine project is fully permitted, Endeavour Silver plans to complete a final improved prefeasibility study in the 3rd quarter and arrange appropriate financing to build Endeavour's next core asset. Following an estimated eighteen month construction period, the Terronera mine is expected to produce more than 5 million oz silver equivalents (at an 80:1 silver:gold ratio) over a minimum 12 year mine life, at an all-in sustaining cost per oz of silver produced in the lowest quartile of industry peers.

The Risks

There are several risks related to an investment in Endeavour Silver. First of all, the current mining operations are losing money at the current silver price. In Q1, at a realized silver price of $15.5/toz and gold price of $1,315/toz, Endeavour generated a net loss of $13.3 million and mine operating cash flow before taxes of $4.6 million. The AISC climbed to $19.37/toz silver. If the 2019 production guidance should be met, the remaining three quarters should be better, but it is only to be seen how much better. The future of the company is Terronera. If its development somehow fails, the company will get into huge trouble (barring a strong precious metals bull market).

Although the Terronera project looks good, it is a little disturbing that Endeavour decided not to make a feasibility study. It prepared a PFS and an updated PFS and now it works on a final updated PFS. Although it doesn't have to be a problem, there were several companies that skipped some of the typical stages (PEA - PFS - FS) in order to quicken the whole development process and things didn't end up well.

Another problem is project financing. According to the latest corporate presentation, Endeavour wants to secure a $50-million debt financing. But as of the end of Q1, it held cash and cash equivalents worth only $21.8 million. The good news is that the company is virtually debt-free. As of the end of Q1, the long-term debt stood at $1.83 million. It means that securing the debt financing shouldn't be a problem. The bad news is that even if Endeavour somehow manages to stabilize the current operations, it is hard to expect the company to generate meaningful cash flows at the current silver prices. It means that debt of $50 million won't be enough. In order to create a safety buffer, Endeavour should raise at least $70-80 million. Moreover, the final PFS will probably provide a different initial CAPEX. It can be lower but it can be also higher.

Conclusion

Endeavour Silver is a risky bet on higher silver prices. Given the high production costs of its mines, its share price has high leverage to growing silver prices. On the other hand, at the current metals prices, the Terronera mine should be able to generate annual cash flows around $40 million on average. At a relatively conservative 6x multiplier, Terronera alone justifies current Endeavour's market capitalization of $257 million. Not to mention the other producing assets and exploration projects. It means that thanks to Terronera, Endeavour's downside risk is pretty limited (assuming that the Terronera financing and development don't bring any negative surprises). As a result, Endeavour Silver is something like a call option on silver, with a 14-15 year expiration at least. As the Terronera project clears next hurdles (the final PFS and the financing), Endeavour's share price should react favorably. If also the other operations start to improve and the silver price starts to collaborate, the gains may be really high.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in EXK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Peter Arendas and get email alerts