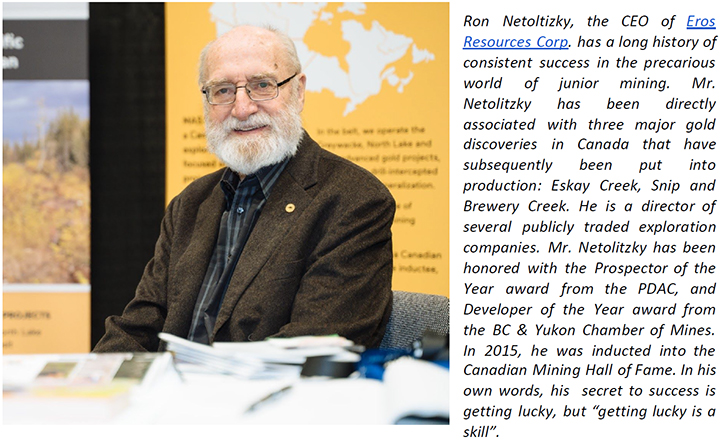

EROS Resources Corp. (TSXV: ERC): Successful Team, Well-Funded Gold Exploration and Development and Strategic Investments, in North America; Ron Netolitzky, President & CEO and Andrew Davidson, CFO Interviewed

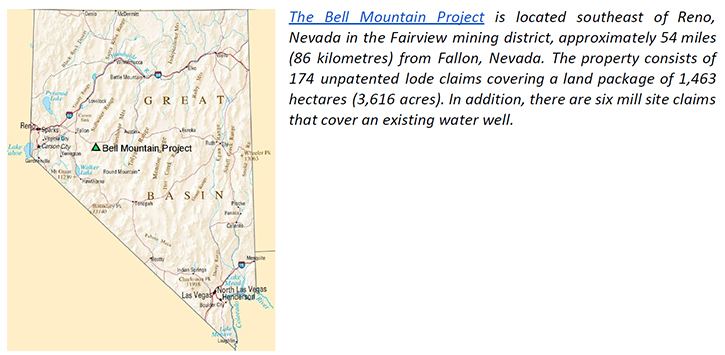

EROS Resources Corp. (TSXV: ERC) is a well-funded Canadian public Company, focused on the exploration and development of mostly gold focused resource projects, as well as strategic investments, in resource companies in North America.We learned from Ron Netolitzky, President, CEO, and Director of Eros Resources, and from Andrew Davidson, the Company's CFO, that they are currently advancing their Bell Mountain gold project, located in Reno, Nevada in the Fairview mining district, through the permitting process for mine development. According to Mr. Netolitzky, there is still some exploration drilling left to complete, with the goal to significantly expand the resource base of the heap leach operation. We learned from Mr. Davidson, that the Bell Mountain will be fully permitted in a matter of months, which distinguishes EROS from a lot of other exploration companies in Nevada. Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ron Netolitzky, President, CEO, and Director of ?EUR Dr. Allen Alper: Your approach sounds interesting. I would certainly like to learn more about what's happening at your Bell Mountain project Ron. Can you give us a closer understanding of what is Bell Mountain and where you guys are at?Ron Netolitzky: We are now advancing Bell Mountain towards the final permit. But let me give you the basics first, so your readers have an opportunity to understand the project. Bell Mountain is a gold permitting stage project that has a strong potential to become a producing mine.It is located southeast of Reno, Nevada in the Fairview mining district, approximately 54 miles or 86 kilometres, if you are metric minded, from Fallon, Nevada. The property consists of 174 unpatented lode claims covering a land package of 1,463 hectares/ 3,616 acres. On top of that, there are six mill site claims that cover an existing water well. There are four gold/silver bearing deposits available to us; the Spurr, Varga, Sphinx and East Ridge deposits.

Dr. Allen Alper: Your approach sounds interesting. I would certainly like to learn more about what's happening at your Bell Mountain project Ron. Can you give us a closer understanding of what is Bell Mountain and where you guys are at?Ron Netolitzky: We are now advancing Bell Mountain towards the final permit. But let me give you the basics first, so your readers have an opportunity to understand the project. Bell Mountain is a gold permitting stage project that has a strong potential to become a producing mine.It is located southeast of Reno, Nevada in the Fairview mining district, approximately 54 miles or 86 kilometres, if you are metric minded, from Fallon, Nevada. The property consists of 174 unpatented lode claims covering a land package of 1,463 hectares/ 3,616 acres. On top of that, there are six mill site claims that cover an existing water well. There are four gold/silver bearing deposits available to us; the Spurr, Varga, Sphinx and East Ridge deposits.  Dr. Allen Alper: You mentioned that a lot of work has already been done on the property. Can you please give us an overview?Ron Netolitzky: We actually have a Preliminary Economic Assessment established for the project. It was put together in 2017 and it works at $1,300 per ounce of gold and $17.5 per ounce of silver.Obviously, the situation on the market with precious metals have improved significantly since 2017. Therefore, we will be doing an update on the project, seeing what is possible with the current gold and silver prices.We also have a bit of an exploration potential untapped on this project. We want to pick that up. We are in the process of developing that program with our team in Nevada. The soil samples have actually been already collected and they are awaiting analyses in the lab. The goal to identify satellite deposits of gold-silver mineralization at Bell Mountain. So to achieve this, a soil geochemical survey covered approximately 992 acres (401 hectares) in near proximity and on trend with the known deposits. We collected 1,000 soil samples on a 200 ft x 200 ft sample grid. Where bedrock was present, we collected a rock-chip sample. We plan to identify the targets by anomalous gold in soil and favorable geology (silicification) where present. Reverse-circulation exploration drilling will test targets as warranted. The program will include infill drilling, step out drilling as well as condemnation drilling to plan the mine dumps. In terms of resources, our target is, instead of 50,000 ounces, we hope to get it up to a couple hundred thousand ounces. That would be our outside target for a heap leachable material on this project. Even though it is a relatively small project, the numbers work and the timing is right. With permitting mostly in place, this project offers a low risk and fast opportunity towards production, being in a good position to take advantage of the current swell in precious metals' prices.

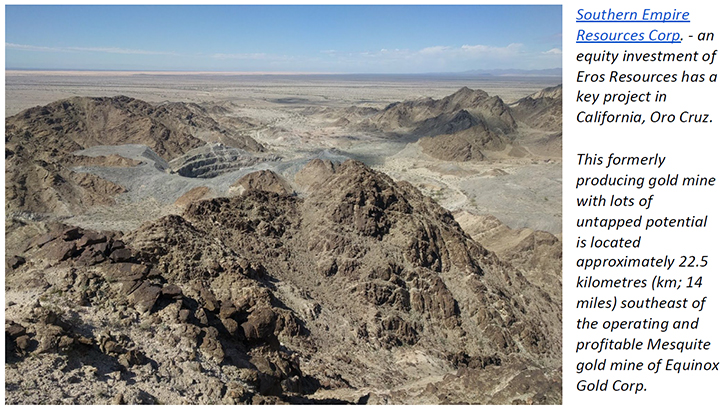

Dr. Allen Alper: You mentioned that a lot of work has already been done on the property. Can you please give us an overview?Ron Netolitzky: We actually have a Preliminary Economic Assessment established for the project. It was put together in 2017 and it works at $1,300 per ounce of gold and $17.5 per ounce of silver.Obviously, the situation on the market with precious metals have improved significantly since 2017. Therefore, we will be doing an update on the project, seeing what is possible with the current gold and silver prices.We also have a bit of an exploration potential untapped on this project. We want to pick that up. We are in the process of developing that program with our team in Nevada. The soil samples have actually been already collected and they are awaiting analyses in the lab. The goal to identify satellite deposits of gold-silver mineralization at Bell Mountain. So to achieve this, a soil geochemical survey covered approximately 992 acres (401 hectares) in near proximity and on trend with the known deposits. We collected 1,000 soil samples on a 200 ft x 200 ft sample grid. Where bedrock was present, we collected a rock-chip sample. We plan to identify the targets by anomalous gold in soil and favorable geology (silicification) where present. Reverse-circulation exploration drilling will test targets as warranted. The program will include infill drilling, step out drilling as well as condemnation drilling to plan the mine dumps. In terms of resources, our target is, instead of 50,000 ounces, we hope to get it up to a couple hundred thousand ounces. That would be our outside target for a heap leachable material on this project. Even though it is a relatively small project, the numbers work and the timing is right. With permitting mostly in place, this project offers a low risk and fast opportunity towards production, being in a good position to take advantage of the current swell in precious metals' prices.  Dr. Allen Alper: You mentioned the Bell Mountain project is pretty far along and a lot of de-risking in terms of obtaining necessary permits has already been done. What exactly do you guys have in place? Ron Netolitzky: All the big permits are basically already there. We went through the Environmental Assessment and received a Finding of No Significant Impact or FONSI in April of 2020. That is a significant, door opening milestone in terms of permitting. The next one, and basically the last missing one is the Water Pollution Control Permit. The application has already been submitted. Once we have that, the next step will be a development decision and permits related to building the mine. As a matter of fact, we could be a fully permitted operation in a matter of months, not years. That distinguishes us from a lot of other exploration companies in Nevada these day Dr. Allen Alper: All right, with all this already in place Bell Mountains seems like a pretty straightforward project. What about the other side of your activities at Eros Resources? You mentioned that you are evolving a portfolio of equities, mostly in gold space. Can you talk about it? Ron Netolitzky: Okay. I'll leave, Anndrew Davidson, our CFO, to discuss that part of our business Andrew Davidson: Absolutely. What we have done at Eros is construct a portfolio of junior gold explorers. We diversify in terms of investee companies, but our sole focus is the gold sector. All of Ron's greatest successes have been in gold, so it makes the most sense that we continue that. Having someone like Ron, who is an inductee of the Canadian Mining Hall of Fame, to do the geological due diligence on any company that we are considering investing in is invaluable. It's a competitive advantage that we hold over just about anyone else in Canada. We have structured our portfolio so that we have a few core, highly liquid positions that we trade actively. Generally, we will look for flow-through shares on the private placement side for the tax advantages. We will then continue to build a position through public markets. With a large degree of success, we're backing known management teams in known regions with histories of success, with projects that make geological sense. We have the ability to evaluate projects geologically, with Ron onboard, and are then comfortable taking larger positions. Our minimum investment size is about $50,000 and we have no restrictions on maximums.That's our investment portfolio in a nutshell. We hold approximately 30 names in our portfolio at any time, a number of smaller positions and some highly concentrated large, open positions. One of the strong holdings in the portfolio is our position Skeena Resources, which is a company Ron is very familiar with, and knows the geology of their project exceptionally well. This speaks to the investing advantage that we have over others. We own over 3 million shares of Skeena. As of the date of recording, this one position is worth over $8 million on its own. That position allows us to generate cash flow internally, through selling and then buying back at lower prices, which we've been quite successful doing. It keeps our operation afloat to a great degree, combined with a few others that we've had some success trading in and out of as well. Our other more significant investments are Southern Empire Resources Corp. and MAS Gold Corp.Southern Empire?EUR< is a relatively new company that was spun out of Eros to a large degree. We own in excess of 9 million shares of that company. We don't trade that position, we hold it and our strategy is to be long-term holders.Another important aspect of our portfolio is a company called MAS Gold Corp. The advanced exploration properties MAS Gold is currently focused on are located in Saskatchewan, in the La Ronge gold belt and have been largely overlooked by the investing public for a number of years and for a number of reasons, which presents a very nice and significant opportunity.There is already just over 500,000 ounces of defined resource there and the initial goal of the exploration activities planned for this winter is to bring us swiftly to the first million ounces mark

Dr. Allen Alper: You mentioned the Bell Mountain project is pretty far along and a lot of de-risking in terms of obtaining necessary permits has already been done. What exactly do you guys have in place? Ron Netolitzky: All the big permits are basically already there. We went through the Environmental Assessment and received a Finding of No Significant Impact or FONSI in April of 2020. That is a significant, door opening milestone in terms of permitting. The next one, and basically the last missing one is the Water Pollution Control Permit. The application has already been submitted. Once we have that, the next step will be a development decision and permits related to building the mine. As a matter of fact, we could be a fully permitted operation in a matter of months, not years. That distinguishes us from a lot of other exploration companies in Nevada these day Dr. Allen Alper: All right, with all this already in place Bell Mountains seems like a pretty straightforward project. What about the other side of your activities at Eros Resources? You mentioned that you are evolving a portfolio of equities, mostly in gold space. Can you talk about it? Ron Netolitzky: Okay. I'll leave, Anndrew Davidson, our CFO, to discuss that part of our business Andrew Davidson: Absolutely. What we have done at Eros is construct a portfolio of junior gold explorers. We diversify in terms of investee companies, but our sole focus is the gold sector. All of Ron's greatest successes have been in gold, so it makes the most sense that we continue that. Having someone like Ron, who is an inductee of the Canadian Mining Hall of Fame, to do the geological due diligence on any company that we are considering investing in is invaluable. It's a competitive advantage that we hold over just about anyone else in Canada. We have structured our portfolio so that we have a few core, highly liquid positions that we trade actively. Generally, we will look for flow-through shares on the private placement side for the tax advantages. We will then continue to build a position through public markets. With a large degree of success, we're backing known management teams in known regions with histories of success, with projects that make geological sense. We have the ability to evaluate projects geologically, with Ron onboard, and are then comfortable taking larger positions. Our minimum investment size is about $50,000 and we have no restrictions on maximums.That's our investment portfolio in a nutshell. We hold approximately 30 names in our portfolio at any time, a number of smaller positions and some highly concentrated large, open positions. One of the strong holdings in the portfolio is our position Skeena Resources, which is a company Ron is very familiar with, and knows the geology of their project exceptionally well. This speaks to the investing advantage that we have over others. We own over 3 million shares of Skeena. As of the date of recording, this one position is worth over $8 million on its own. That position allows us to generate cash flow internally, through selling and then buying back at lower prices, which we've been quite successful doing. It keeps our operation afloat to a great degree, combined with a few others that we've had some success trading in and out of as well. Our other more significant investments are Southern Empire Resources Corp. and MAS Gold Corp.Southern Empire?EUR< is a relatively new company that was spun out of Eros to a large degree. We own in excess of 9 million shares of that company. We don't trade that position, we hold it and our strategy is to be long-term holders.Another important aspect of our portfolio is a company called MAS Gold Corp. The advanced exploration properties MAS Gold is currently focused on are located in Saskatchewan, in the La Ronge gold belt and have been largely overlooked by the investing public for a number of years and for a number of reasons, which presents a very nice and significant opportunity.There is already just over 500,000 ounces of defined resource there and the initial goal of the exploration activities planned for this winter is to bring us swiftly to the first million ounces mark Dr. Allen Alper: Oh, that sounds excellent. Could you, Andrew, tell our readers/investors a little bit more about your capital and share structure and your balance sheet? Andrew Davidson:Eros has 96,893,741 shares outstanding. We have recently completed rights offering earlier this summer, where we raised $2.4 million. It was a highly successful and fully subscribed rights offering, where we couldn't even fit in all the demand. I've never seen one like that before.This speaks of the support we have behind the scenes. It's a tightly held company. Even with close to a hundred million shares outstanding, 80% of that can be directly tracked down through our contact list, including all the management insiders, friends, and family. Which is great, they're a very supportive base. Some large shareholders based in Germany have followed us for some time. From a balance sheet perspective, Eros is very clean. There are virtually no liabilities. When it comes to assets, we hold cash, the Bell Mountain Gold and Silver project and our gold focused portfolio of securities. Just consider this; Our market cap, as of right now, is approximately $8 million. The fair value of our investment in Skeena right now is approximately $8 million. So essentially, we trade at the fair value of our investment in Skeena, without taking into account all the other assets as mentioned before, the advanced gold operation in Nevada and the other 25 odd investments we hold.

Dr. Allen Alper: Oh, that sounds excellent. Could you, Andrew, tell our readers/investors a little bit more about your capital and share structure and your balance sheet? Andrew Davidson:Eros has 96,893,741 shares outstanding. We have recently completed rights offering earlier this summer, where we raised $2.4 million. It was a highly successful and fully subscribed rights offering, where we couldn't even fit in all the demand. I've never seen one like that before.This speaks of the support we have behind the scenes. It's a tightly held company. Even with close to a hundred million shares outstanding, 80% of that can be directly tracked down through our contact list, including all the management insiders, friends, and family. Which is great, they're a very supportive base. Some large shareholders based in Germany have followed us for some time. From a balance sheet perspective, Eros is very clean. There are virtually no liabilities. When it comes to assets, we hold cash, the Bell Mountain Gold and Silver project and our gold focused portfolio of securities. Just consider this; Our market cap, as of right now, is approximately $8 million. The fair value of our investment in Skeena right now is approximately $8 million. So essentially, we trade at the fair value of our investment in Skeena, without taking into account all the other assets as mentioned before, the advanced gold operation in Nevada and the other 25 odd investments we hold. Dr. Allen Alper: Well, that sounds like an outstanding opportunity for our readers/investors. I don't see how they could lose on that kind of investment.That's really an amazing opportunity. Andrew Davidson: It is. While it is not uncommon for holding companies to trade at a discount, 20% is a more realistic amount. The discount that Eros is currently trading at attributes no value to an almost fully permitted gold operation, with a defined resource in Nevada.That is unusual.So, we look forward to telling the story on Bell Mountain and make the market fully understand and appreciate the opportunity. Yes, it is a small deposit. However, according to our models, it presents an opportunity to develop and run a very profitable, small operation. With permitting almost in place a lot of the initial risk is dealt with. I would take a smaller permitted project over a larger unpermitted project in terms of how soon to see it produce a cash flow, one clearly supersedes the other.As Ron mentioned, we are also taking steps so we can increase our resource base by a factor of five through some exploration work. What you take that into account,boy oh boy, that really changes the picture.

Dr. Allen Alper: Well, that sounds like an outstanding opportunity for our readers/investors. I don't see how they could lose on that kind of investment.That's really an amazing opportunity. Andrew Davidson: It is. While it is not uncommon for holding companies to trade at a discount, 20% is a more realistic amount. The discount that Eros is currently trading at attributes no value to an almost fully permitted gold operation, with a defined resource in Nevada.That is unusual.So, we look forward to telling the story on Bell Mountain and make the market fully understand and appreciate the opportunity. Yes, it is a small deposit. However, according to our models, it presents an opportunity to develop and run a very profitable, small operation. With permitting almost in place a lot of the initial risk is dealt with. I would take a smaller permitted project over a larger unpermitted project in terms of how soon to see it produce a cash flow, one clearly supersedes the other.As Ron mentioned, we are also taking steps so we can increase our resource base by a factor of five through some exploration work. What you take that into account,boy oh boy, that really changes the picture.  Dr. Allen Alper: Right. And the team is an outstanding, award-winning team, well-recognized in the industry with an amazingly successful track record. Ron Netolitzky as CEO, Ross McElroy as one of the directors, and your background in finance, that's truly great, and also Tom. Maybe someone could just highlight a little more about the team members. Andrew Davidson: Obviously, we're led by the experience and terrific track record of Ron Netolitzky, a member of the Canadian mining hall of fame, and for good reason. If you want to find a gold property that could turn into a producer, he'd be at or near the very top of your list of people to go to. He is the captain behind the steering wheel pointing us in these directions, and continues to be driving the efforts in Nevada.That's a key advantage that we have. Myself, I've been in this industry for over a decade now, focused on taking these junior exploration companies and keeping them properly financed and properly managed, so that capital is preserved while advancing the projects held within, that's key in this business.We have a strong team of outstanding geologists and engineers that are helping us through the permitting process on Bell Mountain.On the Board, we have a couple of other legends in the junior resource space: Ross McElroy, who's built a great name for himself in the uranium business in Saskatchewan, and will be of great help to Ron and our entire team going forward in evaluating our continued investment in things like Southern Empire as they develop in Saskatchewan. Also Tom McNeil, who is quite likely the sharpest investment mind I've ever come across when it comes to investing in the junior resource space. He's been doing it for almost 40 years now with a great degree of success.Tom's success mirrors Ron's in that they have a track record of taking projects from the early stages of capital formation and project genesis all the way through to eventual sale to large producers. It's happened numerous times for both parties. So, it's a relatively unique talent set. The Board of Directors is involved in all major decisions that we make, we actually use their help. Dr. Allen Alper: That's a fantastically strong accomplished team. It's a group that has worked together and knows the industry and knows the mining business so well, both geologically and financially. Andrew Davidson: Yeah, I agree. That's the principle reason we have so much control over the float, because the primary shareholders, or the insiders, are people that have followed the insiders through our various transactions in the past, so they're all confident in what we areable to do. And they're patient with us in tough times, like we've come through over the last number of years.This might sound awfully awfully promotional, but I personally believe, the payoffs are coming sooner rather than later for everyone who's been patient with the Company to this point. Dr. Allen Alper: Well, that sounds great. Could you, Andy, summarize the primary reasons our readers/investors should consider investing in Eros? Andrew Davidson: Absolutely. I'll start with the advanced gold project, Bell Mountain, because it is likely the most overlooked gold project in the Nevada region right now.Even though it is a small project, the permitting is almost there and the current exploration activities are poised to grow the resource base several times over. Once we make a production decision, this project has a potential to cash flow quite fast. Number two is the investment portfolio, which holds a number of gold projects at various stages of exploration, from greenfield all the way to late stage.This mix allows us to hold stocks that are relatively illiquid to start with, because we have very liquid ones at the other end.The fact that the current market cap of ?EUR

Dr. Allen Alper: Right. And the team is an outstanding, award-winning team, well-recognized in the industry with an amazingly successful track record. Ron Netolitzky as CEO, Ross McElroy as one of the directors, and your background in finance, that's truly great, and also Tom. Maybe someone could just highlight a little more about the team members. Andrew Davidson: Obviously, we're led by the experience and terrific track record of Ron Netolitzky, a member of the Canadian mining hall of fame, and for good reason. If you want to find a gold property that could turn into a producer, he'd be at or near the very top of your list of people to go to. He is the captain behind the steering wheel pointing us in these directions, and continues to be driving the efforts in Nevada.That's a key advantage that we have. Myself, I've been in this industry for over a decade now, focused on taking these junior exploration companies and keeping them properly financed and properly managed, so that capital is preserved while advancing the projects held within, that's key in this business.We have a strong team of outstanding geologists and engineers that are helping us through the permitting process on Bell Mountain.On the Board, we have a couple of other legends in the junior resource space: Ross McElroy, who's built a great name for himself in the uranium business in Saskatchewan, and will be of great help to Ron and our entire team going forward in evaluating our continued investment in things like Southern Empire as they develop in Saskatchewan. Also Tom McNeil, who is quite likely the sharpest investment mind I've ever come across when it comes to investing in the junior resource space. He's been doing it for almost 40 years now with a great degree of success.Tom's success mirrors Ron's in that they have a track record of taking projects from the early stages of capital formation and project genesis all the way through to eventual sale to large producers. It's happened numerous times for both parties. So, it's a relatively unique talent set. The Board of Directors is involved in all major decisions that we make, we actually use their help. Dr. Allen Alper: That's a fantastically strong accomplished team. It's a group that has worked together and knows the industry and knows the mining business so well, both geologically and financially. Andrew Davidson: Yeah, I agree. That's the principle reason we have so much control over the float, because the primary shareholders, or the insiders, are people that have followed the insiders through our various transactions in the past, so they're all confident in what we areable to do. And they're patient with us in tough times, like we've come through over the last number of years.This might sound awfully awfully promotional, but I personally believe, the payoffs are coming sooner rather than later for everyone who's been patient with the Company to this point. Dr. Allen Alper: Well, that sounds great. Could you, Andy, summarize the primary reasons our readers/investors should consider investing in Eros? Andrew Davidson: Absolutely. I'll start with the advanced gold project, Bell Mountain, because it is likely the most overlooked gold project in the Nevada region right now.Even though it is a small project, the permitting is almost there and the current exploration activities are poised to grow the resource base several times over. Once we make a production decision, this project has a potential to cash flow quite fast. Number two is the investment portfolio, which holds a number of gold projects at various stages of exploration, from greenfield all the way to late stage.This mix allows us to hold stocks that are relatively illiquid to start with, because we have very liquid ones at the other end.The fact that the current market cap of ?EUR