Equity markets sour on junior mining sector - report

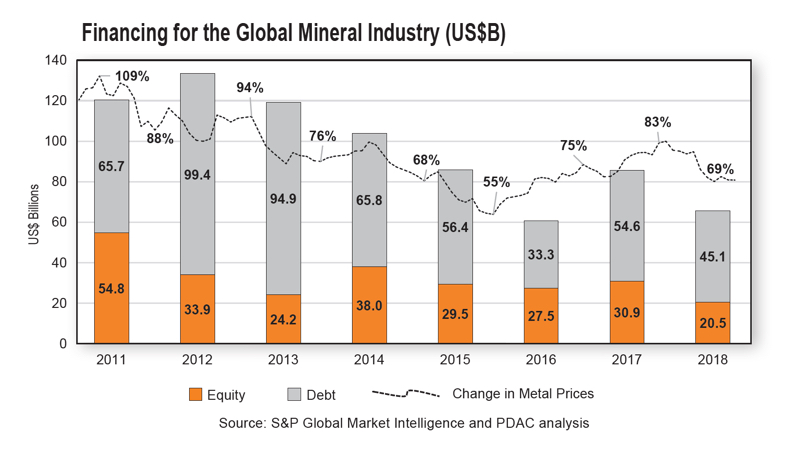

Financing for global mining and exploration lost momentum in 2018 with equity markets in particular shunning the metals and minerals sector according to a report released on the eve of mining's biggest annual gathering in Toronto, Canada.

State of Mining Finance 2019, produced by the Prospectors & Developers Association of Canada (PDAC) and junior financing tracker Oreninc, paints a grim picture of mining and exploration companies' ability to attract capital, citing metal price weakness last year as a main driver behind the decline.

Source: State of Mineral Finance 2019

Mineral industry equity financing in 2018 dropped by nearly 35% from a year earlier to establish a new decade low for both total value raised and number of transactions completed according to the report titled At a Crossroads.

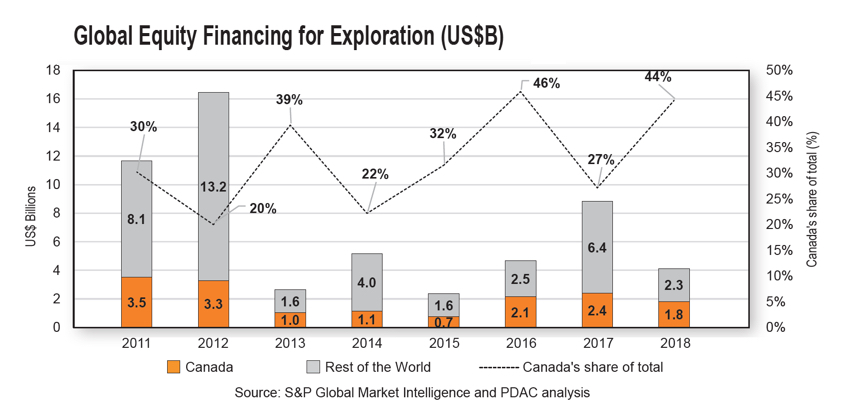

While funding earmarked specifically for exploration remained above the lows of 2013 and 2015, it more than halved last year to $4.1 billion. That's also less than 1/4 of the peak hit in 2012.

Source: State of Mineral Finance 2019

Nothing ventured nothing gained

Toronto's stock exchanges managed to bump its share of global exploration capital raised to 44%, but juniors hoping to raise money on the TSX and TSX-V found it tough going.

The value of equity raised by juniors on the TSX and TSX-V decreased by 58% and 23% in 2018 respectively. A drop in the number of transactions to 83 from 151 on the TSX and on the TSX-V to 885 from 1,178 also suggest a narrower distribution of funds across market participants.

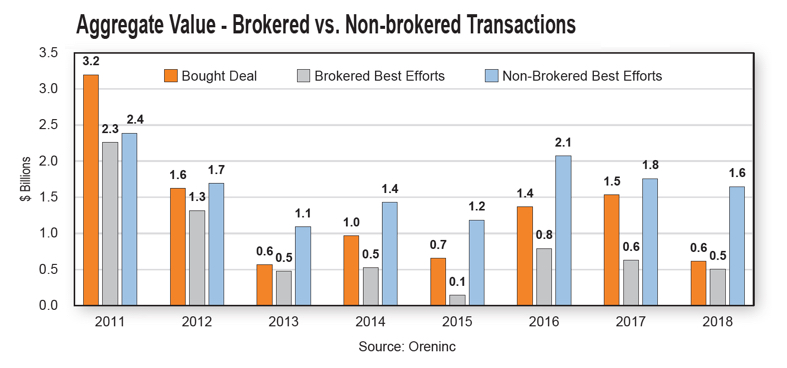

Most concerning for the industry is the 60% year-over-year drop in bought-deal financing for junior explorers to just $600m in 2018 from $1.5 billion the year before.

This is the lowest figure recorded in a decade and since bought deals inherently exposes underwriters to high levels of risk it "hints at a lack of sector confidence by large brokerages," according to the authors.

Source: State of Mineral Finance 2019