Equinox Gold Corp: Undervalued Gold Miner Playing Catch-Up To Peers

Equinox Gold is at an earnings inflection point with commercial production of the Aurizona mine in July likely leading to a positive earnings spike in Q3 2019.

The company is materially undervalued relative to peers, with upcoming U.S. listing a catalyst for shares to rerate higher.

Equinox is guiding 200-235,000 oz in 2019 production at an all-in sustaining cost of $900-950 per oz, with 450,000 oz per year of potential gold production built into existing assets.

Summary

Equinox Gold (OTCPK:EQXFF) is a mid-tier gold miner whose assets consist of the Aurizona Mine ("Aurizona") in Brazil, the Mesquite Mine ("Mesquite") in the United States, and a development-stage project in the Castle Mountain Mine ("Castle Mountain") in California. Equinox has the potential to produce more than 450,000 ounces of gold per year from its existing asset base. For 2019, the company is guiding 200-235,000 oz of production at an all-in sustaining cost (AISC) of $900-950/oz (vs. gold spot price of +$1500/oz).

Formed through a three-way merger between Anfield Gold, NewCastle Gold, and Trek Mining, Equinox has significant financial backing from deep-pocketed investors like Ross Beaty (who is chairman of the board), Sprott, the Abu Dhabi sovereign wealth fund Mabadala Investment, and Sandstorm Gold (SAND).

I became familiar with Equinox through my research into the Aurizona asset as a SAND shareholder, a position I've since sold for a 78% return over a two-year holding period.

Company financials

(All dollar amounts in USD unless otherwise specified).

Share price: $1.13 per share Shares outstanding: 553,436,166 (712mm fully diluted after accounting for convertible debt) Market capitalization: $637.9mm Enterprise value: $890mmWhy is there an opportunity?

Precious metals - and miners in particular - have largely been neglected by institutional investors. Until recently, the global consensus was that interest rates would continue to rise with central banks raising rates and quantitative tightening. A rising rate environment would've put pressure on gold prices, as gold is an asset that pays no coupon and earns nothing.

In the past year, however, interest rates have plummeted amidst slowing global growth, leading to a 20% spike in gold prices and a run-up in gold mining stocks. To add fuel to the fire, there are now over $16 trillion dollars worth (and climbing) of negative-yielding debt around the world, amidst historically expensive equity and bond valuations, and a recession on the horizon. At this point, the zero percent expected return of gold starts to look mighty attractive relative to the negative real returns investors would likely find anywhere else.

Estimating the value of Equinox assets

1. Aurizona mine restart (in production)

2019 production guidance: 75-90,000 oz 2019 AISC: $950-$1,025/oz soldThe history of the Aurizona mine in northeastern Brazil is a lesson in the perils of investing into a cycle peak. Aurizona was an active open-pit mine operated by Luna Gold (later renamed Trek Mining) from 2010 to 2015, right as gold prices hit their peak of +$1,800/oz in 2011, before collapsing to under $1,100/oz, effectively shuttering the Aurizona mine as a going concern. In August 2017, a combined company under Equinox Gold launched a mine restart plan following a feasibility study that estimated 970,000 oz of proven and probable reserves with gold prices at $1,250 (compared to +$1,500/oz today).

For valuation purposes, I'll use a conservative estimate of actual reserves (800,000 oz), and assume Aurizona is mined to depletion within 8 years at a $1,400 per oz average realized gold price. Based on those assumptions, I estimate the after-tax annual cash flows of Aurizona to be between $30-35mm.

Applying a 7% discount rate gives us a rough NAV estimate of $180-210mm for Aurizona.

2. Mesquite mine (in production)

2019 production guidance: 125-145,000 oz 2019 AISC: $930-$980/oz soldEquinox acquired the Mesquite mine in late 2018 from New Gold Inc (NGD), financing the acquisition with a combination of debt and equity for a total of $158mm. In 2019, proven and probable reserves amounted to roughly 1 million ounces.

Again, assuming 8 years to depletion, with no further exploration upside or mine life extension at $1,400 realized gold prices - would give us after-tax cash flows of $40-45mm, or a rough NAV estimate of $240-270mm for the Mesquite mine.

3. Castle Mountain (Phase 1 production set for Q3 2020)

According to Equinox's estimate, the company intends to put the Castle Mountain mine back into production with the expectation of producing 2.8 million oz of gold and generating US$865 million in after-tax cash flow over a 16-year mine life - or roughly $54mm per year.

Now, let's factor in potential operational challenges and delays between now and Phase 1 production scheduled for Q3 2020, and discount those cash flows by a higher project WACC of 10%. This give us a NAV estimate of 420mm.

Valuation

| Asset Name | Estimated after-tax cash flows (assuming $1,400/oz gold price) | NAV | NAV per share |

| Aurizona (7% discount rate) | $30-35mm | $180-210mm | $0.25-0.30 per share ........................ |

| Mesquite (7% discount rate) | $40-45mm | $240-270mm | $0.34-0.38 per share |

| Castle Mountain (10% discount rate) | $50-54mm | $420mm | $0.59 per share |

| Total Equinox value: | $120-134mm | $810-900mm | $1.18-1.27 per share |

Adding up all the NAV estimates for each assets gives us a NAV per share for Equinox of between $1.18-1.27, which means based on Equinox stock is trading at 0.90-0.95x book value. Keep in mind: this valuation is based on conservative reserve and production estimates, assuming all assets are mined to depletion, while NOT accounting for any exploration upside, mine life extension, or any future acquisitions made by management, all three of which are in Equinox's plans.

In fact, Equinox has an ambitious goal of growing production to 1 million oz of annual production by 2023 - over double their potential production based on its current assets.

In other words, even if gold prices were to settle at $1,400/oz long term, the downside risk would be minimal considering that Equinox is currently trading below book value. At the same time, investors get free call options on the following:

Exploration upside of its existing assets Management's ability to successfully scale production through acquisitions Gold prices staying near today's levels (~$1,500/oz) or moving higherCatalysts

There are a number of potential catalysts over the next year that could drive Equinox shares higher to better account for its growth potential.

1. Operating earnings are set to inflect in Q3 2019 once Aurizona mine production appears on Equinox financials. As of the Q2 2019, only around 7,000 oz of Aurizona production were accounted for in June 2019.

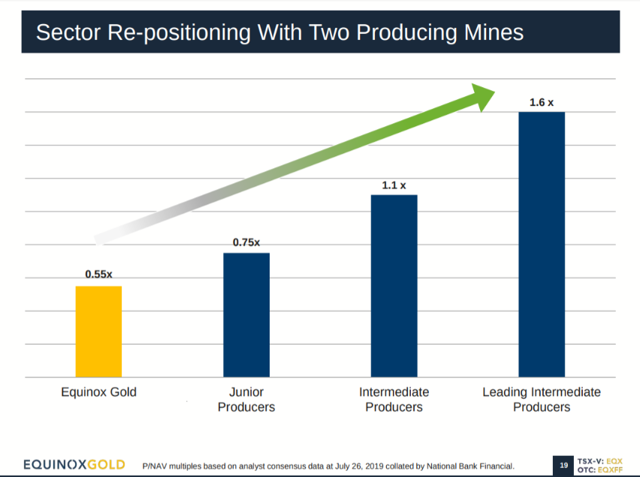

2. Equinox's valuation is playing catch-up to comparable mid-tier gold producers. The market has been slow to account for Equinox's rapid, two-year transition from a single-asset gold mine developer to a mid-tier producer with 250,000 oz/year of existing gold production.

Source: Equinox investor presentation

3. Equinox's planned share consolidation to pursue U.S. listing in 2H 2019 will likely attract a new investor base, especially as precious metals is slowly gaining traction again amidst a world awash with negative yielding debt.

4. Management ability to grow cash flows over time through acquisitions. Equinox Gold shareholders are getting the experience and investing prowess of Ross Beaty thrown in for free, whose track record should be familiar to long-time followers who profited from my Alterra write-up.

Conclusion

As of this writing, I've accumulated a mid-sized position in Equinox Gold at an average cost basis of $1.20 CAD (or $0.90 USD at current exchange rates). With the 10-year U.S. treasury rate sitting below 1.60%. which, in my view, is grossly overbought, I expect gold to give up some gains in the short term. If this happens, I'll be using the opportunity to add to Equinox until it represents a 10% stake in my total investment portfolio.

Disclosure: I am/we are long EQXFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Ivan K. Wu and get email alerts